PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699403

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699403

Low Voltage Switchgear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

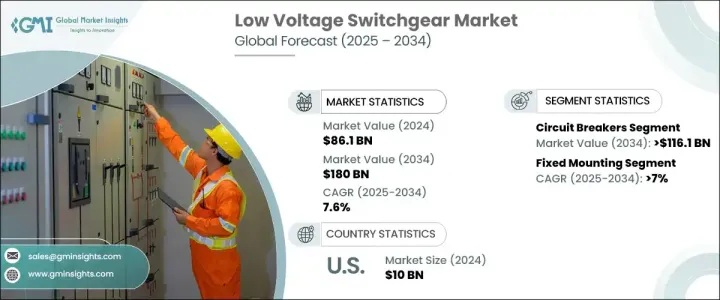

The Global Low Voltage Switchgear Market was valued at USD 86.1 billion in 2024 and is projected to expand at a CAGR of 7.6% from 2025 to 2034. Increasing electricity consumption, infrastructure expansion, and technological advancements in smart grid solutions are driving this growth. The market spans industrial, commercial, and residential applications, supported by automation trends, renewable energy adoption, and stringent safety regulations. Rapid urbanization and industrialization in developing economies are accelerating demand, particularly in data centers, commercial spaces, and industrial facilities. Growing investments in power generation and distribution infrastructure are fueling demand for advanced switchgear solutions. The transition toward Industry 4.0 and industrial automation is reshaping the market, increasing the need for intelligent and digitally integrated switchgear. Smart systems equipped with AI-driven predictive analytics enable early detection of electrical faults, enhancing efficiency and reliability.

In terms of protection type, the circuit breaker segment is projected to surpass USD 116.1 billion by 2034, driven by significant investments in the electrical sector. Industry investments exceeding USD 80 billion are anticipated to meet future electricity demands, further boosting demand. The shift toward sustainable energy sources is amplifying the need for low voltage switchgear. In 2024, over USD 110 billion was allocated to energy projects, including clean energy technologies, highlighting the market's growth trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $86.1 Billion |

| Forecast Value | $180 Billion |

| CAGR | 7.6% |

The fixed mounting segment is expected to register a CAGR of over 7% through 2034, driven by cost-effectiveness, reliability, and ease of installation. Its widespread application in industrial, commercial, and utility sectors makes it a key market component. The increasing reliance on electricity, coupled with population growth and urban expansion, is intensifying demand for low voltage switchgear, especially in regions experiencing rapid infrastructure development.

The U.S. market has witnessed steady growth, reaching USD 8.7 billion in 2022, USD 9.3 billion in 2023, and USD 10 billion in 2024. Extensive investments in electrical infrastructure are fueling demand for low voltage switchgear across various industries. Investor-owned utilities allocated approximately USD 170 billion toward grid expansion in 2023, signaling strong market potential. Additionally, around USD 134 billion was directed toward power construction projects, further driving demand for switchgear solutions. The increasing number of such projects is set to bolster the market across North America, reinforcing its upward trajectory.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Protection, 2021 – 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Circuit breakers

- 5.2.1 ACB

- 5.2.2 MCCB

- 5.2.3 MCB

- 5.2.4 MSP

- 5.2.5 MPCB

- 5.3 Fuse

- 5.3.1 Fuse-Switch disconnector

- 5.3.2 Switch disconnector with fuse

- 5.3.3 Others

Chapter 6 Market Size and Forecast, By Product 2021 – 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Fixed mounting

- 6.3 Plug-in

- 6.4 Withdrawable unit

Chapter 7 Market Size and Forecast, By Rated Current 2021 – 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 ≤ 1000 Ampere

- 7.3 > 1000 Ampere to ≤ 5000 Ampere

- 7.4 > 5000 Ampere

Chapter 8 Market Size and Forecast, By Voltage Rating 2021 – 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 ≤ 250 volts

- 8.3 > 250 volts to ≤ 750 volts

- 8.4 > 750 volts

Chapter 9 Market Size and Forecast, By Current 2021 – 2034 (USD Million, Units)

- 9.1 Key trends

- 9.2 AC

- 9.3 DC

Chapter 10 Market Size and Forecast, By Application 2021 – 2034 (USD Million, Units)

- 10.1 Key trends

- 10.2 Substation

- 10.3 Distribution

- 10.4 Power factor correction

- 10.5 Sub distribution

- 10.6 Motor control

Chapter 11 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.2.3 Mexico

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 France

- 11.3.3 Germany

- 11.3.4 Italy

- 11.3.5 Russia

- 11.3.6 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Australia

- 11.4.3 India

- 11.4.4 Japan

- 11.4.5 South Korea

- 11.5 Middle East & Africa

- 11.5.1 Saudi Arabia

- 11.5.2 UAE

- 11.5.3 Turkey

- 11.5.4 South Africa

- 11.5.5 Egypt

- 11.6 Latin America

- 11.6.1 Brazil

- 11.6.2 Argentina

Chapter 12 Company Profiles

- 12.1 ABB

- 12.2 Bharat Heavy Electricals

- 12.3 CG Power and Industrial Solutions

- 12.4 E + I Engineering

- 12.5 Eaton

- 12.6 Fuji Electric

- 12.7 General Electric

- 12.8 HD Hyundai Electric

- 12.9 Hitachi

- 12.10 Hyosung Heavy Industries

- 12.11 Lucy Group

- 12.12 Mitsubishi Electric

- 12.13 Ormazabal

- 12.14 Schneider Electric

- 12.15 Siemens

- 12.16 Skema

- 12.17 Toshiba