PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666654

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666654

North America Low Voltage Switchgear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

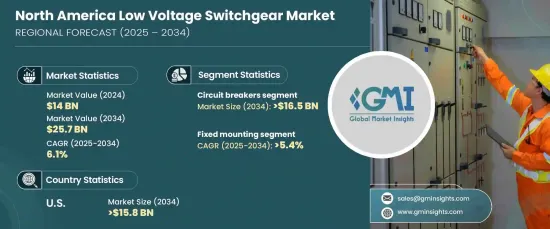

North America Low Voltage Switchgear Market reached USD 14 billion in 2024 and is projected to expand at a CAGR of 6.1% from 2025 to 2034. This surge is being driven by increasing investments in industrial automation, the integration of renewable energy sources, and robust infrastructure development across the region. With energy efficiency becoming a top priority, businesses and consumers are demanding more reliable, efficient power distribution systems. This trend is particularly evident in the expansion of data centers, commercial buildings, and manufacturing plants, which require advanced, reliable switchgear solutions. Furthermore, government initiatives to modernize electrical grids and support renewable energy adoption are boosting demand for low-voltage switchgear. As these initiatives evolve, companies are increasingly focusing on providing solutions that optimize energy usage and minimize costs, further accelerating the market's expansion.

Among various protection solutions, circuit breakers are expected to generate a market value of USD 16.5 billion by 2034. These components are crucial for preventing electrical hazards such as overloads and short circuits, ensuring both safety and operational continuity across industrial, commercial, and residential sectors. The reliability, cost-effectiveness, and ease of use of circuit breakers make them an essential part of electrical systems, offering rapid responses to faults and ensuring system stability. This growing demand for enhanced safety features is expected to continue as industries expand their operations and infrastructure, increasing the importance of fault protection.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14 Billion |

| Forecast Value | $25.7 Billion |

| CAGR | 6.1% |

The fixed mounting switchgear segment is projected to see a steady growth rate of 5.4% through 2034. This product type is especially popular in industrial and commercial sectors, where long-term, dependable performance is critical. Fixed mounting switchgear offers durability, low maintenance, and high efficiency, which make it a preferred choice for applications that require consistent power distribution. Additionally, as industrial automation continues to advance, the demand for smart grid integration and infrastructure upgrades is expected to drive further growth in this segment.

In the U.S., the low voltage switchgear market is anticipated to reach USD 15.8 billion by 2034. The country's ongoing infrastructure modernization projects and the need to replace outdated electrical systems are major factors propelling this demand. As the U.S. continues to invest in enhancing its power grid to accommodate renewable energy, particularly solar and wind, the need for switchgear systems that can manage fluctuating power loads and distributed energy resources is becoming more apparent. With the adoption of energy-efficient technologies on the rise, low voltage switchgear solutions are expected to play a crucial role in supporting this transformation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive landscape, 2024

- 3.1 Strategic dashboard

- 3.2 Innovation & sustainability landscape

Chapter 4 Market Size and Forecast, By Protection, 2021 – 2034 (USD Million, ‘000 Units)

- 4.1 Key trends

- 4.2 Circuit Breakers

- 4.2.1 ACB

- 4.2.2 MCCB

- 4.2.3 MCB

- 4.2.4 MSP

- 4.2.5 MPCB

- 4.3 Fuse

- 4.3.1 Fuse-Switch disconnector

- 4.3.2 Switch disconnector with fuse

- 4.3.3 Others

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 Fixed mounting

- 5.3 Plug-in

- 5.4 Withdrawable unit

Chapter 6 Market Size and Forecast, By Rated Current, 2021 – 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 ≤ 1000 ampere

- 6.3 > 1000 ampere to ≤ 5000 ampere

- 6.4 > 5000 ampere

Chapter 7 Market Size and Forecast, By Voltage Rating, 2021 – 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 ≤ 480 volts

- 7.3 > 480 volts to ≤ 1 kV

- 7.4 > 1 kV

Chapter 8 Market Size and Forecast, By Current, 2021 – 2034 (USD Million, ‘000 Units)

- 8.1 Key trends

- 8.2 Dead tank

- 8.3 Live tank

- 8.4 GIS

Chapter 9 Market Size and Forecast, By Application, 2021 – 2034 (USD Million, ‘000 Units)

- 9.1 Key trends

- 9.2 Substation

- 9.3 Distribution

- 9.4 Power factor correction

- 9.5 Sub distribution

- 9.6 Motor control

Chapter 10 Market Size and Forecast, By Country, 2021 – 2034 (USD Million, ‘000 Units)

- 10.1 Key trends

- 10.2 U.S.

- 10.3 Canada

- 10.4 Mexico

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Bharat Heavy Electricals

- 11.3 CG Power and Industrial Solutions

- 11.4 E + I Engineering

- 11.5 Eaton

- 11.6 Fuji Electric

- 11.7 General Electric

- 11.8 HD Hyundai Electric

- 11.9 Hitachi

- 11.10 Hyosung Heavy Industries

- 11.11 Lucy Group

- 11.12 Mitsubishi Electric

- 11.13 Ormazabal

- 11.14 Schneider Electric

- 11.15 Siemens

- 11.16 Skema

- 11.17 Toshiba