Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636113

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636113

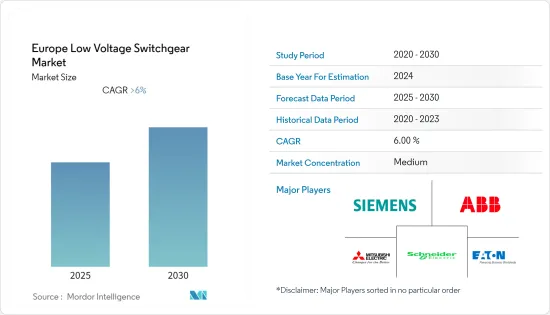

Europe Low Voltage Switchgear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Europe Low Voltage Switchgear Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels. Over the medium term, the increasing investment in the electricity sector and increasing development of substations and distribution systems are expected to increase the demand for a Europe Low Voltage Switchgear Market.

- On the other hand, high operations and maintenance costs are expected to hinder the market growth.

- Nevertheless, the increasing technological investments in the market to produce energy-efficient switchgear are expected to create huge opportunities for the Europe Low Voltage Switchgear Market.

- Germany is expected to dominate the market during the forecasted period due to the increasing demand for electricity and increasing investments in upgrading electricity infrastructure.

Europe Low Voltage Switchgear Market Trends

Distribution Segments to dominate the market

- The distribution system includes a network of power lines, substations, transformers, and other equipment that is used to transport and deliver electrical power to the end users. The distribution system is divided into two categories primary and secondary distribution. The primary distribution refers to the transmission of high-voltage electricity from the power plant to the local substations. The secondary distribution refers to the delivery of lower-voltage electricity to end-users.

- In recent years, Europe has witnessed a surge in industrialization and urbanization, leading to the emergence of numerous commercial and industrial entities. This has resulted in substantial growth in sectors such as manufacturing, data centers, and various other industries. It is anticipated that this trend will persist throughout the forecasted period.

- With this increasing industrialization and urbanization, the demand for electricity has increased consequently. Increasing the demand for distribution systems in various countries such as Germany, France, the United Kingdom, Spain, etc.

- According to Eurostat, electricity consumption in Europe was on the rise again after 2020. The electricity consumption in Europe was 3205 TWh which was a rise of 4.53% compared to 2020. The consumption is further expected to increase during the forecasted period owing to increasing investments by companies to expand their business in Europe.

- For instance, in February 2023, BYD Company, a leading Chinese battery manufacturing company, announced their plans to build their own manufacturing plant in Europe and shortlisted various locations in Germany and the United Kingdom in order to expand in the European region and improve their market shares.

- Therefore owing to the above-mentioned points, the distribution system is expected to hold a significant market share during the forecasted period.

Germany to Witness Significant Growth

- Germany is one of the largest consumers of electricity in the European Union and globally. According to the Federal Ministry for Economic Affairs and Energy, the gross electricity consumption in Germany in 2022 was around 293.02 Terra watt-hours (TWh), which is a slight decrease from the previous year's consumption of 319.6 Terra watt-hours (TWh).

- The decrease was mainly due to recent geopolitical developments like the Russia-Ukraine conflict, which significantly affected the natural gas supplies, thus reducing electricity production in the country.

- Therefore, the country has prioritized energy security in the country and has started expanding renewables in the country. According to the International Renewable Energy Agency (IRENA), Germany witnessed a 7% rise in the overall installed capacity of renewable energy in the year 2022, with an installation of almost 9.81 GW. The country is predicted to witness a remarkable increase in installed capacity for onshore and offshore wind as well as solar power, making it a crucial market for EPC (engineering, procurement, and construction) services for solar and wind projects.

- In June 2022, Vestas AS secured a contract to provide EnBW's He Dreiht offshore wind project with 64 V235-15.0 MW wind turbines, generating a capacity of 900 MW. Additionally, Vestas has inked a deal with Cadeler for the transportation and installation of the turbines, slated to begin in the second quarter of 2025.

- Moreover, according to the German federal network agency, the country's existing transmission and distribution system does not offer operational flexibility efficiently. The agency expects the German government to invest around USD 58 billion by 2030 in order to match the transmission and distribution network capacity with the increasing adoption of renewable energy.

- These developments in the renewable energy sector will increase the investments in the substations and distribution systems which will increase the demand for low voltage switchgear in the country during the forecasted period.

Europe Low Voltage Switchgear Industry Overview

The Europe Low Voltage Switchgear Market is moderately fragmented. Some of the key players in this market (in no particular order) are ABB Ltd., Siemens AG, Mitsubishi Electric Corporation, Schneider Electric SE, and Eaton Corporation PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 5000060

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Substation

- 5.1.2 Distribution

- 5.1.3 Utility

- 5.2 Installation

- 5.2.1 Outdoor

- 5.2.2 Indoor

- 5.3 Voltage Rating

- 5.3.1 Less Than 250 V

- 5.3.2 250 V - 750 V

- 5.3.3 750 V - 1000 V

- 5.4 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 United Kingdom

- 5.4.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd.

- 6.3.2 Rockwell automation

- 6.3.3 Schneider Electric SE

- 6.3.4 Siemens AG

- 6.3.5 Havells India Ltd

- 6.3.6 Hitachi, Ltd.

- 6.3.7 Eaton Corporation PLC

- 6.3.8 Mitsubishi Electric Corporation

- 6.3.9 HD Hyundai Electric

- 6.3.10 Fuji Electric Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.