PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699356

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699356

Autonomous Ships Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

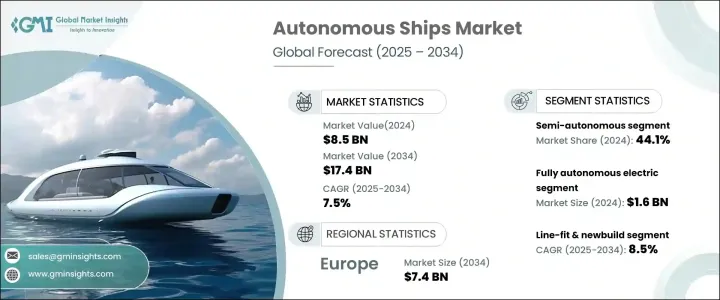

The Global Autonomous Ships Market reached USD 8.5 billion in 2024 and is anticipated to grow at a CAGR of 7.5% from 2025 to 2034. The increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies is driving market expansion, revolutionizing the way autonomous vessels operate. Manufacturers are heavily investing in the development of fully autonomous ships by integrating cutting-edge components such as GPS, sensors, and the Internet of Things (IoT). These advancements are significantly enhancing the operational efficiency of autonomous ships, minimizing human intervention, and ensuring better safety standards.

The autonomous shipping industry is evolving rapidly, driven by the need for more cost-efficient and environmentally friendly solutions. With global trade rising, shipping companies are increasingly looking for ways to optimize operational costs, improve safety measures, and reduce emissions. Autonomous vessels offer a promising alternative by streamlining maritime operations and minimizing human error. AI-powered navigation systems enable ships to respond to environmental and navigational changes in real time, reducing the risks associated with human miscalculations. Additionally, regulatory bodies are supporting the shift towards automation, as seen in increasing investments in smart port infrastructures and digital maritime solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.5 Billion |

| Forecast Value | $17.4 Billion |

| CAGR | 7.5% |

The market is segmented based on vessel type into semi-autonomous, fully autonomous, and remotely operated ships. Semi-autonomous ships accounted for 44.1% market share in 2024 and continue to see steady demand. These vessels can function autonomously under specific conditions, providing flexibility while reducing reliance on human operators. Manufacturers are making semi-autonomous ships more cost-effective by simplifying design, eliminating costly subsystems like deck houses and heating, and reducing capital investment. The industry's focus on semi-autonomous solutions highlights the growing preference for gradual automation, allowing shipping companies to adopt technology without a complete overhaul of their existing fleets.

Another key segment of the market is propulsion technology, which includes fully electric, hybrid, and conventional systems. Fully electric autonomous ships, valued at USD 1.6 billion in 2024, represent a major step toward achieving zero emissions. With sustainability taking center stage in the maritime industry, electric propulsion is expected to drive further innovation. Fully electric vessels offer a cleaner and more energy-efficient alternative to conventional fuel-powered ships, aligning with global carbon reduction goals. Hybrid systems are also gaining traction as they offer a balance between fuel efficiency and operational range, making them a preferred choice for long-haul shipping routes.

Germany Autonomous Ship Market is poised for substantial growth, projected to expand at a CAGR of 10.1% through 2034. The country is at the forefront of autonomous shipping technology, with multiple companies pioneering advancements that enhance vessel autonomy. As the industry matures, autonomous ships are expected to reduce operational costs, lower emissions, and improve maritime safety. The increasing focus on sustainability and efficiency is positioning autonomous vessels as a game-changer for the global shipping industry, ensuring long-term benefits for both businesses and the environment.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancement in AI & Machine learning

- 3.2.1.2 Cost reduction in labour and operations

- 3.2.1.3 Growing demand for green shipping solutions

- 3.2.1.4 Supportive government & maritime policies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruption of raw materials

- 3.2.2.2 Consumers trust issues in autonomous ship

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Semi-Autonomous

- 5.3 Fully autonomous

- 5.4 Remotely operated

Chapter 6 Market Estimates and Forecast, By Propulsion Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Fully electric

- 6.3 Hybrid

- 6.4 Conventional

Chapter 7 Market Estimates and Forecast, By Fit, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Line-fit & newbuild

- 7.3 Retrofit

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- >8.2 Commercial

- 8.2.1 Passenger ship

- 8.2.2 Container ship

- 8.1.3 Tankers

- 8.2.4 Others

- 8.3 Military & defense

- 8.3.1 Submarines

- 8.3.2 Aircraft carriers

- 8.3.3 Destroyers

- 8.3.4 Frigates

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB Ltd.

- 10.2 Aselsan A.S.

- 10.3 BAE Systems

- 10.4 DNV GL

- 10.5 Fugro

- 10.6 General Electric

- 10.7 Hyundai Heavy Industries Inc.

- 10.8 Kongsberg Maritime

- 10.9 L3Harris Technologies, Inc.

- 10.10 Mitsui E&S Shipbuilding Co., Ltd.

- 10.11 Northrop Grumman Corporation

- 10.12 Praxis Automation Technology B.V.

- 10.13 RH Marine

- 10.14 Rolls-Royce Holdings plc

- 10.15 Samsung Heavy Industries Co., Ltd.

- 10.16 Sea Machines Robotics, Inc

- 10.17 Siemens AG

- 10.18 Ulstein Group ASA

- 10.19 Valmet

- 10.20 Vigor Industrial LLC

- 10.21 Wartsila