PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1831818

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1831818

Global Naval Surface Vessels Market 2025-2035

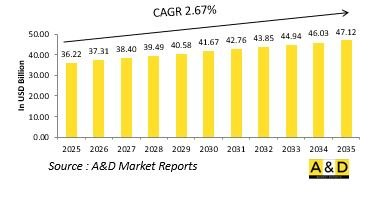

The Global Naval Surface Vessels market is estimated at USD 36.22 billion in 2025, projected to grow to USD 47.12 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 2.67% over the forecast period 2025-2035.

Introduction to Naval Surface Vessels Market:

The defense naval surface vessels market is a cornerstone of maritime power projection, deterrence, and strategic dominance, encompassing a diverse range of platforms such as destroyers, frigates, corvettes, patrol vessels, and aircraft carriers. These vessels serve as the backbone of naval operations, enabling countries to secure sea lanes, enforce maritime sovereignty, conduct expeditionary missions, and respond to emerging security challenges. Modern surface combatants are equipped with advanced sensors, weapon systems, and command-and-control capabilities, allowing them to operate effectively in multi-domain environments. They play a crucial role in anti-air, anti-surface, and anti-submarine warfare, as well as in humanitarian assistance, disaster relief, and maritime security operations. The strategic value of naval surface vessels extends beyond combat capabilities-they also serve as diplomatic instruments, projecting national influence and fostering alliances through joint exercises and freedom of navigation operations. With maritime threats becoming increasingly sophisticated, the demand for technologically advanced, multi-mission-capable vessels is rising. Nations are investing in modular designs, stealth technologies, and network-centric systems to ensure operational flexibility and adaptability. As geopolitical competition intensifies and maritime trade routes gain strategic importance, naval surface vessels remain essential for maintaining global stability and securing national interests at sea.

Technology Impact in Naval Surface Vessels Market:

Technological innovation is transforming the design, capabilities, and operational effectiveness of naval surface vessels. Advances in stealth technology are reducing radar cross-sections and enhancing survivability, allowing ships to operate undetected in contested environments. Integrated combat systems and network-centric architectures are enabling seamless information sharing and coordinated operations across air, sea, land, and space domains. The adoption of modular and open-architecture designs allows vessels to be reconfigured for multiple missions, extending their operational life and reducing upgrade costs. Propulsion advancements, including hybrid-electric and integrated power systems, are improving fuel efficiency, endurance, and power availability for advanced sensors and directed-energy weapons. Automation and artificial intelligence are enhancing Personal Protective Equipment, optimizing crew workload, and enabling predictive maintenance. Additionally, advanced radar, sonar, and electronic warfare systems are improving detection, tracking, and engagement capabilities against increasingly complex threats. The integration of unmanned surface and aerial vehicles with surface ships is further expanding operational reach and flexibility. These technological developments are redefining naval surface combatants as highly adaptive, multi-mission platforms capable of responding rapidly to evolving threats. As a result, modern surface vessels are becoming more capable, survivable, and strategically valuable in complex maritime security environments.

Key Drivers in Naval Surface Vessels Market:

Several strategic imperatives are driving the growth of the naval surface vessels market. Rising geopolitical tensions and territorial disputes are prompting nations to strengthen their surface fleets to assert maritime dominance and protect national interests. The increasing importance of securing global trade routes and exclusive economic zones is fueling investments in advanced surface combatants. The shift toward multi-domain operations and network-centric warfare is creating demand for ships that can integrate seamlessly with joint and allied forces. Naval modernization programs aimed at replacing aging fleets with highly capable, modular vessels are a key driver of market activity. Additionally, the proliferation of advanced threats-including anti-ship missiles, swarm tactics, and asymmetric maritime challenges-is pushing navies to adopt more agile, survivable, and technologically sophisticated platforms. Expeditionary and blue-water naval capabilities are also gaining priority, driving the demand for vessels with greater range, endurance, and mission flexibility. Furthermore, international collaboration, joint development initiatives, and defense industrial partnerships are supporting capability enhancement and cost-sharing. These factors collectively highlight the strategic importance of surface vessels in achieving maritime superiority, projecting power, and maintaining security in increasingly contested and complex naval theaters.

Regional Trends in Naval Surface Vessels Market:

The naval surface vessels market demonstrates distinct regional trends influenced by security priorities, strategic ambitions, and defense modernization goals. In North America, significant investments focus on next-generation destroyers, frigates, and carriers with enhanced stealth, integrated power, and advanced weapon systems. European countries are prioritizing modular and multi-mission vessels to enhance rapid deployment, alliance interoperability, and maritime security capabilities. The Asia-Pacific region is experiencing rapid expansion, with nations strengthening their surface fleets to assert territorial claims, secure sea lanes, and project power amid rising regional tensions. Middle Eastern navies are acquiring advanced surface combatants to protect strategic waterways, offshore assets, and critical infrastructure, often through partnerships with Western shipbuilders. In Latin America and Africa, procurement efforts are centered on cost-effective patrol and littoral vessels for coastal defense, counter-piracy, and maritime law enforcement missions. Across all regions, there is a strong emphasis on domestic shipbuilding capabilities and technology transfer agreements, reflecting a broader push for defense self-reliance. Collaborative programs and multinational exercises are also shaping fleet development priorities. These regional dynamics underscore the central role of naval surface vessels in national defense strategies, maritime security, and the maintenance of strategic balance across global waters.

Key Naval Surface Vessels Program:

A contract for the procurement of 11 Next Generation Offshore Patrol Vessels (NGOPVs) under the Buy (Indian-IDDM) category has been signed with Goa Shipyard Ltd (GSL) and Garden Reach Shipbuilders & Engineers (GRSE), Kolkata, at a total cost of Rs 9,781 crore. Of these 11 vessels, GSL will indigenously design, develop, and manufacture seven, while GRSE will build four. Deliveries are scheduled to begin in September 2026. The induction of these ships will enhance the Indian Navy's operational readiness, supporting missions such as anti-piracy, counter-infiltration, anti-poaching, anti-trafficking, non-combatant evacuation operations, search and rescue (SAR), and protection of offshore assets. The construction program is also expected to generate approximately 11 million man-days of employment over a span of seven and a half years.

Table of Contents

Naval Surface Vessels Market - Table of Contents

Naval Surface Vessels Market Report Definition

Naval Surface Vessels Market Segmentation

By Region

By Platform

By Application

Naval Surface Vessels Market Analysis for next 10 Years

The 10-year naval surface vessels market analysis would give a detailed overview of naval surface vessels market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Naval Surface Vessels Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Naval Surface Vessels Market Forecast

The 10-year naval surface vessels market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Naval Surface Vessels Market Trends & Forecast

The regional naval surface vessels market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Naval Surface Vessels Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Naval Surface Vessels Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Naval Surface Vessels Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Naval Surface Vessel Market Forecast, 2025-2035

- Figure 2: Global Naval Surface Vessel Market Forecast, By Region, 2025-2035

- Figure 3: Global Naval Surface Vessel Market Forecast, By Platform, 2025-2035

- Figure 4: Global Naval Surface Vessel Market Forecast, By Application, 2025-2035

- Figure 5: North America, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 6: Europe, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 8: APAC, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 9: South America, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 10: United States, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 11: United States, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 12: Canada, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 14: Italy, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 16: France, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 17: France, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 18: Germany, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 24: Spain, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 30: Australia, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 32: India, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 33: India, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 34: China, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 35: China, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 40: Japan, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Naval Surface Vessel Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Naval Surface Vessel Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Naval Surface Vessel Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Naval Surface Vessel Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Naval Surface Vessel Market, By Platform (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Naval Surface Vessel Market, By Platform (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Naval Surface Vessel Market, By Application (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Naval Surface Vessel Market, By Application (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Naval Surface Vessel Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Naval Surface Vessel Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Naval Surface Vessel Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Naval Surface Vessel Market, By Region, 2025-2035

- Figure 58: Scenario 1, Naval Surface Vessel Market, By Platform, 2025-2035

- Figure 59: Scenario 1, Naval Surface Vessel Market, By Application, 2025-2035

- Figure 60: Scenario 2, Naval Surface Vessel Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Naval Surface Vessel Market, By Region, 2025-2035

- Figure 62: Scenario 2, Naval Surface Vessel Market, By Platform, 2025-2035

- Figure 63: Scenario 2, Naval Surface Vessel Market, By Application, 2025-2035

- Figure 64: Company Benchmark, Naval Surface Vessel Market, 2025-2035