PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698554

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698554

Educational Toys Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

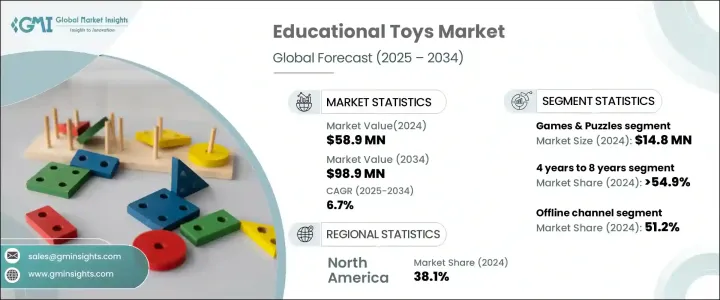

The Global Educational Toys Market was valued at USD 58.9 million in 2024 and is projected to expand at a CAGR of 6.7% from 2025 to 2034. This market is driven by increasing consumer awareness of the developmental benefits of educational toys and the rising demand for STEM-focused products. Parents and educators recognize the role of interactive play in fostering cognitive, social, and motor skills, leading to a growing preference for learning-oriented toys.

Consumers are becoming more conscious of the materials used in toys, especially as young children tend to explore their surroundings through touch and taste. Exposure to harmful chemicals such as phthalates, lead, and BPA has raised concerns, prompting a shift towards non-toxic alternatives like wooden toys, BPA-free plastic, and Montessori-based options. With safety regulations tightening globally, manufacturers are responding by introducing products that meet strict environmental and health standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $58.9 Million |

| Forecast Value | $98.9 Million |

| CAGR | 6.7% |

The rising popularity of educational and STEM-focused toys is significantly influencing market trends. Studies indicate that a majority of preschool-age children engage with toys that encourage skill-building activities. This surge in interest reflects a broader shift towards products designed to enhance problem-solving, creativity, and critical thinking abilities. Among product categories, games and puzzles generated USD 14.8 million in revenue in 2024 and are forecasted to expand at a CAGR of 7.4% in the coming years. Consumer preferences are also evolving, with an increasing inclination toward sustainable and eco-friendly educational toys. Growing environmental concerns are pushing companies to adopt responsible sourcing, recyclable materials, and greener manufacturing processes.

Age-based segmentation highlights that children aged 4 to 8 years represent the largest share of the market, accounting for 54.9% in 2024. This segment is projected to expand at a 6.9% CAGR through 2034. At this developmental stage, children experience rapid growth in cognitive and motor functions, making educational toys particularly beneficial. Parents and educators are investing in toys that support foundational skills in literacy, numeracy, and analytical thinking, reinforcing early learning experiences.

The market is also segmented by distribution channels, with offline retail accounting for 51.2% of sales in 2024. Many parents prefer in-store shopping, where they can assess the quality and safety of toys before making a purchase. Retailers provide expert guidance to help customers choose age-appropriate educational products. However, online sales are rapidly increasing, driven by the convenience of home shopping, access to a wider product range, and easy price comparisons.

Geographically, North America leads the educational toys market, holding a 38.1% share and generating USD 22.4 million in revenue in 2024. The region's high disposable income and emphasis on early childhood education drive significant spending on learning-based toys. A strong retail infrastructure ensures accessibility, while ongoing government investments in educational programs further boost market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Integration of technology in toys

- 3.10.1.2 Increase in demand for non-harmful materials

- 3.10.1.3 Growing focus on STEM Toys

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Counterfeit products

- 3.10.2.2 Rising prevalence of unbranded products

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Mn) (Thousand Units)

- 5.1 Key trends

- 5.2 Arts & craft

- 5.3 Games & Puzzles

- 5.4 Motor Skills

- 5.5 Musical Toys

- 5.6 STEM Toys

- 5.7 Role play

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Age Group, 2021 - 2034 ($Mn) (Thousand Units)

- 6.1 Key trends

- 6.2 4 years to 8 years

- 6.3 Up to 4 years

- 6.4 Above 8 years

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 ($Mn) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn) (Thousand Units)

- 8.1 Key trends

- 8.2 Offline

- 8.3 Online

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Bandai Namco Holdings Inc.

- 10.2 Clementoni S.p.A.

- 10.3 Fisher-Price, Inc.

- 10.4 Gigo Toys

- 10.5 Hape International AG

- 10.6 Hasbro, Inc.

- 10.7 K’NEX Brands

- 10.8 LeapFrog Enterprises, Inc.

- 10.9 LEGO Group

- 10.10 Mattel, Inc.

- 10.11 Melissa & Doug, LLC

- 10.12 Ravensburger AG

- 10.13 Spin Master Corp.

- 10.14 VTech Holdings Limited

- 10.15 WowWee Group Limited