PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684587

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684587

Infants and Toddlers Toy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

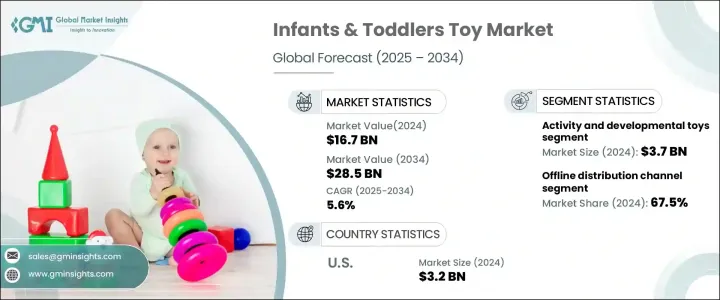

The Global Infants And Toddlers Toys Market reached USD 16.7 billion in 2024 and is projected to grow at a CAGR of 5.6% between 2025 and 2034. As more parents and guardians recognize the vital role toys play in the development of young children, the demand for educational and developmental toys continues to rise. Toys designed to enhance motor skills, foster early learning, and promote problem-solving abilities have become a top priority for parents dedicated to supporting their child's growth and cognitive development. The increasing awareness around the importance of early childhood development and the role of engaging toys in it is reshaping buying behaviors. Furthermore, with a rising global middle class and expanding purchasing power in emerging markets, more parents are investing in quality toys that contribute positively to their child's learning process.

The market for infants & toddlers toys spans various categories, including educational, soft, activity and developmental, ride-on, construction sets, bath toys, and others. Among these, activity and developmental toys are expected to dominate in 2024, representing a market share of USD 3.7 billion. This segment is projected to grow by 6% annually from 2025 to 2034, driven by an increasing preference for toys that stimulate both cognitive and physical development. Parents are particularly drawn to toys that encourage problem-solving and creativity, which are essential to early childhood education. As such, these toys are not only seen as playthings but also as valuable tools for educational engagement.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.7 Billion |

| Forecast Value | $28.5 Billion |

| CAGR | 5.6% |

Toys for infants & toddlers are primarily distributed through two channels: online and offline. In 2024, offline sales led the market, accounting for 67.5% of the market share. This segment is expected to experience a growth rate of 5.4% from 2025 to 2034. Physical stores, such as toy retailers, department stores, and supermarkets, offer a key advantage by allowing customers to physically inspect and handle toys before making a purchase. This is especially important for parents, who prioritize safety, quality, and age appropriateness when choosing toys. These factors significantly influence purchasing decisions, making in-store shopping a valuable experience for parents seeking to ensure their child's development is supported by the best possible toys.

In 2024, the U.S. dominated the infants and toddlers toy market with a 38.2% share. The strong consumer culture and the growing number of young children in the country fuel this dominance. Both offline and online sales channels are well-established and cater to a variety of consumer preferences. Similarly, in the Asia-Pacific region, China holds a notable share of 31.2% of the infants & toddlers toy market in 2024. The country benefits from a rapidly expanding child population and a robust domestic production capacity, which supports the growing demand across both urban and rural areas. China's prominent role in the global toy manufacturing sector also enhances its position in this market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing awareness of early childhood development

- 3.2.1.2 Popularity of eco-friendly and safe toys

- 3.2.1.3 Personalized and customizable toys

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Imitation and counterfeit products

- 3.2.2.2 Parenting trends and changing consumer preferences

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Educational toys

- 5.3 Soft toys

- 5.4 Activity and developmental toys

- 5.5 Ride-on toys

- 5.6 Building sets

- 5.7 Bath toys

- 5.8 Others (teething toys, pull-along toys)

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 – 2034, (USD Billion)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Wooden

- 6.4 Fabric/cloth

- 6.5 Silicone/rubber

- 6.6 Eco-friendly materials (e.g., bamboo, recycled materials)

Chapter 7 Market Estimates & Forecast, By Age Group, 2021 – 2034, (USD Billion)

- 7.1 Key trends

- 7.2 0–6 Months

- 7.3 6–12 Months

- 7.4 1–2 Years

- 7.5 2–4 Years

Chapter 8 Market Estimates & Forecast, By Price, 2021 – 2034, (USD Billion)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce platforms

- 9.2.2 Brand websites

- 9.3 Offline

- 9.3.1 Supermarkets/hypermarkets

- 9.3.2 Specialty toy stores

- 9.3.3 Department stores

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Mattel, Inc.

- 11.2 Hasbro, Inc.

- 11.3 Spin Master Corp.

- 11.4 LEGO Group

- 11.5 Hamleys

- 11.6 VTech

- 11.7 Fisher-Price

- 11.8 Melissa & Doug

- 11.9 Little Tikes

- 11.10 Chicco

- 11.11 Playmobil

- 11.12 Tomy

- 11.13 Clementoni

- 11.14 Hape

- 11.15 Janod