PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892748

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892748

Bicycle Derailleur Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

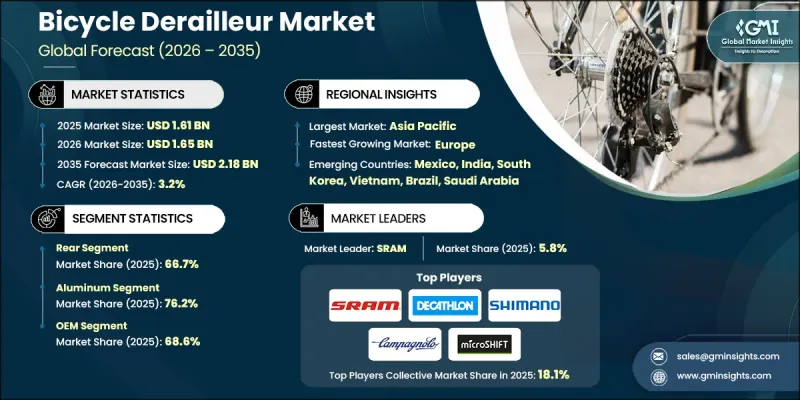

The Global Bicycle Derailleur Market was valued at USD 1.61 billion in 2025 and is estimated to grow at a CAGR of 3.2% to reach USD 2.18 billion by 2035.

The growth of the bicycle industry has directly fueled the demand for advanced components, with derailleurs being a critical element that manages pedal speed and gear transitions. Manufacturers are focusing on creating lighter, stronger, and more precise derailleurs to provide smoother shifting, reduced maintenance, and enhanced performance. Rising interest in e-bikes, gravel bikes, and mountain biking has increased demand for derailleurs that can handle higher torque, broader gear ranges, and challenging terrain. Aftermarket customization is another major driver, as cyclists increasingly seek components that match their riding style and optimize bike performance. These trends are complemented by the continuous innovation in materials and design to improve durability, weight efficiency, and sustainability while maintaining affordability.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.61 Billion |

| Forecast Value | $2.18 Billion |

| CAGR | 3.2% |

Cost and convenience play a pivotal role in market growth. Derailleur makers are developing components that are lightweight, long-lasting, and budget-friendly. Easy availability through online stores and bicycle shops simplifies purchase and installation for riders. Brand competition has pushed manufacturers to offer aluminum, steel, and composite derailleurs that balance performance, weight, and cost. Growing environmental awareness is encouraging the use of recycled materials to appeal to eco-conscious consumers.

The rear derailleur segment held 66.7% share in 2025, reflecting its essential role in multi-gear drivetrains. Most shifting occurs at the rear cassette, making rear derailleurs the most widely used across road, mountain, hybrid, gravel, and e-bikes, while front derailleurs are gradually being phased out.

The aluminum segment held a 76.2% share in 2025, due to its cost-effectiveness, corrosion resistance, and durability compared to steel or carbon fiber. However, fluctuations in aluminum pricing occasionally push manufacturers to explore alternative materials.

U.S. Bicycle Derailleur Market reached USD 343.2 million in 2025. OEM sales dominate the market, as most derailleurs are pre-installed on new bicycles sold by major brands and retailers, particularly in road, mountain, and e-bike segments.

Leading companies in the Bicycle Derailleur Market include SRAM, Decathlon, Shimano, Campagnolo, MicroSHIFT, SunRace, FSA, KMC Chain Industrial, SR Suntour, and The Hive. To strengthen their Bicycle Derailleur Market presence, companies are focusing on continuous product innovation by developing lighter, more precise, and durable derailleurs suited for high-performance cycling. Expanding distribution through online and retail channels improves accessibility, while investment in R&D ensures adaptation to evolving biking trends such as e-bikes and gravel/mountain riding. Brands also emphasize sustainability by using recycled and eco-friendly materials. Strategic partnerships and OEM collaborations help secure long-term contracts and visibility among global bicycle manufacturers. Additionally, aftermarket customization options cater to enthusiasts, increasing brand loyalty and driving repeat purchases.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Size

- 2.2.4 Mechanism

- 2.2.5 Material

- 2.2.6 Bicycle

- 2.2.7 Sales Channel

- 2.2.8 End Use

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Global cycling participation growth

- 3.2.1.2 E-bike market expansion & integration

- 3.2.1.3 Technology advancement in electronic shifting

- 3.2.1.4 Urban mobility & commuting trends

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of premium electronic systems

- 3.2.2.2 Material cost inflation

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets development

- 3.2.3.2 Wireless electronic system democratization

- 3.2.3.3 Sustainability & circular economy integration

- 3.2.3.4 Direct-to-consumer distribution models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.7.3 Technology roadmaps & evolution

- 3.7.4 Technology adoption lifecycle analysis

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Patent analysis

- 3.11 Consumer insights & behavioral intelligence

- 3.11.1 Customer experience mapping

- 3.11.2 User pain points

- 3.11.3 Premiumization trend

- 3.11.4 Purchase decision motivators

- 3.12 Sustainability & circular economy opportunities

- 3.12.1 Material sustainability

- 3.12.2 Recycling & refurbishing opportunities in aftermarket

- 3.12.3 Eco-friendly derailleur design frameworks

- 3.12.4 Impact of e-bike motor torque on derailleur lifespan & sustainability

- 3.13 OEM partnership landscape & sourcing strategies

- 3.13.1 Bicycle brand sourcing patterns

- 3.13.2 OEM selection criteria

- 3.13.3 Strategic sourcing opportunities for derailleur brands

- 3.13.4 OEM-supplier dependency risks

- 3.14 Market disruption scenario analysis

- 3.14.1 Shift to belt-drive systems

- 3.14.2 Material shortage or carbon price volatility

- 3.14.3 Impact of global cycling subsidy programs

- 3.14.4 Geopolitical supply risk

- 3.15 Product replacement & failure pattern analysis

- 3.15.1 Replacement rates by bike type

- 3.15.2 Wear & tear characteristics

- 3.15.3 Maintenance frequency mapping

- 3.15.4 Factors influencing early failure

- 3.16 Best case scenarios

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Vendor selection criteria

Chapter 5 Market Estimates & Forecast, By Product, 2022 - 2035 ($Mn, Units)

- 5.1 Key trends

- 5.2 Front

- 5.3 Rear

Chapter 6 Market Estimates & Forecast, By Size, 2022 - 2035 ($Mn, Units)

- 6.1 Key trends

- 6.2 Short

- 6.3 Medium

- 6.4 Long Cage

Chapter 7 Market Estimates & Forecast, By Mechanism, 2022 - 2035 ($Mn, Units)

- 7.1 Key trends

- 7.2 Manual/Mechanical

- 7.3 Electronic

- 7.4 Automatic

- 7.5 Hybrid

Chapter 8 Market Estimates & Forecast, By Material, 2022 - 2035 ($Mn, Units)

- 8.1 Key trends

- 8.2 Aluminum

- 8.3 Carbon fiber

- 8.4 Steel

Chapter 9 Market Estimates & Forecast, By Bicycle, 2022 - 2035 ($Mn, Units)

- 9.1 Key trends

- 9.2 Road bikes

- 9.3 Mountain bikes

- 9.4 Hybrid bikes

- 9.5 E-bikes

- 9.6 Gravel Bikes

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Mn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Mn, Units)

- 11.1 Key trends

- 11.2 Professional Cyclists

- 11.3 Enthusiasts

- 11.4 General/Commuter Users

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn, Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Nordics

- 12.3.8 Benelux

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 ANZ

- 12.4.6 Singapore

- 12.4.7 Malaysia

- 12.4.8 Indonesia

- 12.4.9 Vietnam

- 12.4.10 Thailand

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Colombia

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Global companies

- 13.1.1 Shimano

- 13.1.2 SRAM

- 13.1.3 Campagnolo

- 13.1.4 MicroSHIFT

- 13.1.5 Full Speed Ahead

- 13.1.6 SunRace

- 13.1.7 KMC Chain Industrial

- 13.1.8 SR Suntour

- 13.1.9 The Hive

- 13.1.10 Decathlon

- 13.2 Regional companies

- 13.2.1 Box Components

- 13.2.2 Cane Creek Cycling Components

- 13.2.3 Paul Component Engineering

- 13.2.4 Ritchey Design

- 13.2.5 Gipiemme

- 13.2.6 Garbaruk

- 13.2.7 Wolf Tooth Components

- 13.2.8 CeramicSpeed

- 13.3 Emerging companies

- 13.3.1 ROTOR

- 13.3.2 L-TWOO Sports Technology

- 13.3.3 WHEELTOP

- 13.3.4 Praxis Cycles

- 13.3.5 Gevenalle

- 13.3.6 Archer Components

- 13.3.7 Sensah

- 13.3.8 S-Ride