PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684659

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684659

Bicycle Front Hub Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

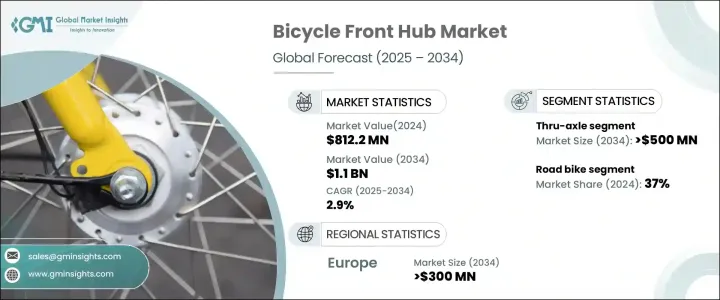

The Global Bicycle Front Hub Market was valued at USD 812.2 million in 2024 and is projected to grow at a CAGR of 2.9% from 2025 to 2034. This growth is driven by increasing demand for high-performance bicycles, spurred by advancements in hub technology and the surge in popularity of electric bikes (e-bikes) and urban mobility solutions. The market benefits from innovations such as lightweight materials, advanced engagement systems, and sealed bearings, which significantly enhance hub performance and durability. As governments worldwide continue to support cycling infrastructure improvements, the demand for bicycles-especially e-bikes-continues to grow. Alongside this, a growing trend toward aftermarket customization and replacement further contributes to the market's expansion. These factors are paving the way for a more dynamic and evolving market.

The push for more sustainable transportation, coupled with the rising popularity of cycling as a recreational activity, is driving the need for more advanced bicycle hubs. As urban mobility trends shift in favor of e-bikes, the demand for front hubs capable of handling the increased power and load of these vehicles continues to rise. E-bike front hubs must not only support the weight of the motor but also provide durability and performance for extended usage. This shift is changing the industry, with more cyclists opting for solutions that enhance both the efficiency and comfort of their riding experience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $812.2 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 2.9% |

The bicycle front hub market is segmented by product type into quick-release, thru-axle, and bolt-on hubs. In 2024, the thru-axle segment captured 47% of the market share and is expected to generate USD 500 million by 2034. Thru-axle hubs are gaining traction, particularly in high-performance bicycles, thanks to their superior stiffness, strength, and wheel security. These features make them especially suitable for mountain bikes, gravel bikes, and e-bikes, where stability and precision are crucial. The shift toward thru-axle systems is becoming the industry standard, driven by the desire for enhanced handling and more stable rides.

In terms of bicycle types, the market is divided into hybrid bikes, mountain bikes, e-bikes, and road bikes. Road bikes held a 37% market share in 2024, with demand rising for lightweight, high-performance hubs. Advancements in materials such as carbon fiber and aluminum are driving these trends, while improved bearing systems and quick engagement mechanisms are now standard. Road cyclists, increasingly focused on aerodynamics and speed, seek hubs that offer lower friction and greater responsiveness.

Europe accounted for 29% of the global bicycle front hub market share in 2024 and is projected to generate USD 300 million by 2034. Despite challenges like economic fluctuations and evolving consumer preferences, demand for high-performance bicycle components, including front hubs, remains resilient. The growing adoption of e-bikes in the region is further driving innovation in hub technology to meet the evolving demands of modern cyclists.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Hub manufacturers

- 3.2.3 OEMs

- 3.2.4 Distributors and wholesalers

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Technology differentiators

- 3.8.1 Bearing technology

- 3.8.2 Material innovations

- 3.8.3 Engagement systems

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising e-bike adoption boosting hub demand

- 3.9.1.2 Increasing popularity of cycling for recreation

- 3.9.1.3 Advancements in lightweight and durable materials

- 3.9.1.4 Shift towards thru-axle hubs for performance

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High costs of advanced materials and manufacturing

- 3.9.2.2 Compatibility issues across diverse bicycle standards

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Quick-release

- 5.3 Thru-axle

- 5.4 Bolt-on

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Aluminum

- 6.3 Steel

- 6.4 Carbon fiber

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Bicycle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Road bikes

- 7.3 Mountain bikes

- 7.4 Hybrid bikes

- 7.5 E-bikes

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Campagnolo

- 10.2 Chris King

- 10.3 DT Swiss

- 10.4 Easton Cycling

- 10.5 Extralite

- 10.6 Formula

- 10.7 Hope Technology

- 10.8 Industry Nine

- 10.9 Joytech

- 10.10 Mavic

- 10.11 Novatec

- 10.12 Onyx Racing Products

- 10.13 Paul Component Engineering

- 10.14 Phil Wood

- 10.15 Shimano

- 10.16 Spank Industries

- 10.17 SRAM

- 10.18 Stans NoTubes

- 10.19 Tune

- 10.20 White Industries