PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913409

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913409

Bicycle Gear Shifter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

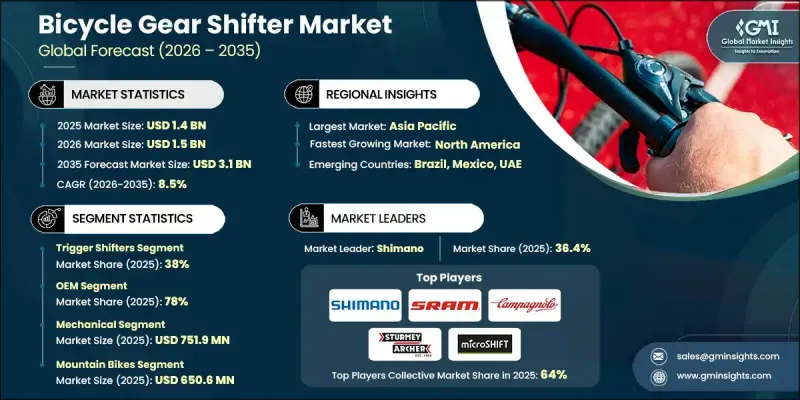

The Global Bicycle Gear Shifter Market was valued at USD 1.4 billion in 2025 and is estimated to grow at a CAGR of 8.5% to reach USD 3.1 billion by 2035.

Market growth is fueled by the increasing popularity of high-performance and customized bicycles, the rising adoption of electric bikes, and a surge in recreational and commuter cycling. As urban populations and cycling enthusiasts seek efficient, ergonomic, and reliable mobility solutions, advanced gear shifters are becoming indispensable for optimizing comfort, performance, and safety across diverse terrains. Technological advancements such as electronic shifting systems, hydraulic shifters, smart connectivity modules, and lightweight, durable materials are transforming modern bicycles, providing smoother gear transitions, enhanced rider control, reduced maintenance, and energy-efficient operation. Market expansion is further supported by growing participation in competitive cycling, mountain biking, urban mobility programs, and fitness-oriented cycling. Additional innovations like wireless derailleurs, ergonomic handlebar designs, multi-speed cassette compatibility, and electronic trigger systems improve usability, component longevity, and overall riding satisfaction, driving broader adoption and market growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.4 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 8.5% |

The trigger shifters segment held 38% share in 2025 and is projected to grow at a CAGR of 7.9% from 2026 to 2035. Trigger shifters dominate the market due to their precise gear control, ergonomic design, broad compatibility with mountain, hybrid, and electric bikes, quick response, and durability, making them a preferred choice for both competitive and recreational cyclists.

The OEM segment held 78% share in 2025 and is expected to grow at a CAGR of 8.2% through 2035. OEM channels drive growth by integrating high-quality shifters with new bicycles across mountain, road, hybrid, and electric bike segments. This ensures component authenticity, optimal drivetrain performance, seamless compatibility, and consistent rider experience, solidifying OEM as the preferred choice for large-scale production and premium bicycles.

China Bicycle Gear Shifter Market held 33% share, generating USD 238.2 million in 2025. The region benefits from rapid urbanization, widespread cycling adoption, expansion of e-bike fleets, and growing demand in recreational, commuter, and competitive cycling. Strong manufacturing capabilities, efficient distribution networks, and rising consumer awareness support the region's leadership in the global market.

Leading companies in the Global Bicycle Gear Shifter Market include microShift, SRAM, Campagnolo, Paul Components, Rivendell Bicycle Works, Shimano, Tektro, Pinion, SunRace, Sturmey Archer, and Box Components. To strengthen their presence, companies focus on continuous product innovation, introducing advanced electronic, hydraulic, and smart connectivity shifters for various bicycle segments. Strategic collaborations with OEMs and e-bike manufacturers ensure integration into new bicycles and fleet programs. Firms invest in lightweight, durable materials and ergonomic designs to enhance performance and customer satisfaction. Expanding distribution networks, strengthening after-sales support, and developing customizable solutions for competitive, commuter, and recreational riders further solidify market foothold.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of e-bikes and high-performance bicycles

- 3.2.1.2 Technological innovations

- 3.2.1.3 Growing recreational and commuter cycling

- 3.2.1.4 Demand for customization and performance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced shifters

- 3.2.2.2 Limited awareness in emerging markets

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in e-bike segment

- 3.2.3.2 Collaborations with OEMs and smart-bike platforms

- 3.2.3.3 Smart & Connected Shifters

- 3.2.3.4 Premium & Customizable Shifters

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 16 CFR Part 1512 - Bicycle Safety Requirements; ISO standards compliance

- 3.4.1.2 CPSC aligned standards; ISO 4210 compliance; CAN/CSA requirements

- 3.4.2 Europe

- 3.4.2.1 EN ISO 4210 (DIN harmonized); General Product Safety Directive (GPSD); CE marking required

- 3.4.2.2 EN ISO 4210 compliance; GPSD framework; Type approval requirements

- 3.4.2.3 EN ISO 4210:2023; GPSD requirements; Post-Brexit alignment with EN standards

- 3.4.3 Asia Pacific

- 3.4.3.1 GB/T standards for bicycle components; QC/T standards for gear mechanisms; Government-mandated inspections

- 3.4.3.2 IS (Indian Standards) 2411 - Cycles (Safety Requirements); ISO 4210 alignment; Bureau of Indian Standards (BIS) certification

- 3.4.3.3 JIS standards for bicycle components; ISO 4210 adoption; Strict mechanical safety requirements for shifter durability

- 3.4.4 Latin America

- 3.4.4.1 ABNT (Associacao Brasileira de Normas Tecnicas) standards; ISO 4210; INMETRO certification requirements for market entry

- 3.4.5 Middle East and Africa

- 3.4.5.1 GSO (Gulf Standardization Organization) standards; ISO 4210 compliance; Local safety certification requirements

- 3.4.5.2 SABS (South African Bureau of Standards) alignment; ISO 4210 compliance; Local product certification

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Consumer Behavior & Trends Analysis

- 3.14 Investment & Funding Analysis

- 3.14.1 R&D investment by major players

- 3.14.2 Venture capital in cycling technology

- 3.14.3 M&A activity

- 3.14.4 Private equity interest in component manufacturers

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2022 - 2035 ($ Bn, Units)

- 5.1 Key trends

- 5.2 Trigger shifters

- 5.3 Twist

- 5.4 Bar-end

- 5.5 Grip

- 5.6 Electronic

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2022 - 2035 ($ Bn, Units)

- 6.1 Key trends

- 6.2 Mechanical

- 6.3 Electronic

- 6.4 Hydraulic

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035 ($ Bn, Units)

- 7.1 Key trends

- 7.2 Mountain bikes

- 7.3 Road bikes

- 7.4 Urban bikes

- 7.5 Touring bicycles

- 7.6 Others

- 7.7 Metal-based

- 7.8 Composite

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 ($ Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global Player

- 10.1.1 Box Components

- 10.1.2 Campagnolo

- 10.1.3 FSA (Full Speed Ahead)

- 10.1.4 Magura

- 10.1.5 microSHIFT

- 10.1.6 Rotor bike component

- 10.1.7 Shimano

- 10.1.8 SRAM

- 10.1.9 SunRace Sturmey-Archer

- 10.1.10 Tektro

- 10.1.11 Rivendell Bicycle Works

- 10.2 Regional Player

- 10.2.1 Acros

- 10.2.2 Blackspire

- 10.2.3 Exustar

- 10.2.4 KCNC

- 10.2.5 KMC Chain

- 10.2.6 PROWHEEL

- 10.2.7 Reverse Components

- 10.2.8 Syntace

- 10.2.9 TruVativ

- 10.2.10 Veloce

- 10.3 Emerging Players

- 10.3.1 BikeYoke

- 10.3.2 Gevenalle

- 10.3.3 JAGWIRE

- 10.3.4 Pinion