PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666951

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666951

Stationary Lead Acid Battery Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

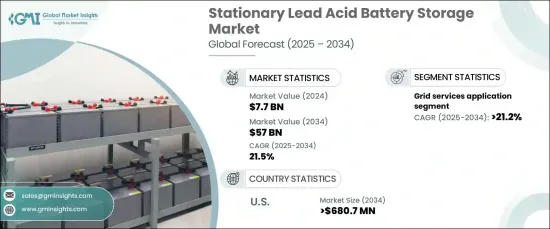

The Global Stationary Lead Acid Battery Storage Market, valued at USD 7.7 billion in 2024, is expected to grow at a CAGR of 21.5% from 2025 to 2034. The increasing demand for reliable energy storage solutions across various sectors is fueling this growth. These batteries are particularly valued for their cost-effectiveness and ability to provide dependable, long-lasting energy storage. Their versatility makes them a preferred choice in commercial, industrial, and residential applications. Technological advancements have significantly improved their performance, efficiency, and durability, ensuring their relevance despite the emergence of alternative energy storage technologies. The rising need for uninterrupted power supply across critical sectors continues to drive demand, as these batteries are well-suited to meet consistent energy requirements.

Stationary lead-acid batteries are crucial in supporting backup power needs in industries with consistent power demands. Their high discharge rates and extended lifespan make them highly dependable for large-scale energy storage systems. These batteries also offer a sustainable solution, as they are cost-effective and relatively easy to recycle. Emerging markets increasingly adopt lead-acid battery systems due to their affordability and established recycling infrastructure. However, newer technologies such as lithium-ion batteries present competition, and lead-acid batteries remain favored for their ability to deliver reliable performance for high-capacity applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $57 Billion |

| CAGR | 21.5% |

The use of lead-acid battery systems in grid services is projected to grow significantly over the forecast period, with a CAGR of 21.2%. Their reliability and cost advantages make them suitable for essential grid operations such as peak load management and emergency power supply. Utilities value these batteries for their capacity to stabilize grids, integrate renewable energy sources, and meet large-scale energy demands efficiently. The strong growth potential in this segment highlights their continued importance in the global energy storage landscape.

The stationary lead-acid battery storage market in the United States is anticipated to surpass USD 680.7 million by 2034. The demand for dependable backup power in industrial and commercial settings is a key growth driver. These batteries also support utilities by managing grid loads and integrating renewable energy storage. Innovations in design have improved safety and extended lifecycle performance, further enhancing their adoption. While stricter regulations surrounding lead handling and disposal present challenges, they also incentivize advancements in battery recycling technologies, contributing to their sustainability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Grid services

- 5.3 Behind the meter

- 5.4 Off grid

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 France

- 6.3.3 Germany

- 6.3.4 Italy

- 6.3.5 Russia

- 6.3.6 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Australia

- 6.4.3 India

- 6.4.4 Japan

- 6.4.5 South Korea

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 Turkey

- 6.5.4 South Africa

- 6.5.5 Egypt

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 CD Technologies

- 7.2 Duracell

- 7.3 Enersys

- 7.4 Exide Industries

- 7.5 Furukawa Battery

- 7.6 GS Yuasa

- 7.7 Johnson Controls

- 7.8 Lockheed Martin

- 7.9 Narada

- 7.10 Panasonic

- 7.11 Ritar

- 7.12 Siemens