Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635459

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635459

Europe Lead-acid Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

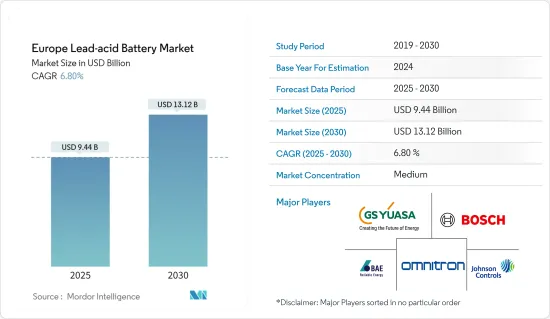

The Europe Lead-acid Battery Market size is estimated at USD 9.44 billion in 2025, and is expected to reach USD 13.12 billion by 2030, at a CAGR of 6.8% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing automotive sector and adoption of battery energy storage systems (BESS) are expected to drive the lead-acid battery market in Europe during the forecast period.

- On the other note, rising adoption of lithium-ion batteries and increasing electric vehicle sales are likely to restrain the growth of the lead-acid battery market over the coming years.

- Nevertheless, increased off-grid solar installation investment is estimated to provide a significant opportunity for the lead acid market in Europe.

- Germany is likely to dominate the lead acid battery market in Europe due to the higher presence of automobile manufacturers in the country.

Europe Lead-acid Battery Market Trends

SLI Battery Segment to Dominate the Market

- Starting, lighting, and ignition (SLI) batteries have been in almost every car for the past 100 years. Generally, SLI batteries are used for short power bursts, such as starting a car engine or running light electrical loads.

- SLI batteries are designed for automobiles and, therefore, are always installed with the vehicle's charging system, which means that there is a continuous cycle of charge and discharge in the battery whenever the vehicle is in use. The 12-volt batteries have been the most commonly used for more than 50 years; however, their average voltage is close to 14-volt.

- Also, the telecom industry is primarily dependent on an elaborate network of mobile phone towers and field facilities for the transmission of phone calls and internet services. For their efficient operations, these towers and field facilities require a constant and highly reliable supply of electric power, usually from the electrical grid converted to direct current (DC) power at -48 volts for wired networks and +24 volts for wireless networks. The batteries used in the telecom industry include VRLA, NiCd, and Li-ion, among others.

- In the last couple of years, the SLI batteries witnessed significant demand due to the growing demand from OEMs and aftermarkets from the automotive sector in the European region. These batteries primarily mostly utilized power start motors, lights, ignition systems, or other internal combustion engines while ensuring high performance, long life, and cost-efficiency.

- Moreover, in 2022, Germany, France and United kingdom are the leading countries in terms of sales of passengers cars. Germany's passenger car sales amounted to around 2.65 million units. in fracne it was around 1.6 million and United kingdom is was around 1.6 million.

- Also, around 9.3 million new passenger cars were sold across the European Union in 2022, which is 4.6% less than the previous year. However, the replacement of the old SLI batteries in old vehicles is anticipated to drive the the market.

- Owing to the above points, SLI Battery Segement is expected to dominate Europe lead-acid battery market during the forecast period.

Germany to Dominate the Market

- Germany is one of the world's largest manufacturing countries for passenger and commercial vehicles. For several decades the automobile industry has been a key sector in the German economy.

- Moreover, Germany has been recognized worldwide as an Innovation hub for the automotive industry, as all major automobile manufacturers have a presence in the country. In 2022, Germany is Europe's number one automotive market, accounting for around 26% of all passenger cars manufactured and approximately 20% of all new car registrations.

- Also, In June 2022, Germany, raised its voice against the EU ban on new ICE vehicles in the region by 2035. The ICE vehicles form a considerable part of the vehicle stock manufactured by major players in Germany like Volkswagen, BMW, and Mercedes. Moreover, Germany's passenger car sales amounted to around 2.65 million units in 2022.

- Germany is considered a highly developed market in the world, and it is the financial powerhouse of the European Union. This, resulting a higher number of data centres, and as of the end of 2023, there were more than 522 active data centres in the country. Furthermore, due to automation and development meant of the 5G network, the demand for the data centre is in Germany.

- The demand for lead acid batteries is rising in Germany due to increased investment in the automobile, data centre and telecommunication industry. Though there is the presence of substitutes, such as lithium-ion batteries, there is still more demand for lead acid batteries from all these industries. The lead acid battery has a long life, safety and good performance in the long run, which makes them the first choices in the data centre, automobile and telecommunication industry.

- Thus all these development in Germany in the automobile and data centre industry is likely to drive the lead acid market during the forecast period.

Europe Lead-acid Battery Industry Overview

The Europe lead-acid battery market is semi fragmented. Some of the key players (in no particular order) in the market include BAE Batterien GmbH, Exide Technologies Inc., GS Yuasa Corporation, Johnson Controls International PLC, Omnitron Griese GmbH, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 91997

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Sales of Automobiles

- 4.5.1.2 Growing Adoption of Battery Energy Storage Systems (BESS)

- 4.5.2 Restraints

- 4.5.2.1 Rising Emphasis on Lithium-Ion Batteries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 SLI (Starting, Lighting, Ignition) Batteries

- 5.1.2 Stationary Batteries (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.1.3 Portable Batteries (Consumer Electronics, etc.)

- 5.1.4 Other Applications

- 5.2 Technology

- 5.2.1 Flooded

- 5.2.2 VRLA (Valve Regulated Lead-acid)

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Spain

- 5.3.5 Italy

- 5.3.6 NORDIC

- 5.3.7 Turkey

- 5.3.8 Russia

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Johnson Controls International PLC

- 6.3.2 Exide Technologies Inc.

- 6.3.3 GS Yuasa Corporation

- 6.3.4 Robert Bosch GmbH

- 6.3.5 Omnitron Griese GmbH

- 6.3.6 BAE Batterien GmbH

- 6.3.7 Amara Raja Batteries Ltd

- 6.3.8 Leoch International Technology Limited

- 6.3.9 Panasonic Corporation

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increased Off-Grid Solar Installation Investment

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.