Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636236

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636236

Lead Acid Battery For SLI Applications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 124 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

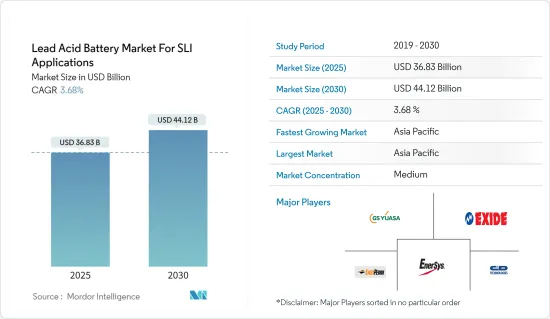

The Lead Acid Battery Market For SLI Applications Industry is expected to grow from USD 36.83 billion in 2025 to USD 44.12 billion by 2030, at a CAGR of 3.68% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing demand from the automotive industry and rising lead-acid battery recycling facilities are expected to drive the market during the forecast period.

- On the other hand, competition from alternative technologies is likely to hinder market growth during the forecast period.

- Nevertheless, technological advancements are expected to provide significant opportunities for the market in the coming years.

- Asia-Pacific is estimated to dominate the market due to the increasing adoption rate of electric vehicles across various countries in the region.

Lead Acid Battery Market Trends

Growing Demand in the Automotive Industry

- Automotive is one of the major industries in various regions, particularly in North America, Europe, and Asia-Pacific. Growing urbanization in these regions is driving the demand for automobiles, thus making it one of the largest markets for SLI batteries globally.

- A lead-acid battery is the technology of choice for all SLI battery applications in conventional combustion engine vehicles, such as cars and trucks, worldwide. Lead-acid batteries are the most economically viable mass-market technology for SLI applications in traditional vehicles. Over 90% of automotive SLI batteries are lead-acid based, and over 90% (by storage capacity) of industrial stationary and motive applications.

- In 2023, China led the world in passenger car production, with approximately 26.1 million units manufactured. Japan, the second-highest producer, produced around 7.8 million units. These countries are also home to some of the world's largest automobile manufacturers, such as GS Yuasa Corporation and Camel Group Co. Ltd, the major SLI battery consumers.

- With expanding vehicle ownership worldwide, especially in developing regions, there is a parallel rise in the need for SLI batteries to power traditional internal combustion engine (ICE) vehicles.

- Although the market for conventional internal combustion engine vehicles is expected to decline over the next 20 to 25 years, replacement car technologies are expected to continue using SLI-type lead-acid batteries to power various electronics and safety features within the vehicle. Advanced lead-based batteries (absorbent glass mat or enhanced flooded batteries) provide start-stop functionality to improve fuel efficiency in major micro-hybrid vehicles. In start-stop systems, the internal combustion engine (ICE) automatically shuts down under braking and rest, reducing fuel consumption by up to 5-10%.

- According to the OICA (Organisation Internationale des Constructeurs d'Automobiles), the global vehicle sales for passenger cars reached 65.27 million in 2023. The vehicle sales for commercial vehicles reached 27.45 million in 2023. This indicates a robust demand for automotive components, including lead-acid batteries for SLI (starting, lighting, and ignition) applications.

- As these vehicles rely on SLI batteries for essential functions like starting the engine and powering onboard electronics, the continued high sales volumes drive the demand for lead-acid batteries. This vehicle production and sales surge is expected to sustain and possibly boost the global lead-acid battery market for SLI applications.

China is Expected to Dominate the Market

- The lead-acid battery market in China, especially for starting, lighting, and ignition (SLI) applications, is set to witness significant growth. This expansion is primarily driven by the robust automotive industry, which continues to recover and expand post-pandemic.

- The automotive industry's demand for reliable, cost-effective batteries makes lead-acid batteries a preferred choice for SLI applications. These batteries are integral to powering start motors, lights, and ignition systems in vehicles, ensuring high performance and longevity.

- According to OICA (Organisation Internationale des Constructeurs d'Automobiles), China's vehicle sales for passenger cars reached 26.06 million in 2023. The sales for commercial vehicles reached 4.03 million in 2023. This created a demand for automotive components, including lead-acid batteries for SLI applications.

- Innovations in lead-acid battery technology, such as improved recycling processes and enhanced battery performance, have made these batteries more competitive. Despite the growing popularity of lithium-ion batteries, lead-acid batteries remain relevant due to their established supply chain and cost-effectiveness.

- The aftermarket for automotive batteries is growing, with consumers increasingly replacing and upgrading their existing batteries. This trend is critical for maintaining demand in the SLI category and ensuring sustained market growth. Companies like Johnson Controls International PLC, Exide Technologies Inc., and Amara Raja Batteries Ltd are leading the market, focusing on strategic expansions and technological innovations to retain their competitive edge.

- Overall, the lead-acid battery market in China is expected to maintain its growth trajectory. Continuous advancements and steady demand from the automotive industry, along with the increasing adoption of electric vehicles and the need for advanced energy storage solutions, are expected to drive this growth.

Lead Acid Battery Industry Overview

The lead acid battery market for SLI applications is fragmented. Some of the major players include (not in particular order) GS Yuasa Corporation, C&D Technologies Inc., East Penn Manufacturing Co. Inc., EnerSys, and Exide Technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003504

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumption

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Demand in the Automotive Industry

- 4.5.1.2 Increasing Lead-acid Battery Recycling

- 4.5.2 Restraints

- 4.5.2.1 Competition from Alternative Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Technology

- 5.1.1 Flooded

- 5.1.2 VRLA (Valve Regulated Lead-acid)

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 Spain

- 5.2.2.4 NORDIC

- 5.2.2.5 Turkey

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Malaysia

- 5.2.3.6 Thailand

- 5.2.3.7 Indonesia

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Egypt

- 5.2.5.5 Nigeria

- 5.2.5.6 Qatar

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Johnson Controls International PLC

- 6.3.2 Exide Technologies

- 6.3.3 EnerSys

- 6.3.4 East Penn Manufacturing Co. Inc.

- 6.3.5 GS Yuasa Corporation

- 6.3.6 Leoch International Technology Limited

- 6.3.7 C&D Technologies Inc.

- 6.3.8 NorthStar Battery Company LLC

- 6.3.9 Camel Group Co. Ltd

- 6.3.10 FIAMM Energy Technology SpA

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.