PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822656

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822656

Europe Power Generation Carbon Capture and Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

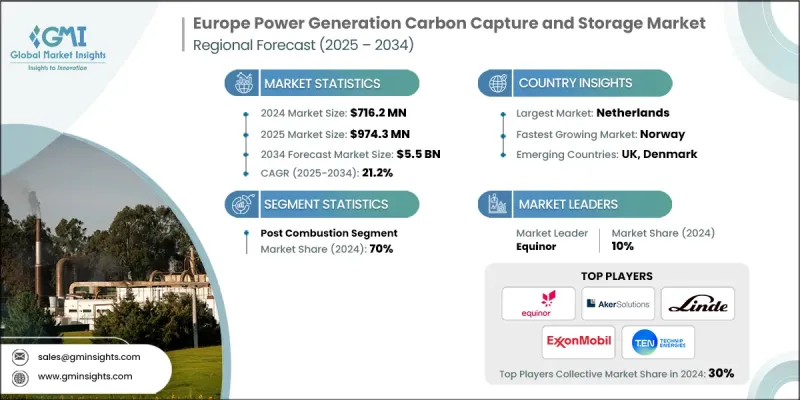

Europe power generation carbon capture, and storage market was estimated at USD 716.2 million in 2024 and is expected to grow from USD 974.3 million in 2025 to USD 5.5 billion by 2034, at a CAGR of 21.2%, according to the latest report published by Global Market Insights Inc.

The European Union's legally binding climate goals, including the ambition to achieve net-zero greenhouse gas emissions by 2050, are pushing utilities and energy producers to adopt carbon capture and storage technologies in power generation to meet compliance standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $716.2 Million |

| Forecast Value | $5.5 Billion |

| CAGR | 21.2% |

Rising Adoption in Post-Combustion

The post-combustion segment held a notable share in 2024, driven by the compatibility with existing fossil fuel power plants. This approach allows for CO2 to be captured directly from flue gases after combustion, making it a practical solution for retrofitting older infrastructure. It is particularly favored in coal- and gas-fired plants where full replacement with renewables is not yet economically feasible. As technological refinements continue to reduce energy penalties and improve capture rates, the post-combustion segment is expected to grow.

Regional Insights

Netherlands to Emerge as a Lucrative Region

Netherlands power generation carbon capture, and storage market held a sizeable share in 2024, driven by strong governmental support, public-private partnerships, and access to offshore storage in the North Sea. Projects such as Porthos and Athos have positioned the country as a hub for CO2 transportation and storage, with captured emissions expected to be injected into depleted gas fields. With the Dutch government providing funding and policy incentives to support industrial decarbonization, the carbon capture and storage market in the country's strategic coastal infrastructure and collaborative regulatory environment make it a model for CCS deployment in dense, industrialized regions.

Major players in the Europe power generation carbon capture and storage market are Technip Energies N.V., Exxon Mobil Corporation, Air Liquide, Sulzer Ltd., Global Thermostat, Chevron Corporation, HALLIBURTON, Linde plc, Equinor, Fluor Corporation, CarbonFree, Mitsubishi Heavy Industries Ltd., Shell plc, Harbour Energy, Siemens, General Electric, SLB, Aker Solutions, Dakota Gasification Company, NRG Energy, Inc.

Companies operating in the Europe power generation carbon capture and storage market are focusing on scalable project development, cross-sector collaboration, and advanced R&D investment to secure long-term positioning. Leading firms are partnering with governments and industrial clusters to build integrated carbon capture, transport, and storage value chains. Others are targeting retrofits in high-emission plants and expanding pilot projects into full-scale operations. Investing in low-cost absorbents, digital monitoring platforms, and modular capture systems is a key area of innovation aimed at improving performance and reducing OPEX. Additionally, forming alliances across borders-for shared storage infrastructure or knowledge transfer-is helping companies tap into EU-level funding while accelerating deployment timelines. These strategies collectively support stronger regional market penetration and contribute to Europe's long-term net-zero ambitions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024, by country

- 4.2.1 Norway

- 4.2.2 Netherlands

- 4.2.3 UK

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Pre combustion

- 5.3 Post combustion

- 5.4 Oxy-fuel combustion

Chapter 6 Market Size and Forecast, By Country, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 UK

- 6.3 Netherlands

- 6.4 Norway

Chapter 7 Company Profiles

- 7.1 Air Liquide

- 7.2 Aker Solutions

- 7.3 Chevron Corporation

- 7.4 CarbonFree

- 7.5 Dakota Gasification Company

- 7.6 Equinor

- 7.7 Exxon Mobil Corporation

- 7.8 Fluor Corporation

- 7.9 General Electric

- 7.10 Global Thermostat

- 7.11 HALLIBURTON

- 7.12 Linde plc

- 7.13 Mitsubishi Heavy Industries, Ltd.

- 7.14 NRG Energy, Inc.

- 7.15 Shell plc

- 7.16 Siemens

- 7.17 SLB

- 7.18 Sulzer Ltd.

- 7.19 Harbour Energy

- 7.20 Technip Energies N.V.