PUBLISHER: VDC Research Group, Inc. | PRODUCT CODE: 1698619

PUBLISHER: VDC Research Group, Inc. | PRODUCT CODE: 1698619

Containers & Virtualization Solutions for Edge & Embedded Systems

Inside this Report

Cloud-native development processes, demand for isolation capabilities, and increasingly complex embedded systems will drive significant growth in the market for edge and embedded container and virtualization solutions over the next five years. This report examines the commercial market for container and hypervisor solutions and related services for IoT and embedded applications. It includes in-depth analysis of emerging engineering trends, use cases, market dynamics, and vendor strategies.

What Questions are Addressed?

- Which factors are driving engineering organizations to adopt containers and/or virtualization solutions?

- How are partnerships and M&A activity creating differentiation in the markets for containers and virtualization solutions?

- Which barriers remain in the way of continued adoption of container technologies?

- Which technologies and development practices aid in preconditioning engineering organizations to the use of containers and virtualization solutions?

- How do current and expected use of containers and virtualization solutions differ across industries?

Who Should Read this Report?

This research program is written for those making critical business decisions regarding product, market, channel, and competitive strategy and tactics. This report is intended for senior decision-makers who are developing embedded technology, including:

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and product strategy leaders

- Channel management and channel strategy leaders

Organizations Listed in this Report:

|

|

|

Executive Summary

The markets for containers and virtualization solutions are being influenced by overarching dynamics and trends influencing embedded development practices. Rising security concerns in the IoT are causing engineering organizations to seek out technologies that can provide isolation capabilities. The complexity of modern development practices (characterized by multicore/heterogenous architectures, mixed criticality, and multiple operating systems) are requiring more advanced virtualization solutions that can simultaneously offer opportunities for hardware BoM consolidation. Overall adoption of cloud-native development practices is familiarizing engineering organizations with containerization, leading to hastened adoption rates across embedded industries. Responding to both the demand for product differentiation through software definition as well as regulatory guidance, embedded OEMs have identified containers as a flexible method of deploying both new product capabilities as well as critical software update packages.

Recent market movements including M&A transactions and partnerships by leading vendors are both solidifying the market positioning of some vendors while opening new opportunities for others seeking to capitalize off embedded market adoption rates. Established market players are looking towards these market dynamics for avenues to update and adapt their solutions, paying particular attention to security and safety.

Key Findings:

- Security requirements remain a key factor behind both the adoption of containers and virtualization solutions, as well as purchasing decision when deciding between different vendors.

- Container technology vendors who have traditionally focused on enterprise/IT markets and use cases are increasingly tailoring their solutions for edge, embedded, and IoT applications.

- Resource constrained projects are increasing their use of both virtualization and container technologies. As use of smaller footprint hardware continues to grow within embedded markets, this market opportunity for vendors of both solutions will continue to expand.

Report Excerpt

Containers Key to Enhancing Post-Deployment Content Integration

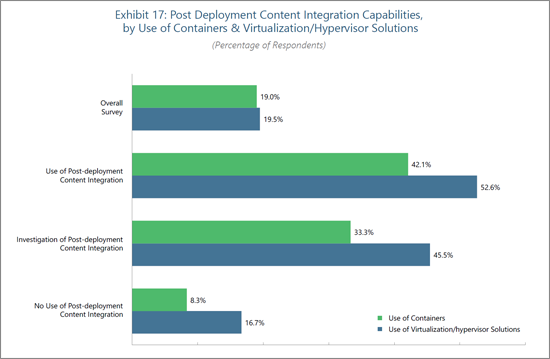

The functionality and value of embedded projects are now defined by software. The ability to continuously deliver post-deployment software features to devices is central to the competitive strategies of original equipment manufacturers (OEMs) across vertical markets. In order to deliver this feature to customers, development organizations are turning to the use of containers and virtualization/hypervisor solutions. Embedded engineers facing post-deployment content requirements within their current projects are utilizing both container and virtualization/hypervisor solutions at significantly increased levels [see Exhibit 17], compared to those not requiring continuous post-deployment content integration.

As software definition continues to drive competitive dynamics within embedded markets, and product differentiation becomes a central goal of embedded development, overall use of containers and virtualization/hypervisor solutions will continue to grow. Vendors of container solutions should seek to market their solutions towards the needs of specific industries (e.g., automotive OTA updates). With a growing convergence of domains occurring across software development tool domains, vendors of container solutions should seek to pair their solutions with complementary, adjacent solutions (e.g., continuous integration and continuous delivery (CI/CD) tools) in order to provide development organizations with more wholistic and integrated offerings. Traditionally CI/CD-focused solution providers such as CloudBees and JFrog are increasingly participating in the OTA update market, serving as strong potential partners for container vendors. Industry initiatives and working groups (the likes of the eSync Alliance) can also serve as an additional avenue for container vendors to leverage the growing demand for OTA updates.

Table of Contents

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Organizations Listed in this Report

Executive Summary

- Key Findings

Global Market Overview

Introduction

- System Complexity Driving Hypervisor Adoption

- Cloud-native Practices Familiarizing Virtualization

- Regulatory Tailwinds Furthering Container Use

- Containers Facing Adoption Hurdles

Recent Market Developments

- Partnerships & Acquisitions

- Broadcom Acquires VMware

- Green Hills Software Partners with NXP on S32 CoreRide Platform

- Mirantis Acquires Shipa

- QNX and Microsoft Enable Cloud-first, Shift-left Development

Important Market Factors

- Organizations

- Cloud Native Computing Foundation

- Standards & Regulations

- Modular Open Systems Approach

- Open Container Initiative

Vertical Markets

- Aerospace & Defense

- Automotive/Rail/Transportation

- Industrial Automation

Regional Markets

- The Americas

- Europe, the Middle East & Africa

- Asia-Pacific

Competitive Landscape

- Selected Vendor Insights

- Canonical

- Elektrobit

- Green Hills Software

- Mirantis

- QNX, a division of BlackBerry

- Red Hat

- SYSGO

- Wind River

End-User Insights

- Containers Key to Enhancing Post-Deployment Content Integration

- Automotive Industry Embracing Containers & Virtualization Solutions

- Security Requirements Drive Adoption of both Containers and Virtualization/Hypervisor Solutions

- Smaller Footprint Devices Increasing Virtualization and Containerization Demand

About the Authors

About VDC Research

List of Exhibits

- Exhibit 1: Global Revenue of Containers, Hypervisors & Related Services for Edge & Embedded Systems

- Exhibit 2: Factors Driving Organizations to Adopt Virtualization/Hypervisor Technology in Current Project

- Exhibit 3: Plans to Use Cloud-based Solutions to Develop Software, by Use of Containers & Virtualization/Hypervisor Solutions

- Exhibit 4: Plans to Use Cloud-based Solutions to Develop Software

- Exhibit 5: Global Revenue of Containers and Related Services for Edge & Embedded Systems, by Vertical Market

- Exhibit 6: Global Revenue of Hypervisors and Related Services for Edge & Embedded Systems, by Vertical Market

- Exhibit 7: Aerospace & Defense Revenue of Containers, Hypervisors & Related Services for Edge & Embedded Systems

- Exhibit 8: Automotive/Rail/Transportation Revenue of Containers, Hypervisors & Related Services for Edge & Embedded Systems

- Exhibit 9: Industrial Automation Revenue of Containers, Hypervisors & Related Services for Edge & Embedded Systems

- Exhibit 10: Global Revenue of Containers and Related Services for Edge & Embedded Systems, by Regional Market

- Exhibit 11: Global Revenue of Hypervisors and Related Services for Edge & Embedded Systems, by Regional Market

- Exhibit 12: The Americas Revenue of Containers, Hypervisors & Related Services for Edge & Embedded Systems

- Exhibit 13: EMEA Revenue of Containers, Hypervisors & Related Services for Edge & Embedded Systems

- Exhibit 14: APAC Revenue of Containers, Hypervisors & Related Services for Edge & Embedded Systems

- Exhibit 15: Global Revenue of Containers and Related Services for Edge & Embedded Systems, by Leading Vendors

- Exhibit 16: Global Revenue of Hypervisors and Related Services for Edge & Embedded Systems, by Leading Vendors

- Exhibit 17: Post Deployment Content Integration Capabilities, by Use of Containers & Virtualization/Hypervisor Solutions

- Exhibit 18: Current and Expected Use of Containers, by Vertical Market

- Exhibit 19: Current and Expected Use of Virtualization/Hypervisor Solutions, by Vertical Market

- Exhibit 20: Factors Driving Organizations to Adopt Virtualization/Hypervisor Technology in Current Project

- Exhibit 21: Factors Driving Organizations to Adopt Container Technology in Current Project

- Exhibit 22: Current and Expected Use of Containers and Virtualization/Hypervisor Solutions within Projects with a CPU/MPU Primary Application Processor

- Exhibit 23: Current and Expected Use of Containers and Virtualization/Hypervisor Solutions within Projects with a MCU Primary Application Processor