PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698557

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698557

Embedded Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

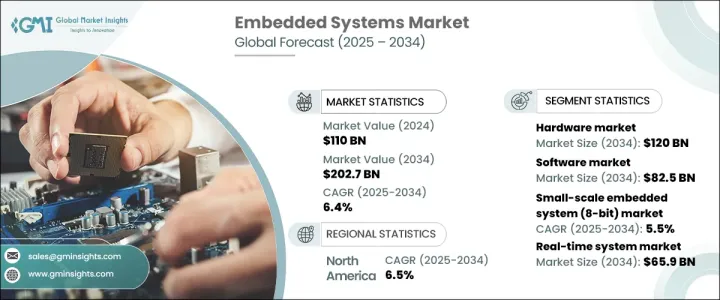

The Global Embedded Systems Market reached USD 110 billion in 2024 and is estimated to grow at a CAGR of 6.4% between 2025 and 2034. The surge in automotive sector developments is a major driver of this market's growth, particularly as embedded systems become crucial for vehicle safety, performance, and automation. The increasing demand for smarter vehicles, which are equipped with multiple microcontrollers, indicates a steady rise in the adoption of embedded systems. The ongoing trend toward electric and connected vehicles further emphasizes the necessity of these systems for seamless integration and operation.

Embedded systems are essentially a combination of computer hardware and software designed to perform specific functions within larger systems. They include microcontrollers, memory, microprocessors, and input/output devices that perform predefined tasks across a range of industries, including automobiles, medical devices, consumer electronics, and household appliances. Within this ecosystem, both hardware and software markets play pivotal roles. Notably, companies are developing integrated solutions to meet the rising demand for advanced devices driven by the increasing popularity of AI and automation. For example, the hardware sector of embedded systems is expected to reach USD 120 billion by 2034, with the demand for high-performance devices used in industries such as automotive, cloud, and data centers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $110 Billion |

| Forecast Value | $202.7 Billion |

| CAGR | 6.4% |

Segment-wise, the embedded systems market is divided into small-scale, medium-scale, and large-scale systems based on processing power. Small-scale systems (8-bit) are particularly prominent in low-complexity applications like home automation and consumer electronics, with a growth rate of 5.5% CAGR. Medium and large-scale embedded systems are expected to support the shift toward autonomous systems and IoT. The real-time system segment is projected to reach USD 65.9 billion by 2034, driven by the growing need for fast, accurate data processing in sectors like manufacturing and healthcare.

In terms of applications, the automotive market, which includes systems for connected cars and automation, is predicted to grow at a CAGR of 6.6%. The consumer electronics sector is another key area, set to reach USD 51.3 billion by 2034, as embedded systems enhance smart devices such as smartphones and home appliances. Additionally, the manufacturing sector is experiencing substantial demand for embedded systems to improve efficiency, with the market expected to reach USD 26.4 billion by 2034.

Geographically, the U.S. is anticipated to see significant growth, with the embedded systems market expected to hit USD 51.2 billion by 2034. The increasing penetration of robotics and electronics within various industries, such as automotive and industrial automation, plays a crucial role in expanding the market's reach. The U.S. continues to lead in innovation, with companies actively developing new solutions to accelerate the growth of embedded systems across sectors.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing automobile sector

- 3.2.1.2 Rise in adoption of newer technologies

- 3.2.1.3 Increasing focus towards automation and robotics

- 3.2.1.4 Rising integration of embedded systems in healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development cost

- 3.2.2.2 Complex design of embedded systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By System, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

Chapter 6 Market Estimates and Forecast, By System Size, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Small-scale Embedded System (8-bit)

- 6.3 Medium-scale Embedded System (16-32-bit)

- 6.4 Large-scale Embedded System(Above 32-bit)

Chapter 7 Market Estimates and Forecast, By Function, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Standalone system

- 7.3 Real-time system

- 7.4 Network system

- 7.5 Mobile system

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Consumer electronics

- 8.4 Manufacturing machines

- 8.5 Retail

- 8.6 Media & entertainment

- 8.7 Military & defense

- 8.8 Telecommunications

- 8.9 Energy

- 8.10 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Advanced Micro Devices, Inc.

- 10.2 Analog Devices, Inc.

- 10.3 ARM Holdings

- 10.4 Broadcom Limited

- 10.5 Fujitsu Limited

- 10.6 Infineon Technologies

- 10.7 Intel Corporation

- 10.8 Lattice Semiconductor

- 10.9 Marvell Technology Group Ltd.

- 10.10 Microchip Technology Inc.

- 10.11 NXP Semiconductor N.V.

- 10.12 Qualcomm Technologies Inc.

- 10.13 Renesas Electronics Corporation

- 10.14 Samsung

- 10.15 STMicroelectronics

- 10.16 Texas Instruments, Inc.

- 10.17 Toshiba Corporation