Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693640

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693640

Spain Light Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 204 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

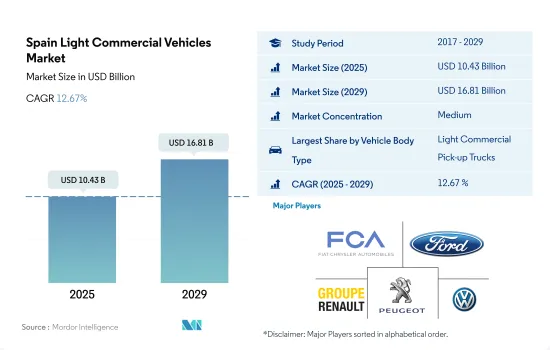

The Spain Light Commercial Vehicles Market size is estimated at 10.43 billion USD in 2025, and is expected to reach 16.81 billion USD by 2029, growing at a CAGR of 12.67% during the forecast period (2025-2029).

Spain's strategic focus on diversifying light commercial vehicle types will boost efficiency and meet the specific needs of businesses in transitioning to a more sustainable economy

- The Spanish light commercial vehicles (LCV) market boasts a diverse range of vehicle types tailored to meet the specific needs of different sectors. These include panel vans, pickup trucks, and small trucks. Panel vans reign supreme in the Spanish LCV market, owing to their adaptability and versatility across a wide range of commercial activities. Their maneuverability in narrow urban streets and ability to securely transport goods, especially for deliveries and service providers, make them highly sought-after. The growth in e-commerce has further fueled the demand for panel vans, highlighting the need for efficient urban logistics solutions.

- Pickup trucks, though occupying a niche, play a crucial role in the market. They find favor among businesses in agriculture, construction, and utilities, owing to their durability and ability to handle diverse terrains. Their versatility, coupled with off-road capabilities, makes them indispensable for businesses operating in rural areas or those requiring transportation to less accessible sites.

- Small trucks, offering higher payload capacities and more space than panel vans or pickups, are a lifeline for logistics, construction, and trade-focused small and medium-sized enterprises (SMEs). While sustainability is gaining traction across segments, the introduction of electric and hybrid small trucks is still limited. Factors like cost and charging infrastructure pose challenges to their wider adoption.

Spain Light Commercial Vehicles Market Trends

Increasing demand for electric vehicles in Spain is driven by government subsidies and initiatives

- The Spanish automobile industry has been growing continuously over the past few years, and the demand for electric vehicles has grown significantly in recent years, especially after 2020. Various government practices in terms of rebates, such as in March 2021, the government of Spain expanded the budget for the Moves II subsidy program from EUR 100 million to EUR 120 million. Under the program, the light commercial vehicle will be subsidized by EUR 3,630, and heavy commercial vehicle buyers are eligible for a subsidy of EUR 6,000. As a result, electric commercial vehicles witnessed an annual growth of 51.06% in 2021 compared to 2020 across Spain.

- The electric car industry in Spain has also grown tremendously in recent years. In 2020, the government of Spain announced a target of having at least 5 million electric vehicles by 2030. The impact of government norms and subsidies offered has contributed to the growth in the sales of electric cars. Such factors have encouraged consumers to opt for EVs. As a result, the country witnessed a growth in the sale of electric cars by 17.90% in 2022 over 2021.

- The government and various companies are making efforts through various projects that are going to accelerate electric mobility in Spain. In March 2023, the government introduced the Moves 3 plan in Europe, including Spain. The government offered subsidies of EUR 4,500 (without scrapping) and EUR 7,000 (with scrapping) for electric vehicles; the plan was offered until December 31, 2023. Such offerings are expected to accelerate the demand for electric cars in Spain between 2024 and 2030.

Spain Light Commercial Vehicles Industry Overview

The Spain Light Commercial Vehicles Market is moderately consolidated, with the top five companies occupying 60.77%. The major players in this market are Fiat Chrysler Automobiles N.V, Ford Motor Company, Groupe Renault, Peugeot S.A. and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93028

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Light Commercial Pick-up Trucks

- 5.1.1.2 Light Commercial Vans

- 5.1.1 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.2.1.4 LPG

- 5.2.1 Hybrid and Electric Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Fiat Chrysler Automobiles N.V

- 6.4.2 Ford Motor Company

- 6.4.3 Groupe Renault

- 6.4.4 IVECO S.p.A

- 6.4.5 Mercedes-Benz

- 6.4.6 Peugeot S.A.

- 6.4.7 Toyota Motor Corporation

- 6.4.8 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.