Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693637

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693637

France Light Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 205 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

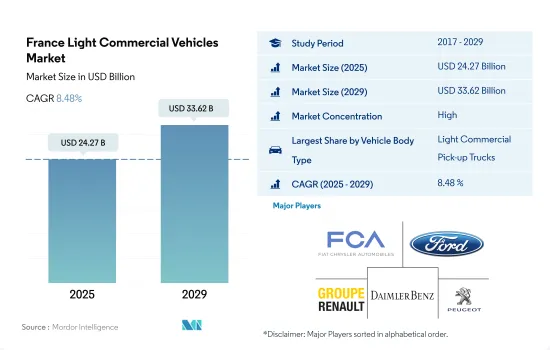

The France Light Commercial Vehicles Market size is estimated at 24.27 billion USD in 2025, and is expected to reach 33.62 billion USD by 2029, growing at a CAGR of 8.48% during the forecast period (2025-2029).

France is focusing on diversifying light commercial vehicle offerings to meet specific market and logistic demands within and beyond its borders

- The French light commercial vehicles (LCV) market, known for its diverse range of vehicle types and applications, is witnessing a notable emphasis on efficiency, environmental consciousness, and innovation. This market encompasses a wide array of vehicles, including panel vans, pickup trucks, and small trucks, each catering to distinct segments of the economy. These segments span from small businesses and tradesmen to large corporations and delivery services. The demand for each vehicle type is influenced by factors like payload capacity, fuel efficiency, reliability, and increasingly, environmental considerations.

- Panel vans, highly prized for their adaptability, payload capacity, and maneuverability in urban settings, dominate the French LCV market. These vans serve as the backbone of the delivery and services sectors, capitalizing on the surge in online shopping and home delivery. Notably, the panel van market is experiencing a notable shift toward electrification, propelled by the French government's environmental policies. These policies include incentives for electric vehicle purchases and the establishment of low-emission zones in urban areas.

- Pick-up trucks and small trucks, crucial players in the French LCV market, cater to specific sectors like construction, landscaping, and utility services. While these segments have been slower in adopting electric and hybrid technologies, there is a rising interest in sustainable alternatives. This shift is driven by both a broader societal push for sustainability and stricter emission regulations. These factors are compelling manufacturers to innovate and offer more eco-friendly options.

France Light Commercial Vehicles Market Trends

France drives electric vehicle sales with government support and incentives

- Canada's GDP stood at USD 45,191.99 in 2017 and a surge to USD 46,625.86 was observed in 2018. This trend, however, was not linear, with 2020 revealing a dip to USD 43,383.71, largely influenced by global disruptions. However, Canada's economic forte shone bright as 2021 numbers rebounded to USD 52,387.81, further accentuated by the 2022 figure. Key industry observers attribute this to Canada's diversified economy, strategic fiscal measures, and strong foundation in the service and technological sectors.

- The government is investing heavily and making efforts to increase the adoption of green vehicles among consumers in France. For instance, in January 2021, the French government invested EUR 200 million to support the local and urban mobility authorities who are ready to electrify their vehicles (bus fleet). Moreover, in February 2021, the French government selected Greenmot's Green-eBus project as one of the future projects to invest in. European Investment Bank funds the project intending to make the European Union the first greenhouse gas-neutral economy by 2050, and such projects are expected to accelerate electric mobility in France.

- Various plans and strategies introduced by the government are adding to the demand and sales of electric vehicles in the country. In October 2021, French President Emmanuel Macron announced a new plan named France 2030. Under the plan, the government will invest USD 30 billion to produce 2 million fully electric and hybrid vehicles domestically by 2030. Production growth is expected to increase the sales and the growing demand for EVs during 2024-2030 in France.

France Light Commercial Vehicles Industry Overview

The France Light Commercial Vehicles Market is fairly consolidated, with the top five companies occupying 66.91%. The major players in this market are Fiat Chrysler Automobiles N.V, Ford Motor Company, Groupe Renault, Mercedes-Benz and Peugeot S.A. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93025

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Light Commercial Pick-up Trucks

- 5.1.1.2 Light Commercial Vans

- 5.1.1 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.2.1.4 LPG

- 5.2.1 Hybrid and Electric Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Fiat Chrysler Automobiles N.V

- 6.4.2 Ford Motor Company

- 6.4.3 Groupe Renault

- 6.4.4 IVECO S.p.A

- 6.4.5 Mercedes-Benz

- 6.4.6 Peugeot S.A.

- 6.4.7 Toyota Motor Corporation

- 6.4.8 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.