Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693543

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693543

South America Fertilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 315 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

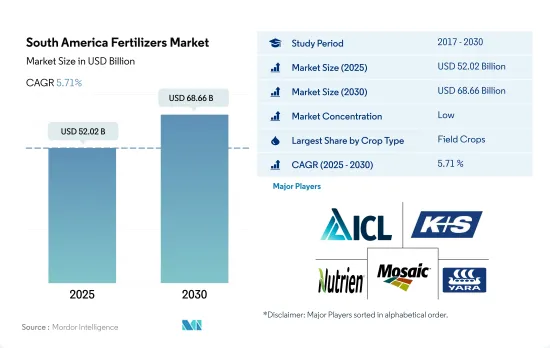

The South America Fertilizers Market size is estimated at 52.02 billion USD in 2025, and is expected to reach 68.66 billion USD by 2030, growing at a CAGR of 5.71% during the forecast period (2025-2030).

The fertilizer market is poised for growth due to shifting climate patterns and rising soil nutrient deficiencies

- The overall fertilizer market value by crop type has accounted for USD 48.1 billion and is estimated to record a CAGR of 5.6% during 2023-2030. By volume, the overall consumption accounted for 64.0 million metric tons and is estimated to record a CAGR of 3.3% during 2023-2030.

- By crop type, field crops are dominating the market by 94.5%, followed by horticultural crops with 5.5% of fertilizer consumption value. Both horticultural and field crops are essential to the country's trade and consumption, and the increased domestic and international demand is bolstering the segment's growth.

- The area under field crop cultivation has increased by a CAGR of 2.2% during 2023-2030. With important crops being cultivated in the country, such as soybean, corn, and wheat, the country is actively importing fertilizers to meet the domestic demand, which is driving the growth of the segments.

- Accordingly, Free trade agreements (FTAs) between the United States, Chile, and several Latin American countries have been a major factor in the increase in fruit and vegetable production in South American countries over the last few decades. These FTAs, including NAFTA (USMCA), CAFTA-DR, and bilateral agreements with countries such as Chile, Colombia, Panama, and Peru, are expected to further boost fertilizer demand in the region.

- The growth of the South American fertilizers market is being driven by various factors, including the need to meet the growing demand, improve crop yield and quality, and increase production. As a result, the market volume is expected to register a CAGR of 3.3% from 2023 to 2030.

Due to higher cultivation areas under major crops like soybeans, fertilizer consumption in Brazil leads to a higher share

- Brazil, accounting for 73.0% of South America's domestic fertilizer consumption, leads the region in fertilizer usage. The Brazilian market is predominantly driven by conventional fertilizers, which held a commanding 95.2% share in 2022. Specialty fertilizers made up the remaining 4.8%.

- Argentina, a global exporter of wheat and soybeans, sees agriculture contributing around 5.9% to its GDP. In 2022, Argentina held a 14.6% share of the South American fertilizer market. Similar to Brazil, conventional fertilizers dominated, capturing 96.1% of the market, while specialty fertilizers accounted for 3.9%. Within the specialty segment, liquid fertilizers led at 44.7%, followed by water-soluble fertilizers at 52.6%.

- The Rest of South America, excluding Brazil and Argentina, held a 14.8% share of the regional fertilizer market in 2022. Field crops, commanding an 83.1% market share by volume, reached 8.15 million metric tons in 2022. Projections indicate this volume will climb to 10.53 million metric tons by 2030, representing a significant growth trajectory.

- Field crops, including soybeans, corn, and sugarcane, dominated the South American fertilizer market in 2022, capturing 94.2% of the market share. These crops have witnessed substantial growth over the past two decades, with further increases expected. Driven by countries like Brazil expanding their cultivated areas and aiming for higher yields, this trend is set to continue.

- Driven by a rising population and the subsequent surge in food grain demand, South America has witnessed a consistent expansion in the area dedicated to major food crops. This trend points to a projected growth in the region's fertilizer market during 2023-2030.

South America Fertilizers Market Trends

The government's initiatives to achieve self-sufficiency have significantly contributed to the increase in the area under field crop cultivation.

- The cultivation area for field crops in South America witnessed a notable rise, surging from 111.6 million ha in 2017 to 126.1 million ha in 2022, marking a 12.8% increase in the total area. This expansion in cultivation is projected to drive up the demand for fertilizers in the region. Field crops dominated the market, accounting for a significant 96.8% share. In 2022, Brazil held the maximum share of the market at 56.9%, with Argentina trailing at 29.3%. Brazil, renowned as the global leader in soy production and exports, saw its soy output reach nearly 135 million tonnes in 2021. Of this, a whopping 105.5 million tonnes, constituting 82%, were exported, with 82% in raw soybean form, 16% as soybean cake, and 2% as soybean oil.

- Soybean, commanding the largest cultivated area in South America, is primarily grown in Brazil (64.4%) and Argentina (26.1%). However, the region is currently grappling with an extended drought, leading to critically low water levels in major rivers. This has severe repercussions, hampering both harvests and the transportation of crucial summer crops, especially soybeans. Consequently, these conditions are amplifying the demand for increased fertilizer application in South America.

- Driven by robust global demand and favorable profitability, soybean cultivation in the Mercosur region witnessed a surge. The surge in soy prices, along with other raw materials, has incentivized producers to invest in new lands and equipment, enabling them to scale up operations and enhance efficiency. As a result, the field crop cultivation area in the region is poised to expand in tandem with the growing domestic and international markets.

The average rate of primary nutrient application for field crops in South America is about 172.73 kg/hectare

- Over the past two decades, South America has emerged as a key player in field crop production, notably for soybeans, corn, wheat, and maize. This surge in production can be attributed to both expanded cultivation and intensified efforts to boost yields. Notably, countries like Brazil are actively expanding their cultivated areas, indicating a further uptick in crop production and a subsequent surge in fertilizer consumption.

- Nutrients are pivotal for plant health, crop growth, and crop output. Primary nutrients, namely nitrogen, phosphorus, and potassium, serve as the fundamental building blocks for plant development. Any deficiency in these nutrients can significantly impact both crop yield and quality, underscoring their importance for field crops. In 2022, the average application rate of primary nutrients for field crops in South America stood at 172.7 kg/hectare. Nitrogen topped the list with an application rate of 193.8 kg/hectare, followed by potassium at 181.9 kg/hectare. Phosphorus trailed slightly behind, with an application rate of 142.4 kg/hectare.

- Among the field crops, wheat, rice, and corn/maize are expected to have the highest average nutrient application rate. Specifically, wheat is projected to have an average nutrient application rate of 231 kg/ha, while rice and corn/maize are estimated to have average rates of 156 kg/ha and 149 kg/ha, respectively. Driven by a growing population and subsequent demand for major food crops, South America has witnessed an expansion in harvested areas. This trend points to a significant uptick in primary nutrient usage for field crops in the region in the coming years.

South America Fertilizers Industry Overview

The South America Fertilizers Market is fragmented, with the top five companies occupying 37.12%. The major players in this market are ICL Group Ltd, K+S Aktiengesellschaft, Nutrien Ltd., The Mosaic Company and Yara International ASA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92608

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Micronutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.2 Primary Nutrients

- 4.2.2.1 Field Crops

- 4.2.2.2 Horticultural Crops

- 4.2.3 Secondary Macronutrients

- 4.2.3.1 Field Crops

- 4.2.3.2 Horticultural Crops

- 4.2.1 Micronutrients

- 4.3 Agricultural Land Equipped For Irrigation

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Type

- 5.1.1 Complex

- 5.1.2 Straight

- 5.1.2.1 Micronutrients

- 5.1.2.1.1 Boron

- 5.1.2.1.2 Copper

- 5.1.2.1.3 Iron

- 5.1.2.1.4 Manganese

- 5.1.2.1.5 Molybdenum

- 5.1.2.1.6 Zinc

- 5.1.2.1.7 Others

- 5.1.2.2 Nitrogenous

- 5.1.2.2.1 Ammonium Nitrate

- 5.1.2.2.2 Urea

- 5.1.2.2.3 Others

- 5.1.2.3 Phosphatic

- 5.1.2.3.1 DAP

- 5.1.2.3.2 MAP

- 5.1.2.3.3 SSP

- 5.1.2.3.4 TSP

- 5.1.2.3.5 Others

- 5.1.2.4 Potassic

- 5.1.2.4.1 MoP

- 5.1.2.4.2 SoP

- 5.1.2.4.3 Others

- 5.1.2.5 Secondary Macronutrients

- 5.1.2.5.1 Calcium

- 5.1.2.5.2 Magnesium

- 5.1.2.5.3 Sulfur

- 5.2 Form

- 5.2.1 Conventional

- 5.2.2 Speciality

- 5.2.2.1 CRF

- 5.2.2.2 Liquid Fertilizer

- 5.2.2.3 SRF

- 5.2.2.4 Water Soluble

- 5.3 Application Mode

- 5.3.1 Fertigation

- 5.3.2 Foliar

- 5.3.3 Soil

- 5.4 Crop Type

- 5.4.1 Field Crops

- 5.4.2 Horticultural Crops

- 5.4.3 Turf & Ornamental

- 5.5 Country

- 5.5.1 Argentina

- 5.5.2 Brazil

- 5.5.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Fertgrow

- 6.4.2 Grupa Azoty S.A. (Compo Expert)

- 6.4.3 Haifa Group

- 6.4.4 ICL Group Ltd

- 6.4.5 K+S Aktiengesellschaft

- 6.4.6 Nortox

- 6.4.7 Nutrien Ltd.

- 6.4.8 Sociedad Quimica y Minera de Chile SA

- 6.4.9 The Mosaic Company

- 6.4.10 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.