Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693470

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693470

Asia-Pacific Tomato Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 218 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

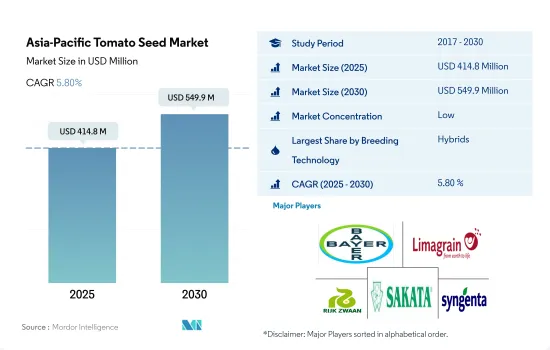

The Asia-Pacific Tomato Seed Market size is estimated at 414.8 million USD in 2025, and is expected to reach 549.9 million USD by 2030, growing at a CAGR of 5.80% during the forecast period (2025-2030).

Hybrids dominate due to increased protected cultivation and a growing preference for higher yield, and better disease resistance

- In Asia-Pacific, hybrid seeds dominate the tomato seed market compared to open-pollinated varieties and hybrid derivatives. In 2022, the sales of hybrid tomato seeds reached 249.5 million, which increased by 49.3% between 2017 and 2022. This is because farmers increasingly prefer hybrid varieties that exhibit superior traits such as higher yield, better disease resistance, and improved nutritional content.

- In 2022, China was the largest producer in the region, holding more than 48.7% share value in the tomato hybrid seed market, followed by India with a 25.4% share value. This is mainly due to the increased yields in cultivating hybrid seeds.

- Hybrids with disease resistance and other quality traits were in great demand in the region due to increased protected cultivation practices and organic farming.

- In 2022, open-pollinated varieties and hybrid derivatives of tomato seeds held 28.3% of the market share in the region. These local seeds specific to the region had low yield characteristics compared to hybrids.

- In 2021, 80% of the tomatoes grown in India were consumed fresh, and 20% were used in the processing industry. As a result, the production of hybrid varieties with sweetness, tastes, and high nutrient content is high in the country.

- Similarly, with increased health awareness in the region, the demand for organic vegetables, especially tomatoes, has increased. Therefore, the consumption of OPV is expected to increase during the forecast period.

- The increased protected cultivation practices in the region, the increase in the processing industry usage of tomatoes, and the increased organic farming acreage are major drivers in the region.

China dominated the Asia-Pacific tomato seed market due to higher area and higher adoption of hybrids

- In 2022, the Asia-Pacific region had a major share because the area under tomato cultivation accounted for 47.3% of the global area under tomato cultivation. Thus, a larger area under tomato cultivation is expected to increase the sales of the seeds during the forecast period.

- China is the largest country, accounting for 24% of the global tomato seed market in 2022. This was owing to the increase in hybrid availability, and most of the tomatoes were grown in greenhouses, which accounted for more than 50% of China's tomato production in 2022.

- India is the second major country in the region for tomato production. In the country, the protected cultivation of tomatoes accounted for only 6% of the total tomato seed market in 2022, which was expected to grow faster than the open-field cultivation of tomatoes. For instance, the CAGR of the protected cultivation segment in the country is expected to be 7%, whereas open-field cultivation is expected to be 5% during the forecast period.

- In Pakistan, tomatoes occupied 22.4% of the vegetable seed market value in 2022. Sindh is the major tomato-producing state, accounting for 45% of the total area. Tomatoes are mainly grown by small land-holding farmers in Pakistan. It offers relatively better profits to growers and generates employment opportunities for rural people. Therefore, these factors will help increase the area under cultivation, which is expected to drive the seed market. Other major countries include Myanmar, Indonesia, and Japan.

- The increase in greenhouse cultivation and higher consumption demand drive the seed demand in the region. Therefore, the market is anticipated to register a CAGR of 5.84% during the forecast period.

Asia-Pacific Tomato Seed Market Trends

India and China dominated the area under cultivation of tomatoes due to the increased availability of high-yielding varieties

- Tomato is the major vegetable in the Asia-Pacific. In 2022, the area under cultivation of tomatoes accounted for 2.6 million hectares. The area under cultivation of tomatoes consistently increased between 2017 and 2022 by 12.3%. This is mainly attributed to increased demand for tomatoes from processing industries and increased availability of high-yielding disease-resistant seeds.

- India and China are the major producers of tomatoes. The area under tomato cultivation in India increased from 797,000 ha in 2017 to 857,321.1 ha in 2022 and from 1.0 million ha to 1.1 million ha during the same period in China. Increased cultivation area is estimated to increase demand for tomato seeds in the region. In China, Shandong, Xinjiang, Hebei, and Henan provinces were the main tomato-producing provinces, and together, the four provinces accounted for more than 50% of the production in 2022.

- Pakistan and Myanmar recorded the largest area under tomato cultivation after China and India. In Pakistan, the area under tomato cultivation was 169 thousand hectares in 2022, which increased by 0.6% compared to the previous year. Also, the production increased from 590 thousand metric ton to more than 594 thousand metric ton between 2017 and 2021. The increase in area is mainly due to increased consumer demand, high domestic prices, and high export potential. The cultivation area of tomatoes in Myanmar was 120.3 thousand ha in 2022, which increased by 7% from 2017. The increase in the cultivation area is due to demand from the processing industries. Tomatoes are largely cultivated in the Magway, Sagaing, and Bago East regions.

- The area under tomato cultivation is estimated to increase during the forecast period with increased availability of quality seeds and demand from processing industries.

Tomato varieties with wider adaptability to outdoor and protected cultivations with disease resistance are the most popular traits preferred by growers in the region

- In Asia-Pacific, the major traits in demand are disease-resistant traits, accounting for 51.6% of the tomato seed market, followed by wider adaptability with 45.2% and others with 3.2% in 2022. The demand for disease-resistant hybrids is expected to decrease crop loss. Tomato is one of the largest segments of vegetables as it is a high-value crop and is in high demand by processing industries for tomato puree, ketchup industry, and others. Major companies such as Rijk Zwaan, East-West Seed, and Namdhari Seeds have tomato seed varieties in Asia-Pacific that are resistant to viral diseases such as leaf curl virus. For instance, in 2022, Rijk Zwaan launched new tomato seed varieties resistant to the tomato brown rugose fruit virus (ToBRFV). Moreover, in 2021, East-West Seed introduced a new tomato hybrid seed variety, EW 815, to resist bacterial wilt and tomato yellow leaf curl disease.

- The major trait important for tomato seeds for fetching high returns from the processing and fresh markets is high lycopene content, which is responsible for the red color of tomatoes. The greenhouse and protected cultivation hybrid seeds contain these traits. The other traits available for tomatoes are longer shelf life, wider adaptability to different regions and climate conditions, resistance to cracking, and other quality traits such as shape, color, and size. These are important traits to meet the demand for processing industries because they require high-quality tomatoes to produce products.

- Factors such as the introduction of new hybrid seed varieties with higher resistance to viruses and high yield are expected to help in the growth of the tomato seed market during the forecast period.

Asia-Pacific Tomato Seed Industry Overview

The Asia-Pacific Tomato Seed Market is fragmented, with the top five companies occupying 31.40%. The major players in this market are Bayer AG, Groupe Limagrain, Rijk Zwaan Zaadteelt en Zaadhandel BV, Sakata Seeds Corporation and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92533

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.2 Most Popular Traits

- 4.3 Breeding Techniques

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.2 Cultivation Mechanism

- 5.2.1 Open Field

- 5.2.2 Protected Cultivation

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 Bangladesh

- 5.3.3 China

- 5.3.4 India

- 5.3.5 Indonesia

- 5.3.6 Japan

- 5.3.7 Myanmar

- 5.3.8 Pakistan

- 5.3.9 Philippines

- 5.3.10 Thailand

- 5.3.11 Vietnam

- 5.3.12 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Bejo Zaden BV

- 6.4.5 East-West Seed

- 6.4.6 Groupe Limagrain

- 6.4.7 Rijk Zwaan Zaadteelt en Zaadhandel BV

- 6.4.8 Sakata Seeds Corporation

- 6.4.9 Syngenta Group

- 6.4.10 Yuan Longping High-Tech Agriculture Co. Ltd

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.