Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693459

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693459

North America Tomato Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 180 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

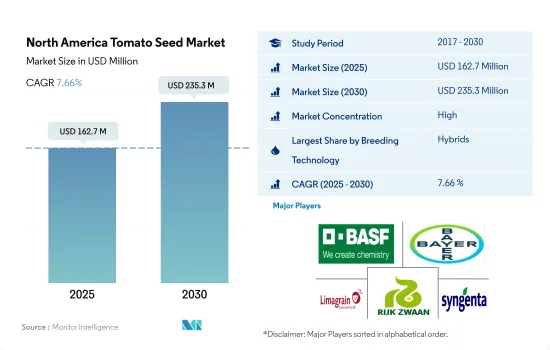

The North America Tomato Seed Market size is estimated at 162.7 million USD in 2025, and is expected to reach 235.3 million USD by 2030, growing at a CAGR of 7.66% during the forecast period (2025-2030).

Hybrids accounted for more share and acreage due to the characteristics such as disease resistance, higher shelf life and wider adaptability

- Tomato is one of the most important vegetable crops under the solanaceous group, which can be grown both under open field conditions and in greenhouses. North America held the second-largest tomato seed market, valued at USD 132 million in 2022. The United States and Mexico are the largest tomato-producing countries in the region.

- In North America, hybrid tomatoes accounted for a market value of USD 110.4 million, and open-pollinated varieties and hybrid derivatives with a market value of USD 21.6 million in 2022. Hybrids accounted for more share and acreage due to characteristics such as disease resistance, increased shelf life, wider adaptability, high yield, strong stem, crack resistance, and high vigor, which fetch more prices for the growers. The United States is the largest consumer in the region. The tomato hybrid seed consumption in the country increased by 26.3% between 2017-2022.

- Open-pollinated tomato seed varieties are projected to record a CAGR of 7.4% during the forecast period as these seeds are used by growers as they are cost-effective and have higher demand from the local markets, and for fresh market utilization, as tomatoes produced have good taste and color. Except for Canada, North American countries are growing at a higher rate in terms of open-pollinated varieties and hybrid derivatives usage in tomato production because of Canada's climatic and environmental conditions. They had to use more inputs and required high maintenance to cultivate using OPV seeds.

- However, the increased protected cultivation practices in the region, the increase in the processing industry usage of tomatoes, and the increased organic farming acreage are major drivers for both hybrids and OPVs in the region.

The United States dominates the market with the increase in demand for commercial hybrids

- Tomato is the most important vegetable crop, grown extensively in tropical and subtropical climates. It is the most widely grown and consumed vegetable in the region. The tomato seed market in the region grew by 9.6% during the historic period. However, the growth of the market has declined since 2021 compared to 2019, owing to the reduction in the adoption of vegetable cultivation.

- The United States is the major country in the region concerning the tomato seed market, which accounted for USD 75.5 million in 2022. The high usage of hybrid seeds and the adoption of new technological innovations, such as greenhouses and artificial intelligence, are driving the market. For instance, in 2021, Bowery Farming in the United States received a grant of USD 300 million, and it announced the use of the funds to accelerate the expansion of indoor farms and introduce vegetables, including hydroponic tomatoes, to the US market.

- In Mexico, tomatoes accounted for 44.6% of the total crops grown under protected cultivation in 2022. The demand for hybrid seeds for protected cultivation is anticipated to increase during the forecast period.

- Tomatoes held a 5.4% share of the Canadian vegetable seeds market in 2022. Canada is one of the fastest-growing countries in the North American tomato seed market, with a CAGR of 8% during the forecast period. New technologies developed by Canadian agriculture universities, the use of hybrid seeds, and exports to major countries such as the United States, Japan, and China are expected to drive growth.

- Therefore, the adoption of new technologies for tomato cultivation, the need for high-yielding tomato hybrids, and the rising demand for tomatoes in processing industries are expected to drive the market at a CAGR of 7.6% during the forecast period.

North America Tomato Seed Market Trends

The increasing adoption of protected cultivation and rising imports of tomatoes are limiting the expansion of open field cultivation

- North America is a significant producer of tomatoes. The area cultivated under tomatoes was recorded at 227.1 thousand hectares in 2022, which decreased by 4.9% between 2017 and 2022. This decrease in acreage is associated with growing tomatoes in protected cultivation, which allows for more controlled and efficient production. This has resulted in a decreased use of open field land for tomato cultivation in the region. However, In 2022, tomatoes held a 5.0% share of the region's crop area for vegetables. This is because tomatoes are one of the most widely consumed vegetables in the region, and their production is economically valuable for many farmers in the region.

- The United States is the largest tomato producer in North America. However, the cultivation area in the country decreased by 10.6% between 2017 and 2022 because increasing imports of tomatoes impacted the demand for domestically grown tomatoes, and advances in agricultural technology and practices allowed farmers to achieve higher yields with fewer acres in the country. Furthermore, Mexico is a major producer of tomatoes in the region. It accounted for 40.3% with 91.5 thousand hectares in 2022. The cultivable land decreased by 1.6% between 2017 and 2022 due to a shift toward protected cultivation.

- In Canada, the area under tomato cultivation accounted for only 2.8% of the area under North American tomato cultivationis. This is due to the soils and the climatic conditions for open cultivation not being suitable for tomato fruits. Hence, protected cultivation is highly followed in the country. However, the demand for tomatoes is increasing, mainly from the processing industry. Thus, the cultivation area is estimated to increase during the forecast period.

Seeds resistant to viral and fungal diseases, long-shelf life, and quality attributes traits are driving the tomato seed market

- Tomato is an important vegetable crop widely cultivated in the region. Tomatoes are grown mainly in open fields. Traits resistant to viral diseases such as tomato mosaic virus, tomato yellow leaf curl virus, blossom end rot, powdery mildew, wilt diseases, and nematodes are popularly used for cultivation in the region.

- It has a limited shelf life under ambient conditions, is a highly perishable fruit, and changes continuously after harvesting. Longer shelf life traits help prevent early decay and increase transport capability. Other traits such as uniform ripening, early production, suitability for greenhouse and heated cultivation, less susceptibility to fruit dropping, string against cracking, high lycopene content, and other quality traits such as size, shape, and color of fruits are popular in the region. For instance, major companies breeding and marketing tomato traits are Enza Zaden, Sakata Seeds, Bayer AG, Bejo Zaden BV, KWS SAAT, Takii seeds, Syngenta, BASF SE, and Rijk Zwaan Zaadhandel BV.

- Moreover, varieties with large fruit, red or pink, are mostly favored by consumers in the region. This has led to increased usage of quality attributes traits among the farmers to produce improved tomato varieties for both open fields and protected cultivation. Companies such as Rijk Zwaan Zaadhandel BV and Bayer AG offer these seed varieties.

- The seed companies are producing new tomato seed varieties with traits such as wider adaptability and resistance to diseases to meet the growing demand of growers, and it is expected to help in the market's growth during the forecast period.

North America Tomato Seed Industry Overview

The North America Tomato Seed Market is fairly consolidated, with the top five companies occupying 110.74%. The major players in this market are BASF SE, Bayer AG, Groupe Limagrain, Rijk Zwaan Zaadteelt en Zaadhandel B.V. and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92521

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.2 Most Popular Traits

- 4.3 Breeding Techniques

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.2 Cultivation Mechanism

- 5.2.1 Open Field

- 5.2.2 Protected Cultivation

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Bayer AG

- 6.4.3 Bejo Zaden BV

- 6.4.4 Enza Zaden

- 6.4.5 Groupe Limagrain

- 6.4.6 Nong Woo Bio

- 6.4.7 Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- 6.4.8 Sakata Seeds Corporation

- 6.4.9 Syngenta Group

- 6.4.10 Takii and Co.,Ltd.

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.