Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692079

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692079

North America Processed Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 238 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

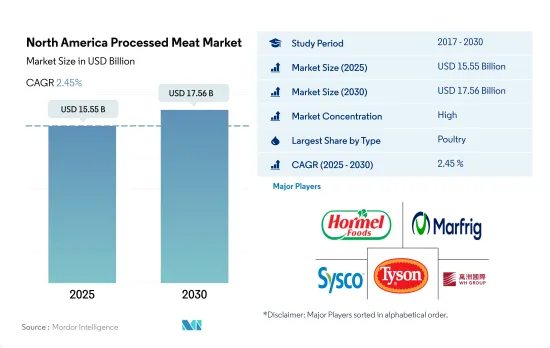

The North America Processed Meat Market size is estimated at 15.55 billion USD in 2025, and is expected to reach 17.56 billion USD by 2030, growing at a CAGR of 2.45% during the forecast period (2025-2030).

Government investment in increasing processed meat production is propelling sales

- The overall sales for processed meat increased by 9.4% in value terms from 2020 to 2022. Companies are innovating their products to gain consumers' interest. They are also expanding the supply of meat products in the market for items like sausages, salami, hot dogs, ham, bacon, and corned beef, which are frequently preserved to maintain quality.

- The other meat segment of the North American processed meat market includes lobsters, crabs, and oysters. It witnessed a growth of 7.3% in value from 2020 to 2022. With the increasing demand for quick-to-eat meals and the growing meat manufacturing industry, the market is projected to expand in the coming years. For instance, in Cuba, the on-trade channel records high sales of lobsters, as the channel offers a buy 1 get 1 scheme for lobster dishes. The increasing number of tourists, especially in Havana, is boosting the channel.

- The processed beef segment held the largest revenue share of 21.9% in 2022, owing to the increasing consumption of processed beef meat, at 26.27 kg/capita, in 2022. Over the forecast period, the market's growth is likely to be driven by organic feed used by farmers. Increased consumer disposable income and the number of working professionals, which increased by 34% in 2021, have driven the market.

- In July 2021, the USDA announced its intent to invest USD 500 million in the American Rescue Plan's funds to expand the capacities of processed meat and poultry. With this investment, the market is likely to observe a constant Y-o-Y growth rate of 2% during the forecast period. The USDA also issued new rules on "Product of the USA" labels, which may further drive the processed meat market.

Investments in processing facilities to favor the growth

- In North America, the overall sales by value for processed meat increased by 8.91% from 2020 to 2022. There is an increasing demand for ready-to-eat or ready-to-cook meat among consumers across the region, owing to their busy lifestyles. Factors such as long shelf life and hygienically processed and stored meat are boosting the growth of the North American processed meat market.

- The United States is a major country that consumes processed meat in North America. The overall sales value for processed meat increased by 3.42% in 2022 compared to 2021. Of all processed meat, processed poultry is the most consumed in the United States and accounts for the major share of 47.6%, followed by processed pork with 36.54% by value in 2022. Processed meat has wide availability in supermarkets, convenience stores, departmental stores, and vending machines, further driving the market's growth in the United States.

- Mexico is expected to be the fastest-growing country in North America to consume processed meat and is projected to register a CAGR of 2.54% by value during the forecast period. Mexicans usually prefer to consume processed meat, especially poultry. Due to this, Mexican animal health authorities are keen to gain recognition of avian influenza disease-free zones in the future, which is expected to drive the market's growth.

- Moreover, government bodies in the United States are investing in processing facilities to benefit American farmers. For instance, in July 2021, USDA invested USD 500 million in meat and poultry processing facilities to increase capacity and make agricultural markets more accessible. It also announced more than USD 150 million for the existing small processing facilities to compete in the market and increase the consumer base.

North America Processed Meat Market Trends

Growing demand and reduced imports are boosting production

- The beef market was highly impacted by increased production costs during the historical period. The rise in production cost was primarily because of the dry conditions. However, beef production in the region was up by 1.25% in 2022 compared to 2021. Drought in locations throughout western North America during the past few years negatively impacted the region's production. Due to difficulty in locating enough food for their animals, farmers who rear cattle are losing money in regions ranging from western Canada to the states of northern Mexico. Some farmers buy feed for their livestock from other parts of North America.

- Canada is the second-largest beef producer in North America after the United States. The production share of Canada and the United States in 2022 was 5.46% and 50.15%, respectively. Despite a dwindling cow herd, live cattle imports positively affect Canadian meat production. In 2022, moisture levels were likely to be a crucial aspect in monitoring the trading of cattle. More cattle may be moved north if the drought subsides in Canada but continues in the United States.

- The declining cow herd and a smaller calf yield in Canada and the United States are resulting in long-term and tighter beef supplies in North America. On January 1, 2022, in Canada, beef cow inventories were down by 1% for the fifth consecutive year to 3.5 million heads. In Canada, 61% of farms have less than 47 cows, with 596,419 beef cows, 16% of the herd. All cattle and calves in the United States as of January 1, 2023, totaled 89.3 million heads, 3% below the 92.1 million heads on January 1, 2022. In addition to having the world's largest-fed cattle industry, the United States is also the world's largest consumer of beef, primarily high-value, grain-fed beef.

Rising retail demand boosted the need for wholesale beef and drove market growth

- The rising retail demand has boosted the need for wholesale beef in recent years, which led to higher beef prices. Since 2021, retail beef prices have been largely stable, and the 12-month moving average of monthly prices has exceeded USD 7.25 USD per pound since April 2022. Given the record beef production in 2022 and the greatest per-capita beef consumption since 2010, at 58.9 pounds, this suggests a strong beef demand. Retail prices for all fresh beef averaged USD 7.30 per pound in 2022, which was a record-high price and an increase of 5.1% above prices in 2021. Tenderloins and ribeyes are up 12% to 15% Y-o-Y, and middle meat prices continue to dominate wholesale prices.

- Like retail prices, wholesale boxed beef prices have fluctuated within a small range for most of 2022. Since March, Choice boxed beef has had an average price of USD 261.77/cwt, with a weekly high and minimum of 272.48/cwt and USD 246.31/cwt, respectively, for a range of USD 26.17/cwt. Following very strong wholesale demand, Choice boxed beef prices averaged USD 279.81/cwt in 2021, with weekly maximums of USD 347.02/cwt, weekly minimums of USD 206.73/cwt, and annual ranges of USD 140.29/cwt.

- However, processing plants struggled with labor shortages that continued during the pandemic and in 2021, limiting their ability to process meat at the same rate as before the outbreak. This decline in production was due to the increasing demand for beef from consumers and restaurants, thus boosting the prices. The regional labor shortage continued in 2021, with a labor force participation rate of 61.6% in September 2021, down from 63.4% in January 2020.

North America Processed Meat Industry Overview

The North America Processed Meat Market is fairly consolidated, with the top five companies occupying 81.17%. The major players in this market are Hormel Foods Corporation, Marfrig Global Foods S.A., Sysco Corporation, Tyson Foods Inc. and WH Group Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90386

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Beef

- 3.1.2 Mutton

- 3.1.3 Pork

- 3.1.4 Poultry

- 3.2 Production Trends

- 3.2.1 Beef

- 3.2.2 Mutton

- 3.2.3 Pork

- 3.2.4 Poultry

- 3.3 Regulatory Framework

- 3.3.1 Canada

- 3.3.2 Mexico

- 3.3.3 United States

- 3.4 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Type

- 4.1.1 Beef

- 4.1.2 Mutton

- 4.1.3 Pork

- 4.1.4 Poultry

- 4.1.5 Other Meat

- 4.2 Distribution Channel

- 4.2.1 Off-Trade

- 4.2.1.1 Convenience Stores

- 4.2.1.2 Online Channel

- 4.2.1.3 Supermarkets and Hypermarkets

- 4.2.1.4 Others

- 4.2.2 On-Trade

- 4.2.1 Off-Trade

- 4.3 Country

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.3.4 Rest of North America

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 BRF S.A.

- 5.4.2 Continental Grain Company

- 5.4.3 Hormel Foods Corporation

- 5.4.4 Industrias Bachoco SA de CV

- 5.4.5 JBS SA

- 5.4.6 Maple Leaf Foods

- 5.4.7 Marfrig Global Foods S.A.

- 5.4.8 OSI Group

- 5.4.9 Sysco Corporation

- 5.4.10 Tyson Foods Inc.

- 5.4.11 WH Group Limited

6 KEY STRATEGIC QUESTIONS FOR MEAT INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.