Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690968

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690968

United States Gelatin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 166 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

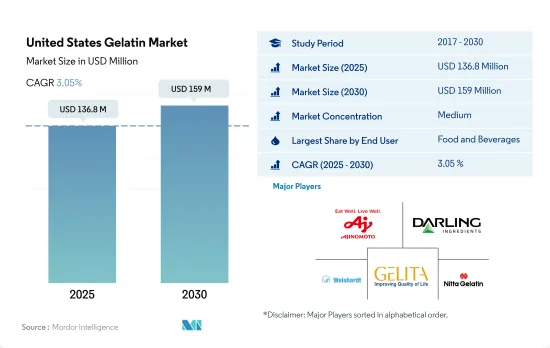

The United States Gelatin Market size is estimated at 136.8 million USD in 2025, and is expected to reach 159 million USD by 2030, growing at a CAGR of 3.05% during the forecast period (2025-2030).

Shifting consumption preferences towards protein infused food and beverages is influencing the use of gelatin

- The food and beverage segment accounts for the highest number of applications in the gelatin market. This is because of the functional suitability of gelatin. The food and beverage segment observed an overall voluminal growth of 26.3% from 2016 to 2022. In 2022, the bakery and beverages sub-segment accounted for the largest market share of around 60% within the food and beverage segment. This was primarily due to the shifting preference from conventionally carbonated beverages and baked goods to more protein-based solutions. In 2021, 35% of US households followed a specific protein-focused diet, such as high-protein, paleo, low-carb, and organic.

- The market observed the highest Y-o-Y growth rate of 10.54% in terms of volume in 2020, which was almost thrice the growth rate of 2019. The in-home consumption volume of convenience food products increased to 26% in 2020 due to the COVID-19 pandemic. However, the importance of health as a lifestyle choice has influenced consumers, which, coupled with rising awareness about the benefits of gelatin, has triggered the demand for gelatin in the food and beverage sector.

- Among all segments, the personal care and cosmetics segment is the fastest-growing industry. It is projected to register a CAGR value of 6.49% during the forecast period. This is attributed to the average protein content of gelatin, which is 5% higher than other dairy proteins like whey and milk proteins. People also prefer gelatin-based personal care and cosmetic products due to their film-forming properties that help cure hair and skin. Gelatin also ensures a more even uptake of pigments in hair dyes and tints.

United States Gelatin Market Trends

The growth of the bakery industry is led by large commercial players

- Several small-scale and large-scale players characterize the US bakery industry. There were more than 23,158 retail bakeries in the United States in 2020. California, New York, Texas, Florida, and Illinois are among the top markets for bakeries in the country. In 2020, California alone accounted for about 3,400 bakeries. The aggressive store opening trend set by major players reflects plenty of growth opportunities. As the demand continues to rise, the market is expected to grow over the forecast period.

- Among all bakery products, bread, rolls, and cakes are the most highly consumed products. In 2022, the bread industry recorded price inflation due to the Russia-Ukraine War, which resulted in a 40% rise in wheat prices. The United States, known as the "breadbasket of the world," witnessed hampered wheat, oats, and cooking oil production due to the war. In 2020, wheat production in the country declined by 5.5% due to the COVID-19 pandemic.

- In 2020, stockpiling during the lockdowns boosted the demand for bakery products. The sales value and volume peaked during that year. Increased demand for packaged bread, morning goods, and cookies resulted in a Y-o-Y growth volume of around 7.52% in 2020. After the lockdown period, the sales of sourdough products, cakes, and cookies increased. Chocolate-chip cookies and molasses cookies witnessed high demand due to widespread interest among consumers. About one in five Americans consumes more than three cookies daily. In terms of cookie addiction, Utah tops the list, closely followed by Idaho and Oregon. People from Maine, Alaska, South Dakota, Iowa, and Kansas are the top consumers of chocolate chip cookies.

Meat production majorly contributes as a raw material for plant protein ingredient manufacturers

- Gelatin is mainly driven by supply from the meat industry, especially from meat of cattle, chickens. As meat consumers, collagen producers account for more than 60%, followed by gelatin. The demand is mainly driven by a strong inclination toward protein and high-protein products across the entire food and beverage sector, especially as a food additive, in the country. Recent advancements in medical research, especially on bone structure and its function, have revolutionized the nutritional approach to optimizing bone health.

- The increasing consumer awareness about gelatin-based products leads to higher production of gelatin, which, along with expanding its application in several industrial segments, is expected to boost the market. The US gelatin market is expected to witness considerable growth of 2.1% during the forecast period due to consumers' lifestyle changes. Manufacturers are increasing their R&D expenditure to develop new kinds of gelatin-enriched products, which, in turn, helps them broaden their customer base and gain a competitive advantage.

- The animal industry's production declined due to the COVID-19 pandemic as production plants shut down across the nation. Gelatin products are mainly used in special dietary applications because their hydrolyzed form is used to protein-fortify dietary foods. Dried, hydrolyzed gelatin contains over 92% protein. Typically, it is blended with other hydrolyzed proteins to balance the nutritional aspects of amino acids. The market is majorly driven by the rise in the usage of gelatin in the functional food industry.

United States Gelatin Industry Overview

The United States Gelatin Market is moderately consolidated, with the top five companies occupying 64.71%. The major players in this market are Ajinomoto Co. Inc., Darling Ingredients Inc., Gelatines Weishardt SAS, GELITA AG and Nitta Gelatin Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90061

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 End User Market Volume

- 3.1.1 Baby Food and Infant Formula

- 3.1.2 Bakery

- 3.1.3 Beverages

- 3.1.4 Breakfast Cereals

- 3.1.5 Condiments/Sauces

- 3.1.6 Confectionery

- 3.1.7 Dairy and Dairy Alternative Products

- 3.1.8 Elderly Nutrition and Medical Nutrition

- 3.1.9 Meat/Poultry/Seafood and Meat Alternative Products

- 3.1.10 RTE/RTC Food Products

- 3.1.11 Snacks

- 3.1.12 Sport/Performance Nutrition

- 3.1.13 Animal Feed

- 3.1.14 Personal Care and Cosmetics

- 3.2 Protein Consumption Trends

- 3.2.1 Animal

- 3.3 Production Trends

- 3.3.1 Animal

- 3.4 Regulatory Framework

- 3.4.1 United States

- 3.5 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Form

- 4.1.1 Animal Based

- 4.1.2 Marine Based

- 4.2 End User

- 4.2.1 Food and Beverages

- 4.2.1.1 By Sub End User

- 4.2.1.1.1 Bakery

- 4.2.1.1.2 Beverages

- 4.2.1.1.3 Condiments/Sauces

- 4.2.1.1.4 Confectionery

- 4.2.1.1.5 Dairy and Dairy Alternative Products

- 4.2.1.1.6 RTE/RTC Food Products

- 4.2.1.1.7 Snacks

- 4.2.2 Personal Care and Cosmetics

- 4.2.3 Supplements

- 4.2.3.1 By Sub End User

- 4.2.1 Food and Beverages

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 5.4.1 Ajinomoto Co. Inc.

- 5.4.2 Baotou Dongbao Bio Tech Co. Ltd

- 5.4.3 Darling Ingredients Inc.

- 5.4.4 Gelatines Weishardt SAS

- 5.4.5 GELITA AG

- 5.4.6 Hangzhou Qunli Gelatin Chemical Co. Ltd

- 5.4.7 Italgelatine SpA

- 5.4.8 Lapi Gelatine SpA

- 5.4.9 Nitta Gelatin Inc.

6 KEY STRATEGIC QUESTIONS FOR PROTEIN INGREDIENTS INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.