Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690966

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690966

United States Milk Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 191 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

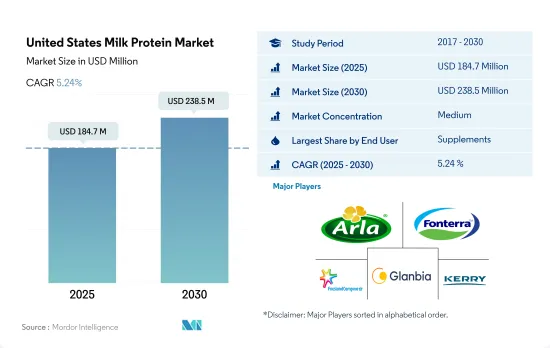

The United States Milk Protein Market size is estimated at 184.7 million USD in 2025, and is expected to reach 238.5 million USD by 2030, growing at a CAGR of 5.24% during the forecast period (2025-2030).

Supplements segment holds significant share with growing fitness and health conscious consumers across the country

- By end user, the supplements segment significantly grew during the study period, primarily driven by the sports/performance nutrition sub-segment, which is projected to register a CAGR of 3.91%, by value, during the forecast period. These regulated goods have recently gained popularity, even though the business is still evolving. More than 75% of Americans take dietary supplements every year. 79% of female adults and 74% of male adults claim to consume at least one form of supplement with their diet. Supplement sales are projected to increase to larger volumes with the expansion of the fitness industry in the country, as well as the promotion of healthy and natural food products.

- Sports nutrition supplements contributed 28% to the overall supplement consumption volume in the country. The escalating demand from the sports/performance nutrition sub-segment has contributed to considerable innovation in the sector. Manufacturers, like FrieslandCampina Ingredients and AMCO Proteins, are introducing milk proteins, like MPI 90 and MPC 85, targeting the performance and active nutrition spaces in the United States.

- In the F&B segment, the application of milk proteins in snacks led the market in 2022. The utilization of milk proteins in snacks increased by almost 1% in 2022 compared to the previous year. The rise in healthy snacking essentially aided the expansion of milk proteins in the snacking market. The increase can primarily be attributed to the rising number of new products targeted toward children below the age of 12. Cheese-flavored snacks are popular in the United States, with most of them employing milk proteins to enhance nutritional value and taste. Some snack products are also aimed at increasing consumption in young children.

United States Milk Protein Market Trends

Sport/performance nutrition is expected to witness significant growth during the forecast period

- Rising health concerns and memberships across health clubs are primarily driving the sport/performance nutrition segment. From 2009 to 2019, the number of gyms in the United States rose by 39%. However, the segment witnessed a significant decline due to gym closures during the COVID-19 pandemic-induced nationwide lockdown in 2020. Health clubs are among the most popular sales channels for sports supplements. The closure of health clubs had a negative impact on the sales of supplements. In 2020, several gyms like Gold's Gym, Flywheel Sports, Town Sports International, and 24-Hour Fitness declared bankruptcy. Sales of sports nutrition products decreased in 2020, and the segment's overall Y-o-Y growth rate reduced by 3.37%.

- The importance of leading an active lifestyle is fueling the sports/performance nutrition segment. In 2021, 67% of US consumers aged six and above participated in fitness activities, of which 43.3% of consumers engaged in individual sports, 52.9% in outdoor sports, and 22.1% in team sports. Consumers are becoming more aware of the value of optimal nutrition and healthier lifestyles, all of which positively impact the sports/performance nutrition segment.

- Sports/performance nutrition is the fastest-growing end-user segment in the US whey protein market, of which animal protein accounts for a major share of 91.1% in terms of value. The fitness industry is rapidly increasing the usage of animal protein ingredients, such as whey, collagen, and milk proteins, in nutritional supplements used for muscle or tissue repair after workouts. The rise in the availability of protein supplements, a growth in the number of recreational and lifestyle users of these products, and an increase in health awareness are expected to boost market growth over the forecast period.

The United States is aiming to focus on milk production

- As of 2022, the average number of milk cows in the United States was 9,402 heads. Milk is usually separated through various processes into components and processed into fluid beverage milk or raw material for other dairy products.

- The consumption of dairy ingredients in the United States has increased over the past few years, and the milk supply is mainly used to produce dairy products and ingredients, including proteins. A total of 17.4 billion pounds of milk were produced in 24 main states (like Arizona, California, and Colorado) in February 2024, up by 2.4% from February 2023. The number of milk cows on farms in the 24 major states was 8.88 million, 61,000 head less than in February 2023 but 8,000 head more than in January 2024. The production per cow in the 24 major states averaged 1,955 pounds for February 2024, 58 pounds above February 2023.

- Goat milk production in the United States has experienced continuous expansion over the last decade. The largest number of milk goats are found in Wisconsin and California, followed by Iowa, Pennsylvania, and New York. Milk produced by goat dairies has various applications, including feeding goat kids, feeding other livestock, such as lambs, veal calves, or piglets, personal consumption, and making goat milk products. Goat milk is used in food products such as candy, yogurt, and ice cream. Due to goat milk's unique nutritional and biochemical properties, it is also used in soaps and lotions.

United States Milk Protein Industry Overview

The United States Milk Protein Market is moderately consolidated, with the top five companies occupying 59.45%. The major players in this market are Arla Foods amba, Fonterra Co-operative Group Limited, FrieslandCampina Ingredients, Glanbia PLC and Kerry Group PLC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90059

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 End User Market Volume

- 3.1.1 Baby Food and Infant Formula

- 3.1.2 Bakery

- 3.1.3 Beverages

- 3.1.4 Breakfast Cereals

- 3.1.5 Condiments/Sauces

- 3.1.6 Confectionery

- 3.1.7 Dairy and Dairy Alternative Products

- 3.1.8 Elderly Nutrition and Medical Nutrition

- 3.1.9 Meat/Poultry/Seafood and Meat Alternative Products

- 3.1.10 RTE/RTC Food Products

- 3.1.11 Snacks

- 3.1.12 Sport/Performance Nutrition

- 3.1.13 Animal Feed

- 3.1.14 Personal Care and Cosmetics

- 3.2 Protein Consumption Trends

- 3.2.1 Animal

- 3.3 Production Trends

- 3.3.1 Animal

- 3.4 Regulatory Framework

- 3.4.1 United States

- 3.5 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Form

- 4.1.1 Concentrates

- 4.1.2 Hydrolyzed

- 4.1.3 Isolates

- 4.2 End User

- 4.2.1 Animal Feed

- 4.2.2 Food and Beverages

- 4.2.2.1 By Sub End User

- 4.2.2.1.1 Bakery

- 4.2.2.1.2 Beverages

- 4.2.2.1.3 Breakfast Cereals

- 4.2.2.1.4 Condiments/Sauces

- 4.2.2.1.5 Dairy and Dairy Alternative Products

- 4.2.2.1.6 RTE/RTC Food Products

- 4.2.2.1.7 Snacks

- 4.2.3 Personal Care and Cosmetics

- 4.2.4 Supplements

- 4.2.4.1 By Sub End User

- 4.2.4.1.1 Baby Food and Infant Formula

- 4.2.4.1.2 Elderly Nutrition and Medical Nutrition

- 4.2.4.1.3 Sport/Performance Nutrition

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 5.4.1 AMCO Proteins

- 5.4.2 Arla Foods amba

- 5.4.3 Dairy Farmers of America

- 5.4.4 Fonterra Co-operative Group Limited

- 5.4.5 FrieslandCampina Ingredients

- 5.4.6 Glanbia PLC

- 5.4.7 Hoogwegt Group

- 5.4.8 Kerry Group PLC

- 5.4.9 Milk Specialties Global

6 KEY STRATEGIC QUESTIONS FOR PROTEIN INGREDIENTS INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.