Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690965

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690965

United States Casein And Caseinate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 175 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

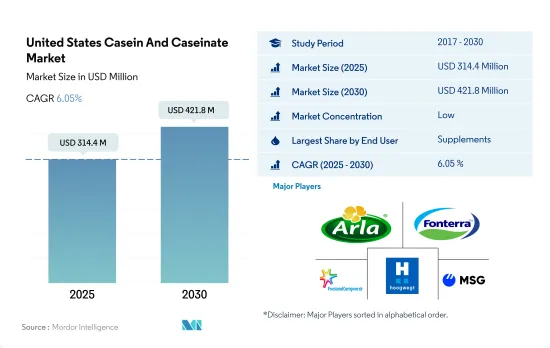

The United States Casein And Caseinate Market size is estimated at 314.4 million USD in 2025, and is expected to reach 421.8 million USD by 2030, growing at a CAGR of 6.05% during the forecast period (2025-2030).

Rising demand for functional ingredients drove the application of casein and caseinates mainly as the use in meal replacement products

- The supplements segment (particularly sports nutrition) dominated the market throughout the review period. Sports nutrition is also projected to register a CAGR of 6.75% during the forecast period (2023-2029). Being a slow-digesting protein (taking over a period of ~ 6-7 h), it can satiate for a longer period, allowing it to be used in products, such as meal replacement and weight loss products. Among all, micellar casein gained huge market penetration in the study period due to its high protein content (90% un-denatured protein) and high levels of bioavailable calcium.

- The sports nutrition segment majorly drives the casein market. An increase in awareness about the benefits of sports nutrition products has increased the growth of the sports nutrition segment in the country. However, the closure of gyms and health clubs in 2020 (22% in the US) resulted in an approximate loss of USD 29.2 billion in revenue) and suspended sports competitions during the COVID-19 pandemic, resulting in sluggish market growth.

- The food and beverage segment is the second major segment in the market. The value of the segment increased by around 25% from 2017 to 2022. The key reason for the rising application of caseins and caseinates in this segment is the ability of caseins to be digested slowly, which is highly required in products like meal replacement or weight loss products. Among the category, beverages is the fastest growing and is projected to register a CAGR of 2.73% during the forecast period. Consumers are increasingly reaching for dairy-based and other products containing functional ingredients to ward off illness or help with existing health issues. Companies are capitalizing on the trend by adding concentrated substances to their products.

United States Casein And Caseinate Market Trends

Sport/performance nutrition is expected to witness significant growth during the forecast period

- Rising health concerns and memberships across health clubs are primarily driving the sport/performance nutrition segment. From 2009 to 2019, the number of gyms in the United States rose by 39%. However, the segment witnessed a significant decline due to gym closures during the COVID-19 pandemic-induced nationwide lockdown in 2020. Health clubs are among the most popular sales channels for sports supplements. The closure of health clubs had a negative impact on the sales of supplements. In 2020, several gyms like Gold's Gym, Flywheel Sports, Town Sports International, and 24-Hour Fitness declared bankruptcy. Sales of sports nutrition products decreased in 2020, and the segment's overall Y-o-Y growth rate reduced by 3.37%.

- The importance of leading an active lifestyle is fueling the sports/performance nutrition segment. In 2021, 67% of US consumers aged six and above participated in fitness activities, of which 43.3% of consumers engaged in individual sports, 52.9% in outdoor sports, and 22.1% in team sports. Consumers are becoming more aware of the value of optimal nutrition and healthier lifestyles, all of which positively impact the sports/performance nutrition segment.

- Sports/performance nutrition is the fastest-growing end-user segment in the US whey protein market, of which animal protein accounts for a major share of 91.1% in terms of value. The fitness industry is rapidly increasing the usage of animal protein ingredients, such as whey, collagen, and milk proteins, in nutritional supplements used for muscle or tissue repair after workouts. The rise in the availability of protein supplements, a growth in the number of recreational and lifestyle users of these products, and an increase in health awareness are expected to boost market growth over the forecast period.

Widespread availability of raw cow milk enables the production of skim milk

- The graph depicts the production of skim cow milk in the United States. The availability of raw cow milk enables the production of skim cow milk in the United States. In 2023, 2,408,7 pounds of milk was produced per cow, an increase of 1.30% from 23,777 pounds in 2020. As of 2022, the average number of milk cows in the United States was 9,402 heads. Milk is usually separated through various processes into components and processed into fluid beverage milk or the manufacture of other dairy products.

- Casein is the major protein in cows' milk and comprises about 80% of the total protein content, of which the rest, some 20%, are whey or serum proteins. Commercial casein is produced from skim milk using one of two main methods: acid precipitation or rennet coagulation. The goal is to remove as much fat, whey proteins, lactose, and minerals as possible through multiple stages of water washing. These impurities can compromise the quality of the casein, so it is important to minimize their presence. Dried, properly produced casein has a relatively good keeping quality and is used mainly in the food and chemical industries. Rennet casein, acid casein, and co-precipitate are major types of casein derived from skim cow milk.

- As the world's largest single-country producer of skim milk powder, this country has tremendous potential in skim cow milk production. US manufacturers continue to boost Y-o-Y production of skim milk to meet changing consumer preferences for low-fat or calorie-deficit diets. SMP contains 5% or less moisture (by weight) and 1.5% or less milkfat (by weight). The difference is that SMP has an adjusted minimum milk protein content of 34%.

United States Casein And Caseinate Industry Overview

The United States Casein And Caseinate Market is fragmented, with the top five companies occupying 21.31%. The major players in this market are Arla Foods amba, Fonterra Co-operative Group Limited, FrieslandCampina Ingredients, Hoogwegt Group and Milk Specialties Global (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90058

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 End User Market Volume

- 3.1.1 Baby Food and Infant Formula

- 3.1.2 Bakery

- 3.1.3 Beverages

- 3.1.4 Breakfast Cereals

- 3.1.5 Condiments/Sauces

- 3.1.6 Confectionery

- 3.1.7 Dairy and Dairy Alternative Products

- 3.1.8 Elderly Nutrition and Medical Nutrition

- 3.1.9 Meat/Poultry/Seafood and Meat Alternative Products

- 3.1.10 RTE/RTC Food Products

- 3.1.11 Snacks

- 3.1.12 Sport/Performance Nutrition

- 3.1.13 Animal Feed

- 3.1.14 Personal Care and Cosmetics

- 3.2 Protein Consumption Trends

- 3.2.1 Animal

- 3.3 Production Trends

- 3.3.1 Animal

- 3.4 Regulatory Framework

- 3.4.1 United States

- 3.5 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 End User

- 4.1.1 Animal Feed

- 4.1.2 Food and Beverages

- 4.1.2.1 By Sub End User

- 4.1.2.1.1 Bakery

- 4.1.2.1.2 Beverages

- 4.1.2.1.3 Confectionery

- 4.1.2.1.4 Dairy and Dairy Alternative Products

- 4.1.2.1.5 RTE/RTC Food Products

- 4.1.2.1.6 Snacks

- 4.1.3 Personal Care and Cosmetics

- 4.1.4 Supplements

- 4.1.4.1 By Sub End User

- 4.1.4.1.1 Baby Food and Infant Formula

- 4.1.4.1.2 Elderly Nutrition and Medical Nutrition

- 4.1.4.1.3 Sport/Performance Nutrition

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 5.4.1 AMCO Proteins

- 5.4.2 Arla Foods amba

- 5.4.3 Erie Group International Inc.

- 5.4.4 Farbest-Tallman Foods Corporation

- 5.4.5 Fonterra Co-operative Group Limited

- 5.4.6 FrieslandCampina Ingredients

- 5.4.7 Hoogwegt Group

- 5.4.8 Milk Specialties Global

- 5.4.9 Tatua Co-operative Dairy Company Ltd

6 KEY STRATEGIC QUESTIONS FOR PROTEIN INGREDIENTS INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.