PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690953

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690953

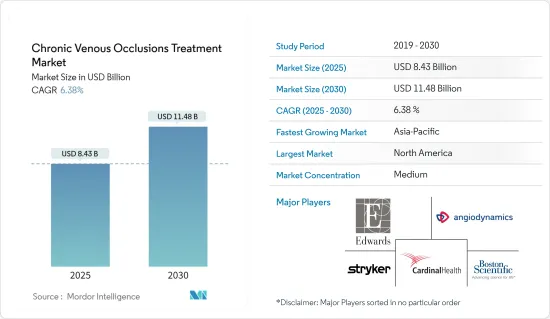

Chronic Venous Occlusions Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Chronic Venous Occlusions Treatment Market size is estimated at USD 8.43 billion in 2025, and is expected to reach USD 11.48 billion by 2030, at a CAGR of 6.38% during the forecast period (2025-2030).

Chronic venous occlusion treatment is used to treat chronic venous diseases. Venous occlusion is when veins are blocked, narrowed, or compressed by nearby structures such as clots, muscles, arteries, or other veins. This can result in blood pooling and flowing backward, causing pain and swelling in the area.

The high prevalence of venous occlusion diseases globally drives the market's growth. For instance, a study published in the International Wound Journal in May 2024 revealed that the mean prevalence of chronic venous diseases was 58.4%, and the prevalence of varicose veins was 22.1%. Such a high prevalence of disease at the global level propels the market's growth.

Major market players are increasingly making strategic moves, such as acquisitions, to bolster their product portfolios, particularly in minimally invasive devices for vascular disease treatment.

For instance, in May 2024, Siemens Healthineers, through its subsidiary Varian, finalized the acquisition of Innova Vascular. Innova Vascular, a prominent player in the medical device industry, specializes in cutting-edge, minimally invasive devices tailored for vascular disease treatment. The flagship product, the Laguna Thrombectomy System, is lauded for its exceptional flexibility, trackability, and diverse range of sizes.

These attributes enable healthcare providers to address venous thromboembolism across patient profiles and clot variations effectively. With this acquisition, Siemens Healthineers has significantly bolstered its offerings for blood clot treatments, setting the stage for substantial growth in this market during the forecast period.

Additionally, pharmaceutical companies are increasingly spearheading initiatives to raise awareness about treating venous insufficiency to propel market growth during the forecast period. For example, in July 2023, LES LABORATOIRES SERVIER rolled out a comprehensive campaign dedicated to venous disease awareness. By closely collaborating with healthcare professionals and patients, the company aims to deepen the understanding of venous insufficiency and enhance symptom management. These concerted efforts from pharmaceutical entities are poised to drive market growth in the coming years.

Thus, owing to the abovementioned factors, such as the high prevalence of venous diseases, increasing awareness of venous diseases, and the launch of new products, the growth of the market is the majority driving it. However, the cost compilations and risk associated with treatment may hinder the growth of the market.

Chronic Venous Occlusions Treatment Market Trends

The Deep Vein Insufficiency Segment is Expected to Drive the Market Growth During the Forecast Period

Chronic venous occlusion treatment therapeutics primarily consist of antibiotics and anticoagulants. These medications aim to either prevent or treat blood clots within blood vessels. Such clots pose severe risks, including stroke, heart attack, deep vein thrombosis, and pulmonary embolism. Anticoagulants prevent clot formation, while thrombolytics dissolve existing clots.

Effective anticoagulants for managing deep venous thrombosis encompass a range, from low molecular weight heparins (LMWHs) like enoxaparin, dalteparin, and tinzaparin to unfractionated heparin (UFH), factor Xa inhibitors, direct thrombin inhibitors, and vitamin K antagonists such as warfarin.

The segment's growth is propelled by the rising adoption of new oral anticoagulants tailored for chronic venous occlusion.

The advent of biosimilars is poised to intensify market competition, driving down the costs of chronic venous occlusion drugs. This cost reduction enhances patient accessibility, directly influencing the segment's growth. In September 2023, Fresenius Kabi Canada achieved public reimbursement approval for ELONOX, its enoxaparin biosimilar, across all Canadian provinces. ELONOX. Health Canada specifically endorsed ELONOX (enoxaparin sodium) for thromboembolic disorder prophylaxis, including deep vein thrombosis. Such reimbursement by health authorities contributes to increased accessibility and adaptability and further propels segmental growth.

The increasing focus on clinical studies targeting deep vein thrombosis is anticipated to be a significant driver for segmental growth. A case in point is Bayer AG, which, in February 2024, initiated a Phase II clinical trial for BAY3018250, an innovative anti-a2 antiplasmin (anti-a2ap) antibody, in DVT patients. The trial's results are expected to highlight the antibody's potential as a crucial treatment avenue for severe medical conditions. Buoyed by these findings, Bayer is keen to advance the antibody to the next phase of clinical trials, with a specific focus on DVT patients. Such initiatives hold promise for patients and bolster the segment's growth.

Therefore, the confluence of factors, including the rise of biosimilars, an uptick in clinical studies for DVT, and strategic moves by major players, like Bayer's new drug trials, is poised to drive significant growth in the segment in the coming years.

North America Dominates the Market During the Forecast Period

North America is poised to dominate the chronic venous occlusion treatment market. It is buoyed by its advanced healthcare infrastructure, high venous disease prevalence, and robust regulatory approvals for medical devices and drugs.

The region's market is witnessing growth, driven by the high prevalence of venous diseases. For instance, in April 2023, the National Institutes of Health (NIH) reported that over 25 million Americans suffer from varicose veins, with a staggering 6 million facing severe venous disease. This highlights the gravity of chronic venous conditions as a significant health concern. The rising burden of these conditions has driven the adoption of chronic venous occlusion treatments, fueling market growth.

Moreover, ongoing clinical trials, such as the VIVID trial in October 2023, which assessed the Duo venous stent system by Koninklijke Philips N.V. for nonmalignant iliofemoral occlusive disease, are set to propel the market further. The Duo system, comprising the Duo Hybrid and Duo Extend stents, caters to the diverse anatomical and mechanical needs of the iliofemoral venous segment. These trials to ensure device efficacy and safety are pivotal for the market's future growth.

Also, the introduction of generic drug variants, like Pharmascience Canada's Pms-rivaroxaban in November 2023, designed for deep vein thrombosis treatment, enhances market accessibility and adaptability. Such launches will drive the market's growth in the coming years.

Given the rising prevalence of cardiovascular and venous diseases, alongside the momentum from ongoing clinical trials and the launch of products, the chronic venous occlusion treatment market is set for substantial growth during the forecast period.

Chronic Venous Occlusions Treatment Industry Overview

The chronic venous occlusion treatment market is semi-consolidated, with several players. Companies in the market use diverse strategies such as mergers, acquisitions, partnerships, and collaborations to develop new drugs and devices. Some of the major players in the market include Cardinal Health, Stryker, Cook Medical, Boston Scientific Corporation, Edward Lifesciences, and AngioDynamics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Availability of Advanced Treatments and Devices

- 4.2.2 Increasing Prevalence of Venous Occlusion Diseases

- 4.3 Market Restraints

- 4.3.1 Cost Consciousness Coupled with Risk and Complications Associated with Treatment

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Treatment Type

- 5.1.1 Chronic Deep Vein Thrombosis

- 5.1.2 Varicose Veins

- 5.1.3 Deep Vein Insufficiency

- 5.1.4 Other Treatment Types

- 5.2 By Product Type

- 5.2.1 Devices

- 5.2.2 Therapeutics

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cardinal Health

- 6.1.2 Stryker

- 6.1.3 Cook Medical

- 6.1.4 Boston Scientific Corporation

- 6.1.5 Edward Lifesciences

- 6.1.6 AngioDynamics

- 6.1.7 SIGVARIS GROUP

- 6.1.8 Johnson & Johnson Inc. (Janssen Global Services LLC)

- 6.1.9 Penumbra Inc.

- 6.1.10 Becton, Dickinson and Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS