PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844342

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844342

Chronic Venous Occlusions Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

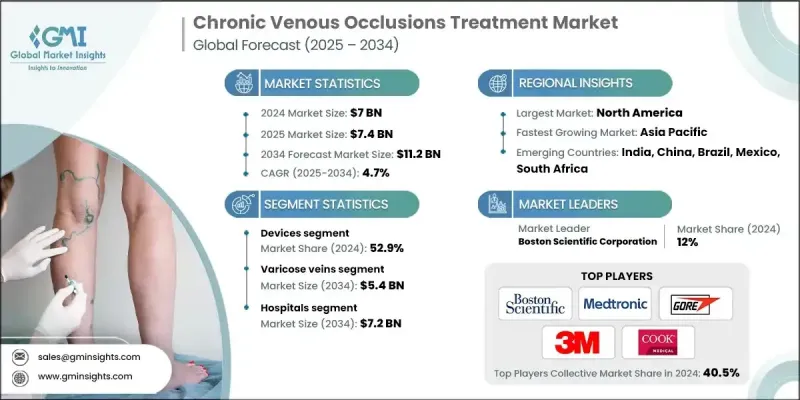

The Global Chronic Venous Occlusions Treatment Market was valued at USD 7 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 11.2 billion by 2034.

The steady growth is driven by a rising number of venous disorders, growing elderly populations, and continuous technological advancements across treatment approaches. With healthcare systems increasingly focused on improving patient outcomes, the adoption of minimally invasive therapies and personalized treatment strategies has gained significant traction. As awareness grows among both patients and clinicians, early diagnosis and proactive treatment planning are becoming more common. Healthcare campaigns, patient education programs, and expanded reimbursement support are helping propel industry development. The convergence of digital health technologies and traditional care models is also transforming post-treatment management. Companies across the value chain including device makers, pharmaceutical developers, and healthcare providers are forging strategic partnerships to introduce innovative solutions and enhance care accessibility. Additionally, increasing medical expenditure and policy support in mature economies have created a strong foundation for future growth across the sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7 Billion |

| Forecast Value | $11.2 Billion |

| CAGR | 4.7% |

Chronic venous occlusions treatment focuses on managing long-term venous blockages through a range of approaches like compression therapy, pharmaceuticals, endovenous procedures, and digital monitoring tools. These treatments work to restore venous blood flow, prevent complications, reduce symptoms, and improve overall quality of life for affected patients. The underlying causes often include vascular scarring, thrombosis, and congenital abnormalities, which contribute to chronic symptoms requiring long-term management.

The devices segment held 52.9% share in 2024, attributed to the rising preference for less invasive treatments and broader use of advanced endovenous tools and compression systems. The shift away from invasive surgical options has led to the popularity of procedures with faster recovery and fewer risks. The growing use of techniques such as ablation therapy, sclerotherapy, and modern compression wear reflects this trend. Both patients and healthcare professionals increasingly favor solutions offering efficient outcomes with minimal disruption to daily life, driving demand for cutting-edge treatment devices.

The varicose veins segment held 48.7% share and is expected to reach USD 5.4 billion by 2034. This dominance is largely due to the high incidence of venous insufficiency, especially among older adults and those with sedentary lifestyles or obesity. The shift toward minimally invasive solutions like endovenous laser and radiofrequency ablation is reinforcing market expansion. Lifestyle-related factors and increasing public awareness are expanding the treatment-seeking patient base, particularly among individuals aged 40 and above.

North America Chronic Venous Occlusions Treatment Market held 40.1% share in 2024. The region's well-established healthcare infrastructure, high awareness levels, and early adoption of novel therapies contribute to its leadership position. A growing elderly population, more vulnerable to venous complications such as chronic insufficiency and thrombosis, is fueling continuous demand. Innovations in diagnostics and reimbursement systems have also supported strong uptake of advanced treatments throughout the region.

Key Players involved in the Global Chronic Venous Occlusions Treatment Market: Pfizer, Boston Scientific Corporation, Terumo, Medtronic, Tactile Medical, Coloplast, Gore, Bayer AG, Sanofi, Viatris, AngioDynamics, ConvaTec, Sciton, Leucadia Pharmaceuticals (Hikma), 3M, Cook Medical, and ConvaTec. Leading companies in the chronic venous occlusions treatment market are prioritizing R&D to develop minimally invasive devices and novel pharmaceuticals with enhanced safety and efficacy. Expanding product portfolios through strategic mergers and acquisitions allows firms to integrate complementary technologies and broaden market access. Many are leveraging partnerships with hospitals, research institutions, and digital health platforms to improve patient monitoring and long-term disease management.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of varicose veins coupled with rising awareness regarding its treatment

- 3.2.1.2 Growing preference for minimally invasive procedures

- 3.2.1.3 Rise in number of orthopedic procedures

- 3.2.1.4 Technological advancements pertaining to chronic venous insufficiency treatment therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects and risks associated with different treatment modes

- 3.2.2.2 Strict regulatory guidelines

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for outpatient and ambulatory care settings

- 3.2.3.2 Integration of digital health and AI

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Rising adoption of minimally invasive stent and catheter-based interventions

- 3.5.1.2 Integration of advanced imaging for precise diagnosis and treatment planning

- 3.5.1.3 Growth in compression therapy innovations for chronic venous insufficiency

- 3.5.2 Emerging technologies

- 3.5.2.1 Development of bioresorbable stents for long-term vascular health

- 3.5.2.2 AI-driven imaging and decision support for venous occlusion treatment

- 3.5.2.3 Non-invasive ultrasound-based therapies

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Strong shift toward ambulatory surgical center-based care

- 3.9.2 Growing penetration in emerging markets with improved healthcare access

- 3.9.3 Strategic collaborations driving innovation and global expansion

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Devices

- 5.2.1 Compression devices

- 5.2.2 Sclerotherapy

- 5.2.3 Endovenous ablation

- 5.2.3.1 Laser ablation

- 5.2.3.2 Radiofrequency ablation

- 5.2.4 Vein stripper

- 5.2.5 Other devices

- 5.3 Drugs

- 5.3.1 Analgesics

- 5.3.2 Antibiotics

- 5.3.3 Anticoagulants

- 5.3.4 Other drugs

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Varicose veins

- 6.3 Edema

- 6.4 Deep vein thrombosis

- 6.5 Venous stasis ulcers

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 AngioDynamics

- 9.3 Bayer AG

- 9.4 Boston Scientific Corporation

- 9.5 Coloplast

- 9.6 ConvaTec

- 9.7 Cook Medical

- 9.8 Gore

- 9.9 Leucadia Pharmaceuticals (Hikma)

- 9.10 Medtronic

- 9.11 Pfizer

- 9.12 Sanofi

- 9.13 Sciton

- 9.14 Tactile Medical

- 9.15 Terumo

- 9.16 Viatris