PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690838

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690838

Latin America Customs Brokerage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

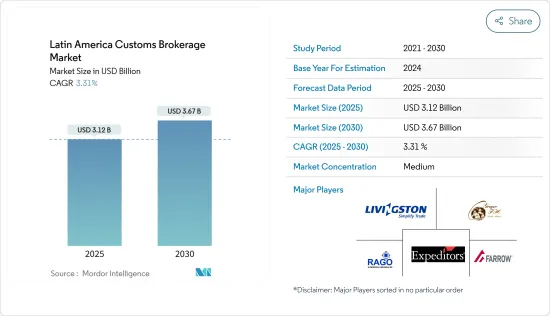

The Latin America Customs Brokerage Market size is estimated at USD 3.12 billion in 2025, and is expected to reach USD 3.67 billion by 2030, at a CAGR of 3.31% during the forecast period (2025-2030).

Countries had to speed up the clearance and release of medicines, diagnostics, kits, and equipment to combat this pandemic. To avoid the accumulation of goods in legal bankruptcy, customs administrations have quickly shortened their deadlines and procedures in countries such as Peru, Panama, Colombia, and Chile.

The friction at the border can be significant for shipping companies entering Latin America's market. There are often long delays in customs clearance due to bureaucracy and outdated clearance procedures. It has resulted in widespread corruption, and many customs officials are known to ask for bribes to process goods more quickly.

To perform efficient customs processes such as documentation and clearance, logistics companies are regularly adopting new technologies and software platforms for different end users.

Some of the main reasons for an extraordinary increase in companies offering specialized customs services as part of their portfolios are rapidly rising last-mile deliveries and smooth, fast, and end-to-end delivery on the logistics broker market. The growth of the Latin American customs brokerage market is propelled by the augmented adoption of Internet of Things-enabled connected devices and an increasing trend toward technology-driven logistics services. Moreover, the market's growth is supported by the development of the e-commerce sector and by an increase in reverse logistics operations. However, the growth of this market is hampered by a need for manufacturers' control over logistics services.

Latin America Customs Brokerage Market Trends

Increase In Ocean Freight

According to industry experts, maritime logistics is considered the backbone of trade, as it transports around 84% of the volumes traded worldwide and almost 70% of the global trade value. Thus, the port is important in ensuring that goods are distributed through supply chains, including those deemede essentia,l, like food or medical supplies.

The sorting of goods takes significant time for customs agents and brokers in the country. As a result, there is a build-up of stocks, and customs costs can be too high, leading to frustration for customers when materials often take too long to arrive.

Forwarders and carriers are investing heavily in South American ports and logistics businesses. They are adding services to the region to capitalize on growing trade volumes and sourcing shifts from diversifying supply chains. In September 2023, Maersk announced the introduction of Grape Express, which is expected to start in 42 Paita, Peru, and go to Philadelphia with a transit time of 11 days.

Growing Demand In Retail Sector

International online sales support the growth of the retail sector. By 2024, global cross-border e-commerce will account for 20.3% of retail sales. In developing regions of Latin America, retailers can penetrate new markets and attract new clients.

Due to cell phones, an increasing number of people in Latin America are accessing the Internet. It is also the reason why eCommerce has grown in this area. Although the Latin American market is small compared with North America and Europe, online sales in this region are estimated to increase by more than 19% over the coming five years.

Latin America's inclination towards e-commerce is increasing. Nearly 65% of all Latin American consumers bought from an overseas retailer in 2022. As of 2023, Mercado Libre, the Argentine giant alone, accounted for roughly 28% of ecommerce in Latin America.

Latin America Customs Brokerage Industry Overview

The market is fragmented, with the presence of many domestic companies. Some countries are open to trade with simple customs laws that are easy to understand and execute. Others use customs as a barrier to controlling trade and sources of revenue. They continually enforce new fees or penalties. The suppliers in the customs brokerage industry in Latin America are observing a high demand due to the exponential growth of industries such as chemicals, pharmaceuticals, FMCG, and packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview (Current Scenario of Customs Brokerage Market in Latin America)

- 4.2 Government Regulations and Initiatives (Related to Logistics and Logistics Infrastructure Development and Its Impact)

- 4.3 Technological Trends (Global and Regional-level Insights)Impact of COVID-19 on the Market (Short-term and Long-term Effects on the Market)

- 4.4 Review of Customs Brokerage Costs as Percentage of Total Logistics Spend

- 4.5 Overview of Customs Pricing

- 4.6 Brief on Customs Brokerage-related Software (Key Software Providers and Trends in the Global and Regional Market)

- 4.7 Impact of COVID-19 on the Market

- 4.8 Industry Attractiveness - Porter Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Mode of Transport

- 5.1.1 Ocean

- 5.1.2 Air

- 5.1.3 Cross-border Land Transport

- 5.2 End User

- 5.2.1 Automotive

- 5.2.2 Chemicals

- 5.2.3 FMCG (Fast-moving Consumer Goods - Includes Beauty and Personal Care, Soft Drinks, Home Care, etc.)

- 5.2.4 Retail (Hypermarkets, Supermarkets, Convenience Stores, and E-commerce Channels)

- 5.2.5 Fashion and Lifestyle (Apparel and Footwear)

- 5.2.6 Reefer (Fruits, Vegetables, Pharmaceuticals, Meat, Fish, and Seafood)

- 5.2.7 Technology (Consumer Electronics, Home Appliances)

- 5.2.8 Other End Users

- 5.3 Country

- 5.3.1 Mexico

- 5.3.2 Brazil

- 5.3.3 Chile

- 5.3.4 Colombia

- 5.3.5 Panama

- 5.3.6 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration Overview, Major Players)

- 6.2 Company Profiles

- 6.2.1 Grupo Ei

- 6.2.2 Livingston International

- 6.2.3 Farrow

- 6.2.4 Rota Brasil

- 6.2.5 Ibercondor Forwarding SA de CV

- 6.2.6 Elemar

- 6.2.7 Grupo Coex

- 6.2.8 Servicios de Aduanas Jimenez

- 6.2.9 Aduana Cordero

- 6.2.10 Deutsche Post DHL Group

- 6.2.11 DSV Panalpina AS

- 6.2.12 Expeditors International*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Key Border Ports in the Region (Country-level)