PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1632067

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1632067

Asia-Pacific Customs Brokerage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

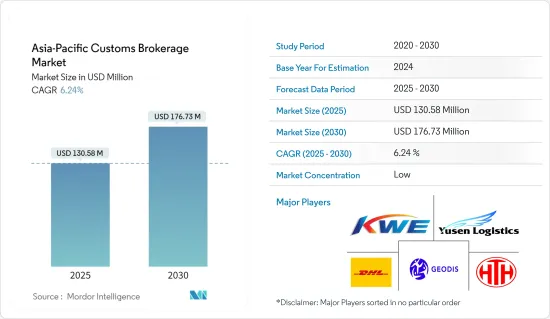

The Asia-Pacific Customs Brokerage Market size is estimated at USD 130.58 million in 2025, and is expected to reach USD 176.73 million by 2030, at a CAGR of 6.24% during the forecast period (2025-2030).

Key Highlights

- As of 2024, the Asia-Pacific customs brokerage market is witnessing robust growth, primarily fueled by a surge in international trade and the adaptation of regulatory frameworks. Countries such as China and India are at the forefront of this cross-border transaction boom.

- For example, in September 2024, China reported exports worth USD 304 billion and imports totaling USD 222 billion, achieving a commendable trade balance of USD 81.7 billion. A year-on-year comparison reveals that from September 2023 to September 2024, China's exports rose by USD 4.58 billion (1.53%), climbing from USD 299 billion to USD 304 billion. Simultaneously, imports saw a USD 703 million (0.32%) uptick, moving from USD 221 billion to USD 222 billion. These figures underscore the growing necessity for adept customs brokerage services to ensure seamless trade operations and adherence to intricate regulations.

- In response to evolving global dynamics, governments are frequently revising customs policies to bolster security and compliance. This evolution has heightened the demand for adept customs brokers, skilled at navigating these complex regulatory terrains.

- For instance, in November 2024, the Authorized Economic Operator (AEO) program was highlighted. This voluntary compliance initiative empowers Indian Customs to bolster cargo security. This is achieved through close collaboration with key players in the international supply chain, including importers, exporters, logistics providers, terminal operators, customs brokers, and warehouse operators. As businesses endeavor to align with these stringent regulatory benchmarks, the pivotal role of customs brokers in ensuring timely and compliant goods clearance becomes increasingly evident.

- Leveraging digital tools and platforms, customs brokers can optimize operations, enhance accuracy, and curtail processing durations. In a significant move, FedEx Express, a major player in global express transportation and a subsidiary of FedEx Corp., unveiled its FedEx Online Import Customs Declaration Tool in Mainland China on May 9, 2024. This technological advancement not only boosts operational efficiency but also underscores the vital role of customs brokers in refining supply chain management for businesses involved in global trade.

- Moreover, as of December 14, 2023, China and Australia commenced customs clearance facilitation for commodities trading through certified operators holding Authorized Economic Operator (AEO) status, as reported by China's General Administration of Customs (GAC). Furthermore, Vietnam's engagement in pacts like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has notably bolstered its export potential, subsequently heightening the demand for customs brokerage services.

Asia-Pacific Customs Brokerage Market Trends

Surge in Chinese Trade Activities Bolsters Market Growth

In the first ten months of 2024, China's imports and exports totaled 36.02 trillion yuan (around USD 5.05 trillion), marking a 5.2% year-on-year rise. This volume constituted 64.1% of China's total foreign trade value. Breaking it down, exports were valued at 20.8 trillion yuan (USD 2.89 trillion), up by 6.7%, while imports reached 15.22 trillion yuan (USD 2.09 trillion), seeing a 3.2% increase as reported by China Breifing. In the same timeframe, China's processing trade hit 6.53 trillion yuan (USD 0.93 trillion), growing at 4% and making up 18.1% of the total trade. Processing trade exports were 4.13 trillion yuan (USD 0.58 trillion), up 1.6%, and imports climbed to 2.4 trillion yuan (USD 0.34 trillion), marking a robust 8.3% rise as reported by General Administration of Customs - China.

Trade via bonded logistics reached 5.09 trillion yuan (USD 0.72 trillion), showcasing a notable 14% growth from the prior year 2023. This segment saw exports at 1.96 trillion yuan (USD 0.28 trillion), up 11.5%, and imports at 3.13 trillion yuan (USD 0.44 trillion), boasting a 15.7% increase as reported by China Customs. Regionally, ASEAN topped the list as China's primary trading partner in 2024, with trade totaling 5.67 trillion yuan (USD 0.81 trillion)-an 8.8% rise, making up 15.7% of China's overall foreign trade. Exports to ASEAN were 3.36 trillion yuan (USD 0.48 trillion), up 12.5%, while imports from the region stood at 2.31 trillion yuan (USD 0.33 trillion), a 3.8% increase. China's trade surplus with ASEAN grew to 1.05 trillion yuan (USD 0.15 trillion), marking a significant 38.2% jump from the previous year 2023 as reported by Trading Economics.

In conclusion, this rising trend in both imports and exports highlights the increasing importance of customs brokerage services in the Asia-Pacific's international trade landscape, especially as China deepens its economic relationships with its neighbors and bolsters its global market standing.

Maritime Trade Driving the Growth of the Market

Maritime freight transport stands as the dominant mode for international goods transit. Sea transport not only leads in customs entries but also drives the revenue of the customs brokerage market. The United Nations Conference on Trade and Development (UNCTAD) reports that 90% of the world's shipping capacity is owned by entities in Asia and Europe in 2024. Notably, Asian companies own over half of the global tonnage, with China (310 million dwt) and Japan (242 million dwt) holding substantial stakes.

Developing countries account for approximately two-thirds of global goods trade. In Q1 2024, trade growth was buoyed by exports from China (up 9%), India (up 7%), and the US (up 3%). In 2024, about 40% of containerized trade traversed the primary East-West routes linking Asia with Europe and the US. Meanwhile, non-mainland routes, like South Asia to the Mediterranean, captured roughly 12.9% of this trade.

Shipbuilding activities in Asia showcased a mixed bag in 2024: China boosted its shipbuilding capacity by 15.5%, South Korea followed with an 8.3% uptick, but Japan faced a notable decline of 16.4%. This variance underscores the competitive dynamics of Asia's shipbuilding sector and its implications for maritime logistics. Furthermore, Asian nations, particularly China, Vietnam, South Korea, and Japan, continue to lead in global trade flows, collectively representing nearly half of all container traffic.

In conclusion, the maritime trade sector significantly influences the customs brokerage market, with Asia playing a pivotal role in global shipping and trade dynamics. The ongoing developments in shipbuilding and trade routes underscore the importance of maritime logistics in facilitating international commerce.

Asia-Pacific Customs Brokerage Industry Overview

The Asia-Pacific customs brokerage market is characterized by fragmentation and intense competition, driven by the presence of numerous customs brokers. To differentiate themselves and secure a competitive advantage, many of these brokers are turning to advanced technologies, including blockchain and integrated supply chain solutions. The major players in the market include Geodis Logistics, Kintetsu World Express, DHL Logistics, Yusen Logistics, HTH Logistics, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising International Trade

- 4.2.2 Supply Chain Efficiency and Cost Reduction

- 4.3 Market Restraints

- 4.3.1 Regulatory Changes

- 4.3.2 Geopolitical Risks

- 4.4 Market Oppurtunities

- 4.4.1 Cross-Border E-Commerce

- 4.4.2 Digital Transformation

- 4.5 Insights into Supply Chain/Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Brief on Customs Brokerage as a Freight Forwarding Function

- 4.8 Overview of Customs Pricing

- 4.9 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Mode Of Transport

- 5.1.1 Sea

- 5.1.2 Air

- 5.1.3 Cross-Border Land Transport

- 5.2 By Geography

- 5.2.1 China

- 5.2.2 Japan

- 5.2.3 India

- 5.2.4 Australia

- 5.2.5 Malaysia

- 5.2.6 South Korea

- 5.2.7 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 DHL Group Logistics

- 6.2.2 Geodis Logistics

- 6.2.3 Kintetsu World Express

- 6.2.4 HTH Corporation

- 6.2.5 Yusen Logistics

- 6.2.6 China International Freight Co.

- 6.2.7 OEC Group

- 6.2.8 Sino Shipping

- 6.2.9 Kawasaki Rikuso Transportation Co.,Ltd.

- 6.2.10 One Global Logistics*

- 6.3 Other Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 External Trade Statistics - Exports and Imports by Product and by Country of Destination/Origin