Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690719

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690719

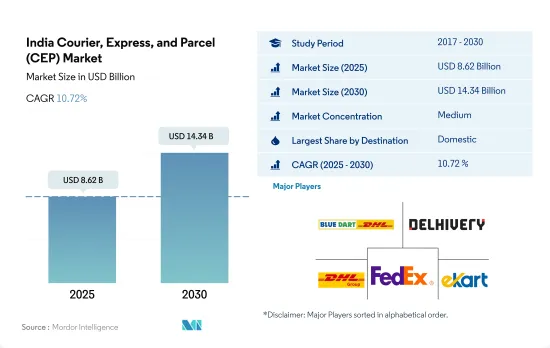

India Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 303 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The India Courier, Express, and Parcel (CEP) Market size is estimated at 8.62 billion USD in 2025, and is expected to reach 14.34 billion USD by 2030, growing at a CAGR of 10.72% during the forecast period (2025-2030).

Steady demand for CEP market owing to growing e-commerce market value despite decline in ecommerce investments leading to rising CEP demand

- In 2021, e-commerce funding in India increased to USD 11 billion, a notable jump from the previous year's USD 900 million. B2B e-commerce and the marketplace model in India allow 100% FDI under the automatic route. For e-commerce by Food Retail Companies, 100% FDI is permitted under the Government approval route, with the condition that the products are manufactured in India. However, in 2022, e-commerce funding dipped to USD 4 billion, largely due to cautious consumer sentiments towards startups. This downward trend persisted through 2023, with Q3 2023 witnessing a stark 47% Y-o-Y drop to USD 224 million and no mega deals in sight.

- E-commerce is a key catalyst for both domestic and international courier and parcel services. With a rapidly expanding internet user base and favorable market conditions, India's e-commerce industry is poised for significant growth. Valued at approximately USD 63.17 billion in 2023, the Indian e-commerce market is projected to reach USD 75.44 billion by 2024 and an estimated USD 107.10 billion by 2027.

India Courier, Express, and Parcel (CEP) Market Trends

Government and private investments, rising exports, and the increasing interstate movement of goods are the major drivers of the transportation industry

- In 2024, the government is dedicated to reducing logistics costs to 5-6%. Indian Railways is taking steps to boost freight capacity, increase the speed of freight trains, lower freight expenses, establish dedicated freight corridors, improve last-mile connectivity between railheads, roads, and ports. They're aligning with PM Gati Shakti, granting industry status to logistics, promoting digital solutions, and developing logistics infrastructure. These efforts aim to cut costs and spur GDP growth in logistics.

- The sector is expected to grow till 2027 and is expected to add 10 million jobs by 2027. India is aiming to become a global hub for manufacturing and logistics, with recent policies attracting around USD 10 billion USD in investments for the warehousing and logistics sector. Also India's infrastructure plans for 2024, such as the Mumbai Trans Harbour Link (MTHL), Navi Mumbai International Airport, Noida International Airport and Western Dedicated Freight Corridor etc, are expected to accelerate India's journey towards becoming a prominent player in the global logistics landscape.

The diesel price increase was less sharp than the increase in petrol prices due to VAT cuts offered by several state governments

- In September 2023, oil prices hit a 10-month high of USD 90 per barrel as Saudi Arabia and Russia extended their voluntary production and export cuts till 2023. As India imports 85% of its oil, the fuel prices were impacted. According to the All-India Motor Transport Congress, which represents 14 million truckers and vehicle operators, the soaring fuel prices are impacting India's truckers as they have limited ability to pass on the rising prices, which account for 70% of the cost of operating a truck.

- The Indian government is contemplating reducing petrol and diesel prices by INR 4 - INR 6 (USD 0.04 - USD 0.07) per litre in 2024, timed with the upcoming Lok Sabha elections in H1 2024. Discussion in ongoing with Oil Marketing Companies to share the burden of this reduction equally, and there's a possibility of a more substantial cut of up to Rs 10 (USD 0.12) per litre. This move aims to alleviate the financial strain on the public and could also help lower retail inflation, which peaked at 5.55% in November 2023.

India Courier, Express, and Parcel (CEP) Industry Overview

The India Courier, Express, and Parcel (CEP) Market is moderately consolidated, with the major five players in this market being Blue Dart Express Limited, Delhivery Ltd., DHL Group, FedEx and Instakart Services Private Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 71124

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 India

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Allcargo Logistics Ltd. (including Gati Express)

- 6.4.2 Blue Dart Express Limited

- 6.4.3 Delhivery Ltd.

- 6.4.4 Department of Posts (India Post)

- 6.4.5 DHL Group

- 6.4.6 DTDC Express Limited

- 6.4.7 Ecom Express

- 6.4.8 FedEx

- 6.4.9 Instakart Services Private Limited

- 6.4.10 Safexpress Pvt. Ltd.

- 6.4.11 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.