Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683920

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683920

ASEAN Domestic Courier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 318 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

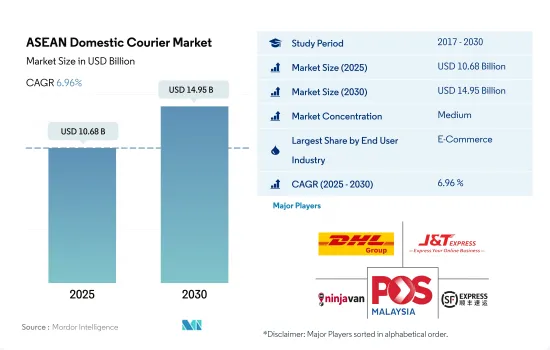

The ASEAN Domestic Courier Market size is estimated at 10.68 billion USD in 2025, and is expected to reach 14.95 billion USD by 2030, growing at a CAGR of 6.96% during the forecast period (2025-2030).

The e-commerce sector in the region grew at a CAGR of 37% during 2017-22, driving the growth of the market

- Domestic courier services are becoming increasingly important in the e-commerce industry. The pandemic brought a drastic change in shopping behavior over the past years, shifting the shopping process worldwide toward online shopping. During 2017-2022, the e-commerce sector in the region registered a CAGR of 37.71%. The development of the e-commerce sector is expected to contribute to the growth of the domestic courier services market. Moreover, the demand for domestic couriers has been increasing as the luxury retail markets in Southeast Asia have been growing due to a combination of demographics, increasing wealth, and their rapid emergence from the COVID-19 pandemic.

- During 2017-2022, the medical devices market recorded a CAGR of 6.52% and reached USD 10.02 billion in 2022. The pandemic has also accelerated the region's demand for express delivery services for healthcare equipment. The growth of domestic courier services for medical devices in ASEAN is driven by a combination of increasing demand for healthcare services, advancements in logistics technology, and the growth of healthcare e-commerce. As a result, the ASEAN domestic courier market is expected to grow positively during the forecast period.

Malaysia's courier services soar with e-commerce, expected 14.44% CAGR in domestic CEP by 2027

- The flourishing e-commerce segment in Malaysia has driven significant growth in the local courier services industry, resulting in intense competition among more than 100 service providers operating in the market. As e-commerce user penetration is projected to reach 55% by 2027, the volume of domestic CEP services is also expected to register a CAGR of 14.44% from 2023 to 2027. Consequently, it is anticipated that there will be a substantial increase in the number of courier licenses issued and a rise in the number of domestic CEP service providers to meet the growing demand.

- The domestic CEP segment has experienced significant growth primarily driven by e-commerce. In 2020, the e-commerce segment saw a YoY increase of 57.76%, reaching USD 35.34 billion, mainly due to remote working and government-imposed social distancing regulations. This trend of online buying remained strong in 2021, with the e-commerce industry growing by 58.43% YoY and reaching USD 55.99 billion. The strong growth in the e-commerce industry is expected to continue during the forecast period and reach USD 88.54 billion by 2025.

ASEAN Domestic Courier Market Trends

Rising FDI in ASEAN countries supported by infrastructure construction projects by country governments driving economic growth

- In May 2024, the Japanese government announced a loan of about JPY140.7 billion (USD 900 million) to build a high-speed rail line in Jakarta, Indonesia. The East-West rail project will cover 84.1 km and be completed in two phases, starting in 2026 and finishing by 2031. The new rail line will feature Japanese technology for trains and signaling systems. Such initiatives are expected to boost GDP contribution from transport and storage sector.

- In February 2024, the Transport Ministry announced plans to invest USD 18.83 billion in around 150 transport projects by the end of 2025 to enhance Thailand's infrastructure. In 2024, 64 projects will commence, with an additional 31 projects valued at USD 11.23 billion in the pipeline. For 2025, there are 57 new projects planned, totaling USD 7.59 billion. These initiatives include 18 motorway projects, 9 railway projects, and plans for regional port development, all aimed at bolstering the transport and storage sector's contribution to GDP in the future.

Impact of the Iran-Israel conflict and Ukraine-Russia war on ASEAN countries led to increased fuel prices and supply chain disruptions

- Indonesia expects a 29% increase in oil and gas sector investments in 2024 to boost drilling and exploration after Shell and Chevron's recent exits. This push is vital for Indonesia to counter a long-term decline in output amid rising financing challenges for fossil fuel projects. Foreign companies like Eni, Exxon Mobil, and BP will contribute 40% of 2024's planned investments. Also, in early 2024, the Ministry of Oil and Gas announced that fuel prices at gas stations will stay stable until at least June 2024, despite the Iran-Israel conflict potentially raising oil prices to USD 100 per barrel.

- Diesel prices in Malaysia surged by over 50% in June 2024 as part of Prime Minister Anwar Ibrahim's efforts to reform the country's long-standing fuel subsidy system. The restructuring aimed to alleviate pressure on national finances by eliminating universal energy subsidies and focusing assistance on those most in need. This move also aims to address issues like the smuggling of subsidized diesel to neighboring countries, where it fetches higher prices.

ASEAN Domestic Courier Industry Overview

The ASEAN Domestic Courier Market is moderately consolidated, with the major five players in this market being DHL Group, J&T Express, Ninja Van, POS Malaysia Bhd and SF Express (KEX-SF) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001610

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Indonesia

- 4.12.2 Malaysia

- 4.12.3 Philippines

- 4.12.4 Thailand

- 4.12.5 Vietnam

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Speed Of Delivery

- 5.1.1 Express

- 5.1.2 Non-Express

- 5.2 Shipment Weight

- 5.2.1 Heavy Weight Shipments

- 5.2.2 Light Weight Shipments

- 5.2.3 Medium Weight Shipments

- 5.3 End User Industry

- 5.3.1 E-Commerce

- 5.3.2 Financial Services (BFSI)

- 5.3.3 Healthcare

- 5.3.4 Manufacturing

- 5.3.5 Primary Industry

- 5.3.6 Wholesale and Retail Trade (Offline)

- 5.3.7 Others

- 5.4 Model

- 5.4.1 Business-to-Business (B2B)

- 5.4.2 Business-to-Consumer (B2C)

- 5.4.3 Consumer-to-Consumer (C2C)

- 5.5 Country

- 5.5.1 Indonesia

- 5.5.2 Malaysia

- 5.5.3 Philippines

- 5.5.4 Thailand

- 5.5.5 Vietnam

- 5.5.6 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BEST Inc.

- 6.4.2 City-Link Express

- 6.4.3 CJ Logistics Corporation

- 6.4.4 DHL Group

- 6.4.5 FedEx

- 6.4.6 J&T Express

- 6.4.7 JWD Group

- 6.4.8 Ninja Van

- 6.4.9 POS Malaysia Bhd

- 6.4.10 PT Pos Indonesia (Persero)

- 6.4.11 SF Express (KEX-SF)

- 6.4.12 SkyNet Worldwide Express

- 6.4.13 Thailand Post

- 6.4.14 United Parcel Service of America, Inc. (UPS)

- 6.4.15 Vietnam Posts and Telecommunications Group (including Vietnam Post Corporation)

- 6.4.16 ViettelPost

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.