PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852165

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852165

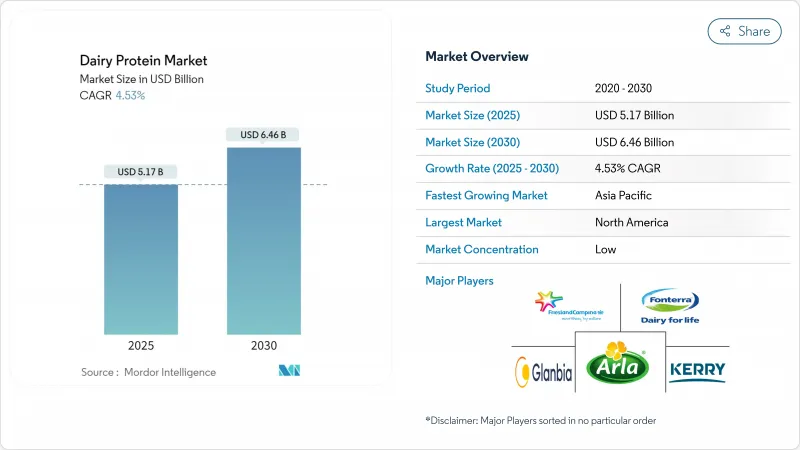

Dairy Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The dairy proteins market size is valued at USD 5.17 billion in 2025 and projected to reach USD 6.46 billion by 2030, growing at a CAGR of 4.53%.

The market growth is primarily driven by increasing consumer preference for high-protein diets to support weight management and muscle development, rising adoption of functional nutrition for overall health benefits, and expanding applications in ready-to-drink (RTD) beverages across various consumer segments. Advancements in membrane filtration and precision fermentation technologies have improved production yields, enhanced protein quality, and enabled new applications in food and beverage formulations. Consumer demand for clean-label products has increased interest in organic and minimally processed options, particularly among health-conscious consumers and those with dietary preferences. Despite milk price fluctuations and supply chain challenges, manufacturers continue to expand production capacity to meet growing global demand. The market is becoming more competitive as major cooperatives consolidate through mergers to achieve economies of scale, while ingredient manufacturers focus on specialized products like lactoferrin and hydrolyzed whey isolates to capture premium market segments. These developments create new opportunities in sports nutrition for athletes and fitness enthusiasts, early-life nutrition for infant formula manufacturers, and clinical nutrition segments for medical food producers.

Global Dairy Protein Market Trends and Insights

Rising Demand for High-Protein Diets

According to the IFIC Food and Health Survey 2024, 71% of consumers actively monitor their protein intake, marking an increase from 69% in 2023. Nearly half of consumers are increasing their protein consumption in the evening across all demographic groups, including young adults, middle-aged individuals, and seniors. This trend is particularly strong among health-conscious consumers aged 25-45. Millennials and Generation Z drive the growth in protein-fortified product launches, expanding the market beyond traditional sports nutrition consumers to everyday dietary supplementation. The demand spans across breakfast items, ready-to-drink beverages, and meal replacement options. Dairy proteins maintain premium pricing due to their complete amino acid profile, which includes essential amino acids like leucine, isoleucine, and valine, compared to plant-based alternatives. The increasing availability of protein-enriched snacks, desserts, beverages, and convenience foods indicates broader market acceptance of protein fortification in multiple food categories. This diversification includes protein-fortified yogurt, cheese snacks, milk-based drinks, and ice cream alternatives, supporting the dairy proteins market growth through 2030.

Growth in Sports Nutrition and Functional Foods

Dairy proteins maintain a strong presence in sports nutrition, primarily due to whey's quick absorption and casein's gradual release properties. The consumer base has expanded beyond traditional athletes to include women and young adults seeking cognitive enhancement benefits, which has led to innovations such as citicoline incorporation in protein supplements and functional beverages. The growth in sports participation, including recreational activities, competitive sports, and fitness training, contributes to market expansion. The World Health Organization's 2024 report indicates that 69% of the global population maintains an active lifestyle through regular exercise and physical activities, while 31% remains physically inactive. This presents substantial growth opportunities in the active lifestyle segment, where athletes and bodybuilders continue to prefer casein protein for its muscle recovery and maintenance properties. The functional hydration segment shows particular promise, as dairy proteins' natural electrolyte content, including essential minerals like potassium, calcium, and magnesium, offers performance benefits. The trend toward personalized nutrition creates opportunities for specialized dairy protein formulations that target specific performance goals, such as endurance enhancement, muscle building, and recovery optimization, while accommodating various dietary needs and restrictions.

Lactose Intolerance and Dairy Allergies

Lactose intolerance affects a significant portion of the global population, with prevalence rates exceeding 90% in certain Asian regions, limiting the adoption of conventional dairy proteins. This condition restricts digestive capabilities and nutrient absorption, constraining consumer options in the protein beverage market. However, advancements in lactose-free processing and protein isolation techniques are overcoming these challenges. Modern filtration systems and enzymatic treatments now enable manufacturers to produce lactose-free dairy proteins while retaining their nutritional value. The FDA's guidelines on plant-based labeling establish clear nutritional distinctions, highlighting dairy options that demonstrate high bioavailability. Companies such as Imagindairy are developing fermentation-based dairy proteins that eliminate both lactose and allergenicity issues. These precision fermentation methods produce proteins identical to dairy without lactose, addressing both intolerance and allergic reaction concerns that have historically restricted market expansion. The implementation of these processing technologies has improved product accessibility while preserving dairy proteins' functional and nutritional properties.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Application in Infant and Early-Life Nutrition

- Increased Popularity in High-Protein RTD Beverages

- Rising Demand for Plant-Based Proteins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Whey protein held a dominant 49.26% share of the dairy proteins market in 2024. This position stems from its extensive use in sports nutrition powders, ready-to-drink protein shakes, and bakery products. The protein's complete amino acid profile, quick absorption rate, and functional properties make it essential across these applications. Casein and caseinates maintain steady demand in sustained-release nutrition products and medical nutrition formulations. Hydrolyzed protein variants are gaining market acceptance due to their improved digestibility and lower allergenicity.

The milk protein segment is expected to grow at a 5.52% CAGR through 2030, supported by processing innovations, particularly in ultrafiltration technology that maintains native micellar structures. These developments enhance protein functionality in ultra-high temperature (UHT) beverages and high-protein yogurt formulations. The commercial production of precision-fermented whey proteins signals a potential market shift while strengthening overall ingredient demand. Technological progress enables market premiumization through specialized ingredients, allowing manufacturers to create targeted solutions for infant formulas, clinical nutrition products, and protein-enriched ice creams. Ingredient manufacturers are prioritizing supply chain traceability and sustainability certifications, creating product differentiation opportunities and supporting market value growth.

Conventional proteins account for 92.5% of the dairy proteins market in 2024, supported by established supply chains, efficient processing methods, and economies of scale. The growing consumer focus on artificial additives, antibiotic usage, and intensive farming methods drives organic dairy protein demand at an 8% CAGR. The clean-label cheese segment demonstrates the market's commercial viability through increased shelf presence and consumer acceptance. While organic production involves higher feed costs, rigorous certification processes, and specialized handling requirements, manufacturers offset these expenses through premium pricing strategies and enhanced consumer trust in product quality.

The organic segment shows significant uptake in infant formula, where parents prioritize stringent quality standards and natural ingredients, and in sports nutrition, where consumers seek products without synthetic additives and preservatives. Clear regulations in key markets and sustained investments in organic dairy farming infrastructure increase the availability of certified milk supplies. Though production capacity remains limited outside developed countries due to certification challenges and infrastructure gaps, organic suppliers establish market positions through targeted brand development, transparent sourcing practices, and expanded e-commerce distribution channels.

The Dairy Proteins Market Report is Segmented by Ingredient (Milk, Whey, Casein and Caseinates), Nature (Conventional, Organic), Source (Cow, Buffalo, Goat and Sheep), Application (Food and Beverage, Sports and Performance Nutrition, Infant and Early-Life Nutrition, and More), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintains a commanding 33% share of the global dairy proteins market in 2024, supported by a well-established sports nutrition ecosystem and comprehensive retail education programs about protein quality. The region's market strength stems from widespread consumer awareness, advanced distribution networks, and continuous product innovation. In August 2024, Kenvue expanded its product portfolio by launching Neutrogena(R) Collagen Bank(TM) with micro-peptide technology, entering the pre-aging category to target Gen Z consumers seeking preventive skincare solutions. The FDA's qualified health claim connecting yogurt consumption to reduced type 2 diabetes risk further strengthens the market position and encourages premium dairy product development.

Asia-Pacific demonstrates remarkable growth potential with an 8.5% CAGR through 2030, driven by increasing urbanization, changing dietary preferences, and growing adoption of high-protein foods and flavored cheeses. The expanding middle class, rising disposable incomes, and proliferation of e-commerce platforms create robust market opportunities. The region's growth is further supported by improving cold chain infrastructure and increasing awareness of protein-rich diets.

Europe's dairy protein market faces challenges as milk production is projected to reach 149.4 million tons in 2025, influenced by stringent environmental regulations and ongoing disease-related challenges, according to USDA data.The significant EUR 19 billion Arla-DMK merger in April 2025 represents industry consolidation, combining procurement capabilities and research facilities to enhance operational efficiency. European consumers' strong emphasis on sustainability and product quality drives increased demand for precision-fermented and low-carbon dairy proteins, reflecting the region's commitment to environmental responsibility.

- Fonterra Co-operative Group Ltd

- Royal FrieslandCampina N.V.

- Arla Foods amba

- Glanbia PLC

- Kerry Group PLC

- Groupe Lactalis S.A.

- Saputo Inc.

- Agropur Co-operative

- Hilmar Cheese Company, Inc.

- Leprino Foods Company

- DMK Group

- Carbery Group Limited

- Morinaga Milk Industry Co., Ltd

- Prolactal GmbH

- Actus Nutrition

- Ingredia SA

- Tatua Co-operative Dairy Co. Ltd.

- Theo Muller Group

- Hoogwegt International B.V.

- Savencia Fromage & Dairy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for High-Protein Diets

- 4.2.2 Growth in Sports Nutrition and Functional Foods

- 4.2.3 Increasing Application in Infant and Elderly Nutrition

- 4.2.4 Increased Popularity and Usage in High Protein of Ready-to-Drink (RTD) Beverages

- 4.2.5 Technological Innovations in Dairy Processing

- 4.2.6 Increasing Demand for Clean Label and Natural Protein Sources

- 4.3 Market Restraints

- 4.3.1 Lactose Intolerance and Dairy Allergies

- 4.3.2 Rising Demand for Plant-Based Proteins

- 4.3.3 Price Volatility of Raw Milk

- 4.3.4 Environmental and Sustainability Concerns

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Ingredient

- 5.1.1 Milk

- 5.1.1.1 Isolate

- 5.1.1.2 Concentrates

- 5.1.1.3 Hydrolyzed

- 5.1.2 Whey

- 5.1.2.1 Concentrates

- 5.1.2.2 Isolates

- 5.1.2.3 Hydrolyzed

- 5.1.3 Casein and Caseinates

- 5.1.1 Milk

- 5.2 By Nature

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By Source

- 5.3.1 Cow

- 5.3.2 Buffalo

- 5.3.3 Goat and Sheep

- 5.4 By Application

- 5.4.1 Food and Beverage

- 5.4.1.1 Bakery and Confectionery

- 5.4.1.2 Dairy Products and Desserts

- 5.4.1.3 Beverages

- 5.4.2 Sports and Performance Nutrition

- 5.4.3 Infant and Early-Life Nutrition

- 5.4.4 Elderly Nutrition and Medical Nutrition

- 5.4.5 Other Applications

- 5.4.1 Food and Beverage

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Russia

- 5.5.2.8 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Argentina

- 5.5.4.2 Brazil

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Fonterra Co-operative Group Ltd

- 6.4.2 Royal FrieslandCampina N.V.

- 6.4.3 Arla Foods amba

- 6.4.4 Glanbia PLC

- 6.4.5 Kerry Group PLC

- 6.4.6 Groupe Lactalis S.A.

- 6.4.7 Saputo Inc.

- 6.4.8 Agropur Co-operative

- 6.4.9 Hilmar Cheese Company, Inc.

- 6.4.10 Leprino Foods Company

- 6.4.11 DMK Group

- 6.4.12 Carbery Group Limited

- 6.4.13 Morinaga Milk Industry Co., Ltd

- 6.4.14 Prolactal GmbH

- 6.4.15 Actus Nutrition

- 6.4.16 Ingredia SA

- 6.4.17 Tatua Co-operative Dairy Co. Ltd.

- 6.4.18 Theo Muller Group

- 6.4.19 Hoogwegt International B.V.

- 6.4.20 Savencia Fromage & Dairy

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK