PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686633

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686633

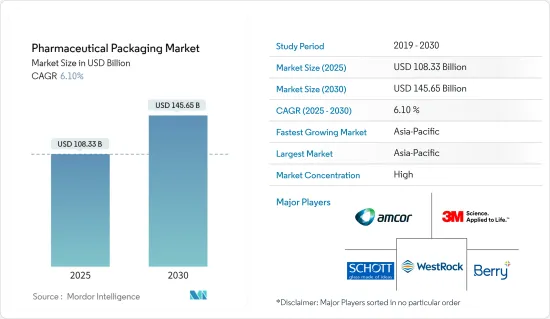

Pharmaceutical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Pharmaceutical Packaging Market size is estimated at USD 108.33 billion in 2025, and is expected to reach USD 145.65 billion by 2030, at a CAGR of 6.1% during the forecast period (2025-2030).

Regulatory Landscape Shapes Packaging Innovation:

The pharmaceutical packaging market is experiencing significant growth driven by stringent regulatory standards and anti-counterfeit measures. Governments worldwide are implementing strict regulations to ensure product safety and combat counterfeit drugs. The European Union's Directive mandates serialization numbers on all pharmaceutical products, while similar regulations exist in the United States, China, India, and Turkey. These measures are propelling the adoption of advanced packaging solutions.

Key Highlights

- FDA Guidelines: The FDA has established guidelines for child-resistant packaging and tamper-resistant packaging for OTC products.

- Authentication Technologies: Pharmaceutical companies are investing in authentication technologies like holograms and hidden batch numbers.

- Serialization Methods: Serialization methods include linear barcodes, two-dimensional barcodes, and radio frequency identification (RFID).

- Smart Packaging: Smart packaging with RFID and NFC tags is gaining traction for product tracking and patient engagement.

Nanotechnology Revolutionizes Packaging Solutions:

The impact of nanotechnology on pharmaceutical packaging is transforming the industry with innovative and new-generation solutions. These advancements not only combat counterfeiting but also enhance product safety and traceability throughout the supply chain.

Key Highlights

- Tracking Capability: Nanotechnology enables the creation of smart packaging that can track products from manufacturing to end-user.

- Smart Packaging Development: Companies like Schott AG are developing smart packaging containment solutions for clear container-based traceability.

- Product Launches: ENTOD Pharmaceuticals launched a nanotechnology-based ocular aesthetic range in India, showcasing the versatility of nano-packaging.

- Biomedicine Applications: Nanoparticles are being utilized in biomedicine for disease detection, prevention, and drug delivery.

Market Drivers and Growth Trends:

The pharmaceutical packaging market is witnessing robust growth, fueled by several key drivers. The expansion of the pharmaceutical industry in emerging economies, coupled with increasing healthcare spending, is propelling market growth.

Key Highlights

- Plastics Segment: The plastics segment is expected to reach USD 54.45 billion by 2028, growing at a CAGR of 6.17%.

- Bottles Segment: The bottles segment was valued at USD 18.24 billion in 2022 and is projected to reach USD 27.30 billion by 2028.

- FDI Growth: Emerging economies like India are experiencing significant growth, with a 200% increase in FDI in the pharmaceutical industry in 2020-2021.

- Asia-Pacific Growth: The Asia-Pacific region is expected to grow at a CAGR of 6.99% from 2023 to 2028, reaching USD 54.59 billion by 2028.

Competitive Landscape and Key Players:

The pharmaceutical packaging market is fragmented, with several major players dominating the industry. These companies are focusing on innovation, sustainability, and strategic expansions to maintain their market positions.

Key Highlights

- Amcor PLC: Established in 1860, Amcor offers a wide range of packaging solutions, including oral dose formats and medical device packaging.

- Schott AG: Founded in 1853, Schott specializes in pharmaceutical tubing and drug containment solutions.

- Berry Global Group: Established in 1967, Berry Global provides medical packaging, bottles, and vials.

- Gerresheimer AG: Gerresheimer AG announced a USD 94 million investment in a US production facility to increase its vial production capacity.

Sustainability and Future Trends:

The pharmaceutical packaging industry is increasingly focusing on sustainability and eco-friendly solutions. This trend is driven by both regulatory pressures and consumer demand for more environmentally responsible packaging.

Key Highlights

- GSK's Initiative: GlaxoSmithKline Consumer Healthcare joined the Pulpex paper bottle partner consortium to explore recyclable paper bottles.

- Bioplastics Investment: Companies are investing in bioplastics and other biodegradable materials as alternatives to traditional plastics.

- Advanced Printing Technologies: Advanced printing technologies, such as Essentra Packaging's Landa S10 Nanographic Printing Machine, are enhancing packaging capabilities.

- 3-D Visualization: The adoption of 3-D visualization and printing strategies is pushing the boundaries of both primary and secondary packaging design.

Pharmaceutical Packaging Market Trends

Plastics Segment Dominates Material Category

The Plastics segment emerges as the largest material category in the Pharmaceutical Packaging Market. In 2022, this segment accounted for 41.84% of the market share, valued at USD 38.03 billion. The segment is projected to reach USD 54.15 billion by 2028, growing at a CAGR of 6.17% during the forecast period. This growth is driven by several factors, including the segment's versatility, cost-effectiveness, and ongoing innovations in plastic packaging solutions.

- Market Share: Plastics accounted for 41.84% of the pharmaceutical packaging market in 2022.

- Cost-Effectiveness: The affordability of plastics makes it a popular choice in pharmaceutical packaging.

- Innovative Solutions: Companies are introducing biodegradable and recyclable plastic solutions to meet sustainability standards.

- Future Growth: The segment is projected to reach USD 54.15 billion by 2028.

- Regulatory Standards Drive Plastic Packaging Innovation: Stringent regulatory standards and norms against counterfeit products are propelling advancements in plastic pharmaceutical packaging. Companies are developing innovative solutions to meet these requirements. For instance, Bormioli Pharma launched EcoPositive in May 2022, a label for sustainable packaging offerings, including recycled plastics, bio-based, biodegradable, and compostable plastic solutions. This initiative demonstrates the industry's response to regulatory pressures and the growing demand for sustainable packaging options.

- EcoPositive Initiative: Bormioli Pharma's EcoPositive showcases sustainable packaging options, including bio-based and compostable plastics.

- Counterfeit Prevention: Anti-counterfeit measures in plastic packaging are becoming increasingly sophisticated to meet global standards.

- Regulatory Pressure: The rise of global regulatory standards is shaping the pharmaceutical plastic packaging segment.

- Sustainability Efforts: Increased investment in biodegradable plastic solutions aligns with environmental regulations.

- Nanotechnology Impacts Plastic Packaging Development: The impact of nanotechnology is driving the development of new-generation packaging solutions in the plastics segment. This technological advancement is enabling the creation of packaging materials with enhanced properties, such as improved barrier functions and antimicrobial capabilities. The integration of nanotechnology in plastic pharmaceutical packaging is expected to contribute significantly to the segment's growth and market dominance in the coming years.

- Barrier Functions: Nanotechnology enables the creation of enhanced barrier properties in plastic pharmaceutical packaging.

- Antimicrobial Solutions: Companies are integrating antimicrobial nanotechnology to improve the safety and longevity of packaging.

- Enhanced Properties: Nanotech innovations are being used to make plastic packaging smarter and more efficient.

- Future Prospects: The integration of nanotechnology is set to propel growth in the plastic packaging sector.

Asia-Pacific to Occupy Major Share

The Asia-Pacific region stands out as the fastest-growing segment in the Pharmaceutical Packaging Market. In 2022, this region held a 40.12% market share, valued at USD 36.60 billion. The market is projected to reach USD 54.59 billion by 2028, exhibiting a robust CAGR of 6.99% during the forecast period. This growth rate outpaces other regions, positioning Asia-Pacific as a key driver of the global pharmaceutical packaging market.

- Market Share: Asia-Pacific holds 40.12% of the global pharmaceutical packaging market.

- Growth Rate: The region is expected to grow at a CAGR of 6.99% from 2023 to 2028.

- Regional Dominance: China and India lead the pharmaceutical packaging market in Asia-Pacific.

- Emerging Trends: The region's rapid growth is driven by increasing demand for innovative and sustainable packaging.

Pharmaceutical Packaging Industry Overview

Global Players Dominate Consolidated Market:

The pharmaceutical packaging market is characterized by the dominance of global players with diverse product portfolios. Companies like Amcor PLC, Schott AG, and Berry Global Group Inc. lead the market, offering a wide range of packaging solutions from bottles and vials to blister packs and syringes. The market structure appears fairly consolidated, with these major players holding significant market share due to their extensive product lines, global presence, and technological capabilities.

Amcor PLC: A global leader in pharmaceutical packaging, with solutions ranging from blister packs to child-resistant bottles.

Schott AG: Specializes in glass-based packaging and pharmaceutical tubing, driving innovation in containment solutions.

Berry Global Group Inc.: Offers extensive plastic packaging solutions, from bottles to prefillable syringes, and is expanding in emerging markets.

Consolidated Market: The market is dominated by large companies with significant technological expertise and product diversity.

Innovation and Sustainability Drive Market Leadership:

Market leaders are distinguished by their focus on innovation and sustainability. Amcor PLC, for instance, introduced the AmFiber family of paper-based products and the PVC-free AmSky blister system for healthcare applications in FY22. Berry Global Group launched a complete bundle solution for child-resistant and tamper-evident syrup and liquid medicine packaging. These companies are also investing heavily in sustainable packaging solutions, with Amcor targeting 30% recycled material across its portfolio by 2030. Their market leadership is further solidified by strategic expansions, such as Berry Global's new manufacturing facility in Bangalore, India, enhancing regional and global access to advanced healthcare solutions.

Sustainability Focus: Companies are prioritizing recyclable and eco-friendly materials to meet sustainability goals.

Innovative Solutions: PVC-free blister packs and child-resistant bottles are gaining traction as safer, sustainable alternatives.

Strategic Expansions: New facilities in emerging markets enable global players to tap into regional demand and grow market share.

R&D Investment: Leading companies invest in R&D to drive sustainable innovation in pharmaceutical packaging.

Factors for Future Success in the Market:

For market players to succeed and grow their market share, several key factors emerge. Firstly, investment in research and development is crucial, as exemplified by Amcor's introduction of innovative products. Secondly, expanding manufacturing capabilities in emerging markets, like Berry Global's new facility in India, is essential for tapping into growing demand. Thirdly, a focus on sustainability is becoming increasingly important, with companies like Klockner Pentaplast introducing recyclable PET blister films. Lastly, strategic acquisitions and partnerships, such as Aptar Pharma's acquisition of Metaphase Design Group, can enhance product offerings and service capabilities. These strategies will be critical for companies looking to strengthen their position or disrupt the market in the coming years.

R&D Investment: Companies must continue to innovate to stay competitive in a rapidly evolving industry.

Emerging Markets: Expansion in high-growth regions like Asia-Pacific is crucial for future market success.

Sustainability Mandate: Companies must address environmental concerns by prioritizing recyclable and biodegradable materials.

Strategic Acquisitions: Acquisitions and partnerships will help expand product offerings and accelerate innovation in pharmaceutical packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 Assessment of Impact of the COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Regulatory Standards on Packaging and Stringent Norms Against Counterfeit Products

- 5.1.2 Impact of Nanotechnology due to Innovative and New- generation Packaging Solutions

- 5.1.3 Regulatory Landscape Shapes Packaging Innovation

- 5.2 Market Challenges

- 5.2.1 Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastics

- 6.1.2 Glass

- 6.1.3 Other Materials

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Syringes

- 6.2.3 Vials and Ampoules

- 6.2.4 Tubes

- 6.2.5 Caps and Closures

- 6.2.6 Labels

- 6.2.7 Other Product Types

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 3M Company

- 7.1.3 Schott AG

- 7.1.4 WestRock Company

- 7.1.5 Berry Global Group Inc.

- 7.1.6 McKesson Corporation

- 7.1.7 AptarGroup Inc.

- 7.1.8 Klockner Pentaplast Group

- 7.1.9 CCL Industries Inc.

- 7.1.10 FlexiTuff International Ltd

- 7.1.11 Gerresheimer AG

- 7.1.12 West Pharmaceutical Services Inc.

- 7.1.13 Becton, Dickinson and Company

- 7.1.14 Vetter Pharma International GmbH

- 7.1.15 Catalent Inc.

- 7.1.16 W. L. Gore & Associates Inc.

- 7.1.17 Nipro Corporation

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS