PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851444

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851444

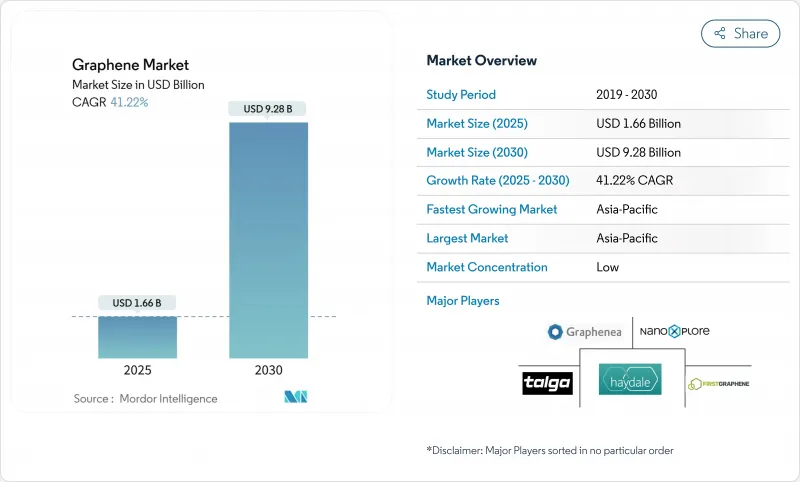

Graphene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The graphene market size is estimated at USD 1.66 billion in 2025 and is expected to reach USD 9.28 billion by 2030, expanding at a 41.22% CAGR between 2025-2030.

This steep ascent signals that commercial-scale production hurdles are receding, moving graphene decisively from the laboratory into mainstream industrial supply chains. Increased process yields, falling unit costs, and closer integration with downstream users now underpin sustained demand from high-growth niches such as batteries, aerospace composites, and biomedical devices. Asia-Pacific remains the centre of gravity: the region held 46% of 2024 revenue and is growing at a 44.69% CAGR thanks to dense electronics clusters, active government funding, and tight coupling between material producers and end-product manufacturers. Fragmentation is increasing as companies carve out vertical positions around specialty uses; intellectual-property control over graphene-enhanced battery chemistries, for example, is already a decisive competitive lever.

Global Graphene Market Trends and Insights

Graphene Aiding the Aerospace Industry

Lightweighting remains a core airline objective, and graphene-reinforced carbon-fiber polymers are yielding 20-30% mass reductions versus legacy composites while maintaining or improving mechanical performance. Embedded graphene sensor meshes also deliver real-time structural-health data, enabling predictive maintenance cycles and lowering unplanned downtime. Commercial aircraft programs in North America and Europe first integrate such multifunctional structures into secondary parts, radomes, fairings, and interior panels, before scaling to primary load-bearing components. Regulatory pathways are shortening as early-service data accumulate, accelerating supplier qualification for Asia-Pacific airframe builders. With jet-fuel savings translating directly into lower emissions fees under tightening carbon-pricing regimes, airlines are incentivised to secure long-term graphene composite supply agreements, reinforcing demand visibility for material producers.

Adoption of Graphene Anti-corrosion Coatings in the Middle-East Desalination Infrastructure

Gulf Cooperation Council utilities operate in extreme salinity and high-temperature environments that corrode steel piping and pressure vessels. Graphene-laden barrier layers impede ion ingress, extending asset life by 15-20 years and cutting maintenance budgets by up to 30%. Because graphene oxide coatings simultaneously raise membrane water flux 80-90%, operators gain higher throughput per installed capacity, which offsets energy expenses, crucial where desalination already accounts for a material share of national electricity demand. As regional capacity is projected to double by 2030, tender specifications increasingly mandate graphene protection for new-build plants, stimulating local formulators to license technology from established providers.

High Production Cost

Chemical-vapor-deposition (CVD) delivers the purity required for advanced electronics, yet its vacuum chambers and temperature control systems drive operating expenditure that limits adoption to premium-priced applications. Material researchers report batch-to-batch variability that complicates downstream quality control, deterring risk-averse customers. Alternative electrolysis routes in molten salts could cut costs by up to 90% without sacrificing crystalline order, though commercialisation remains in early trials. Until scale efficiencies arrive, many mass-market products will continue to rely on cheaper filler materials, capping graphene volumes.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Energy-Storage Applications

- Growing Demand in Electronics and Semiconductors

- Availability of Substitutes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Graphene nanoplatelets captured 57% of 2024 sales and are on track for a 47.63% CAGR to 2030, cementing their status as the workhorse of the graphene market. Their thin but wide morphology disperses easily in polymers, metals, and asphalt, delivering strength and barrier gains at low loadings. Volume growth is lowering unit prices, which further reinforces demand momentum. Avadain's proprietary large-thin-defect-free flake process, licensed to a chemical partner for mid-2025 production, is expected to widen supply and support aerospace and battery developers seeking predictable performance batches.

Sheets and films, and graphene oxide (GO) each trail nanoplatelets but fill essential niches. GO's hydrophilicity suits biomedical hydrogels that accelerate chronic-wound healing, as shown in double-cross-linked dressings that respond to elevated glucose levels. CVD-grown multilayer films, though costlier, unlock quantum transport phenomena valuable for high-speed transistors and next-generation sensors. Demand for three-dimensional foams is also rising where electromagnetic shielding and thermal interface performance are critical; hybrid graphene-foam elastomers have exhibited around 75 dB attenuation across microwave bands.

The Graphene Market Report Segments the Industry by Product Type (Graphene Sheets and Films, Graphene Nanoplatelets (GNP), Graphene Oxide (GO), Nanoplatelets, and Others), Application (Composites, Energy Storage and Harvesting, and More), End-User Industry (Electronics and Telecommunication, Aerospace and Defense, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific dominates the graphene market with 46% revenue in 2024 and the fastest 44.69% CAGR outlook. China's upstream leadership in graphite feedstock and downstream battery assembly grants ecosystem advantages; state grants have underwritten multi-tonne GO expansion lines that feed domestic energy-storage integrators. South Korean groups are diversifying graphite supply from Africa while scaling silicon-rich anode capacity, which indirectly elevates graphene usage for conductivity additives.

North America is pursuing supply-chain resilience. A USD 20 million retrofit of a lithium-metal facility in California will start 200 MWh of graphene-enhanced lithium-sulfur cell output in late 2025, with a 10 GWh Nevada gigafactory planned for 2027. Federal procurement guidelines prioritising domestic content for defense electronics further incentivise local wafer-scale CVD capacity builds.

Europe benefits from deep academic expertise clustered around Manchester, Cambridge and Aachen. Breakthroughs such as 100% room-temperature magnetoresistance in standard magnetic fields illustrate the region's basic-science prowess.

- ACS Material

- Cabot Corporation

- Directa Plus S.p.A.

- First Graphene Ltd

- G6 Materials Corp.

- Global Graphene Group

- Grafoid Inc

- Graphene Manufacturing Group Ltd

- Graphenea

- Haydale Graphene Industries plc

- NanoXplore Inc.

- Perpetuus Advanced Materials

- Talga Group

- The Sixth Element (Changzhou) Materials Technology Co.,Ltd

- Thomas Swan & Co. Ltd

- Universal Matter Inc

- Versarien plc

- Vorbeck Materials Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Graphene Aiding the Aerospace Industry

- 4.2.2 Adoption of Graphene Anti-corrosion Coatings in Middle-East Desalination Infrastructure

- 4.2.3 Expansion of Energy Storage Applications

- 4.2.4 Growing Demand in Electronics and Semiconductors

- 4.2.5 Commercialization of Graphene EMI-shielding Foams for European 5G Infrastructure

- 4.3 Market Restraints

- 4.3.1 High Production Cost

- 4.3.2 Avalability of Substitutes

- 4.3.3 High capex needs for large-area CVD graphene production lines

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Graphene Sheets and Films

- 5.1.2 Graphene Nanoplatelets (GNP)

- 5.1.3 Graphene Oxide (GO)

- 5.1.4 Nanoplatelets

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Composites

- 5.2.2 Energy Storage and Harvesting

- 5.2.3 Printed and Flexible Electronics

- 5.2.4 Biomedical and Healthcare

- 5.2.5 Coatings and Paints

- 5.2.6 Others

- 5.3 By End-user Industry

- 5.3.1 Electronics and Telecommunications

- 5.3.2 Aerospace and Defense

- 5.3.3 Energy and Power

- 5.3.4 Biomedical and Healthcare

- 5.3.5 Others (Automotive, Chemical, and Coatings)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 South Korea

- 5.4.1.4 India

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Turkey

- 5.4.5.4 South Africa

- 5.4.5.5 Egypt

- 5.4.5.6 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ACS Material

- 6.4.2 Cabot Corporation

- 6.4.3 Directa Plus S.p.A.

- 6.4.4 First Graphene Ltd

- 6.4.5 G6 Materials Corp.

- 6.4.6 Global Graphene Group

- 6.4.7 Grafoid Inc

- 6.4.8 Graphene Manufacturing Group Ltd

- 6.4.9 Graphenea

- 6.4.10 Haydale Graphene Industries plc

- 6.4.11 NanoXplore Inc.

- 6.4.12 Perpetuus Advanced Materials

- 6.4.13 Talga Group

- 6.4.14 The Sixth Element (Changzhou) Materials Technology Co.,Ltd

- 6.4.15 Thomas Swan & Co. Ltd

- 6.4.16 Universal Matter Inc

- 6.4.17 Versarien plc

- 6.4.18 Vorbeck Materials Corp.

7 Market Opportunities and Future Outlook

- 7.1 Development of Graphene Nanodevices for DNA Sequencing

- 7.2 Adoption of Graphene into Photodetectors

- 7.3 White-space and Unmet-need Assessment