Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1684103

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1684103

Indonesia Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 271 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

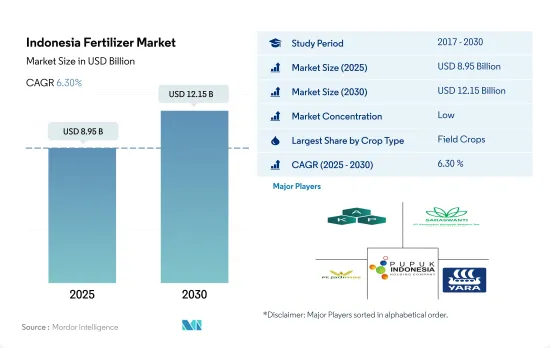

The Indonesia Fertilizer Market size is estimated at 8.95 billion USD in 2025, and is expected to reach 12.15 billion USD by 2030, growing at a CAGR of 6.30% during the forecast period (2025-2030).

Field crops dominate the consumption of fertilizers in the country

- In 2022, field crops dominated the fertilizer market in Indonesia, representing 92.3% of the market's value, which amounted to USD 3.93 billion. Notably, rice is the primary field crop in the country, with Indonesia ranking as the world's third-largest rice producer, trailing only China and India. Key regions for rice cultivation in Indonesia include South Sumatra, West Java, Central Java, East Java, and South Sulawesi.

- Conventional fertilizers held the highest share in the field crop segment, accounting for 76.0% in 2022, while specialty fertilizers made up the remaining 24.0%. Within the specialty fertilizers category, the conventional segment is projected to record a CAGR of 6.1% between 2023 and 2030.

- Horticultural crops constituted 9.3% of Indonesia's fertilizer market in 2022. Given the importance of fruits and vegetables in a balanced diet, it is worth noting that in 2016, Indonesians consumed only 43% of the recommended intake. Furthermore, over the past five years, this consumption has declined, falling below half of the recommended levels. On average, Indonesians consumed 173 grams of fruits and vegetables per day, significantly lower than the recommended 400 grams, indicating potential for growth in this segment.

- In 2022, turf and ornamental crops made up less than 1.0% of Indonesia's fertilizer market, primarily due to their limited cultivation area, accounting for a mere 0.03% of the country's total crop area.

- The turf and ornamental fertilizer market in Indonesia is witnessing an upward trajectory, driven by rising demand, particularly from sports stadiums like football fields. This segment is projected to witness a CAGR of 6.2% between 2023 and 2030.

Indonesia Fertilizer Market Trends

Indonesia is aiming for the self-sufficiency driving the area under cultivation

- In Indonesia, field crops accounted for 89.9% of the total cultivated area in 2022. Rice, corn, cassava, soybeans, and peanuts are major field crops grown in Indonesia. In 2022, rice accounted for 56.7% of the total area under field crops. Rice is cultivated in both lowland and upland elevations throughout Indonesia, with the upland crop typically being rainfed and receiving only low levels of fertilizer applications. Rice cultivation is heavily concentrated in Java but is also prevalent in Sumatra and Sulawesi. These three islands together contribute about 89% of total national rice production. There are typically three rice growing periods or seasons in Indonesia, a single wet-season crop followed by two dry-season crops. Approximately 45% of total production is usually from the wet season crop, cultivated from October to December and harvested from March through April.

- Corn is the second largely cultivated crop in Indonesia after paddy, occupying about 10.8% of agricultural land. Corn is the staple foodstuff in Indonesia for more than 18 million people and is grown by more than 10 million farm households. Corn production was concentrated in various regions, including Jawa Tengah (16% of total corn production), Lampung (9% of total corn production), Sulawesi Selatan (8% of total corn production), and Sumatera Utara (7% of total corn production) in 2022.

- Despite being the world's largest rice producer, Indonesia imported approximately 500,000 tons of rice in 2022 from countries like Thailand, Vietnam, India, and Pakistan. In a bid to bolster self-sufficiency and curb imports, Indonesia's focus on enhancing productivity is set to propel its fertilizers market.

Among all the primary nutrients, nitrogen is applied in a higher quantity in field crops

- Nitrogen, phosphorus, and potassium are the primary nutrients crucial for plant growth. Nitrogen (N) and phosphorus (P) are key components of proteins and nucleic acids, integral to plant tissues. Meanwhile, potassium (K) plays a pivotal role in enhancing the quality of harvested plant products. In Indonesia, the prominent field crops are rice, wheat, soybean, and corn. On average, these crops receive nutrient application rates of 223.8 kg/ha for nitrogen, 57.3 kg/ha for phosphorus, and 88.0 kg/ha for potassium.

- Out of the primary nutrients, nitrogen sees the highest application rate, averaging 223.8 kg/ha for field crops. Nitrogenous fertilizers, when appropriately used, contribute to improved grain quality, accelerated shoot growth, and the production of robust flower buds. Early-stage nitrogen fertilization also stimulates tillering and boosts crop yields. Phosphorus, with an application rate of 57.3 kg/ha in 2022, ranks second among the primary nutrients. It plays a vital role in the development of cereal crops, aiding in early root growth, tiller formation, and grain filling.

- In 2022, field crops in Indonesia received an average potassium application rate of 88.0 kg/ha. Potassium deficiency symptoms are first visible on the lower leaves, as potassium is easily translocated from older to younger leaves within the plant. These symptoms manifest as yellowing, progressing to necrosis (tissue death) along the outer leaf margins, starting from the tip and moving toward the base. The absence of primary nutrients can significantly impact plant health, growth, and crop yield. Given the expanding harvested area for major food crops, the demand for primary nutrients in field crops is poised to rise.

Indonesia Fertilizer Industry Overview

The Indonesia Fertilizer Market is fragmented, with the top five companies occupying 39.73%. The major players in this market are Asia Kimindo Prima, PT Saraswanti Anugerah Makmur Tbk (SAMF), PT. JADI MAS, Pupuk Indonesia (Persero) and Yara International ASA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50002251

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Micronutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.2 Primary Nutrients

- 4.2.2.1 Field Crops

- 4.2.2.2 Horticultural Crops

- 4.2.3 Secondary Macronutrients

- 4.2.3.1 Field Crops

- 4.2.3.2 Horticultural Crops

- 4.2.1 Micronutrients

- 4.3 Agricultural Land Equipped For Irrigation

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Type

- 5.1.1 Complex

- 5.1.2 Straight

- 5.1.2.1 Micronutrients

- 5.1.2.1.1 Boron

- 5.1.2.1.2 Copper

- 5.1.2.1.3 Iron

- 5.1.2.1.4 Manganese

- 5.1.2.1.5 Molybdenum

- 5.1.2.1.6 Zinc

- 5.1.2.1.7 Others

- 5.1.2.2 Nitrogenous

- 5.1.2.2.1 Urea

- 5.1.2.2.2 Others

- 5.1.2.3 Phosphatic

- 5.1.2.3.1 DAP

- 5.1.2.3.2 MAP

- 5.1.2.3.3 TSP

- 5.1.2.3.4 Others

- 5.1.2.4 Potassic

- 5.1.2.4.1 MoP

- 5.1.2.4.2 SoP

- 5.1.2.4.3 Others

- 5.1.2.5 Secondary Macronutrients

- 5.1.2.5.1 Calcium

- 5.1.2.5.2 Magnesium

- 5.1.2.5.3 Sulfur

- 5.2 Form

- 5.2.1 Conventional

- 5.2.2 Speciality

- 5.2.2.1 CRF

- 5.2.2.2 Liquid Fertilizer

- 5.2.2.3 SRF

- 5.2.2.4 Water Soluble

- 5.3 Application Mode

- 5.3.1 Fertigation

- 5.3.2 Foliar

- 5.3.3 Soil

- 5.4 Crop Type

- 5.4.1 Field Crops

- 5.4.2 Horticultural Crops

- 5.4.3 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Asia Kimindo Prima

- 6.4.2 Grupa Azoty S.A. (Compo Expert)

- 6.4.3 Haifa Group

- 6.4.4 PT Saraswanti Anugerah Makmur Tbk (SAMF)

- 6.4.5 PT. JADI MAS

- 6.4.6 Pupuk Indonesia (Persero)

- 6.4.7 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.