PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683975

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683975

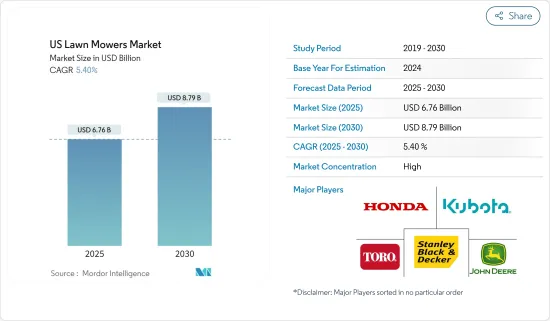

US Lawn Mowers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US Lawn Mowers Market size is estimated at USD 6.76 billion in 2025, and is expected to reach USD 8.79 billion by 2030, at a CAGR of 5.4% during the forecast period (2025-2030).

The United States lawn mowers market is anticipated to grow faster, owing to the growing prominence of landscaping maintenance, rising awareness about green roofs, and expanding technological innovations in the industry. Increasing demand for landscaping services in suburban lawns, golf courses, sports fields, and public parks drive the US lawn mower market. Over the long term, increasing adoption of green spaces and roofs is anticipated to drive market growth. Besides, the government emphasizes expanding and preserving green spaces as part of environmental sustainability. For instance, according to the US Census Bureau, the government planned to invest USD 1,781.2 billion for commercial and residential construction activities, including parks. Hence, such initiatives are likely to support the demand for lawnmowers in the coming years. Moreover, market players have been concentrating on introducing technologically advanced products. For instance, in July 2022, the Toro Company launched a new league of robotic lawn mowers (unnamed) that uses cameras instead of LiDAR for their positioning system, which means the user does not need to use a periphery wire, and the mower can detect obstacles easily.

United States Lawn Mowers Market Trends

Petrol Land Mowers are in High Demand

Petrol lawnmowers are ideal for home or professional use. They are push-powered or self-propelled for large lawn areas due to their superior power and high-grade cutting-edge performance. They are built using rigid, professional-grade components, such as corrosion-resistant chassis and aluminum, and require low maintenance and servicing costs. Moreover, initiatives by the government are anticipated to drive the petrol lawnmower market in the coming years. For instance, in July 2022, the National Park Service distributed USD 192 million to local communities through the Outdoor Recreation Legacy Partnership (ORLP) grant program. This enabled urban communities to create new outdoor recreation spaces, reinvigorate existing parks, and form connections between people and the outdoors in economically underserved areas.

Commercial/Government Sector is the Largest End User

The market for commercial lawnmowers in the United States is expanding with the growing demand for the maintenance of commercial spaces such as golf courses, sports fields, schools, and public parks. The large number of golf courses and sports fields in the country are fueling the commercial lawnmower market growth. For instance, according to a survey by the National Golf Foundation, in 2022, there were a total of 16,000 golf courses in the United States. More than one-third of the US population over the age of 5 played golf (on-course or off-course), followed golf on television or online, read about the game, or listened to a golf-related podcast in 2022. For instance, according to the National Golf Foundation, there were a total of 119 million people who played golf in 2022, 12% up from the previous year. This increase in the number of golf players in the country fuels commercial lawnmower use. Furthermore, the government is focusing on expanding outdoor spaces in California by investing in public park improvements. In 2022, local and state leaders granted nearly USD 15 million to expand outdoor facilities. This expansion of outdoor facilities in the country is expected to increase the use of commercial lawnmowers in the coming years.

United States Lawn Mowers Industry Overview

The United States Lawn Mowers market is consolidated and competitive. Companies compete based on product quality and promotion and focus on strategic moves to hold larger market shares. Companies are investing heavily in developing new products and collaborating with and acquiring other companies, which is expected to increase their market shares and strengthen their R&D activities. Some of the key players in the market are Deere & Co., Stanley Black & Decker, The Toro Company, Kubota Corporation, and American Honda Motor Co. Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand For Landscaping Maintenance

- 4.2.2 Adoption of Green Spaces and Green Roofs

- 4.3 Market Restraints

- 4.3.1 Shortage of Labor In Landscaping

- 4.3.2 High Maintenance Cost of Lawn Mowers

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Manual

- 5.1.2 Electric

- 5.1.3 Petrol

- 5.1.4 Robotics

- 5.1.5 Other Product Types

- 5.2 End User

- 5.2.1 Residential

- 5.2.2 Commercial/Government

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Ariensco

- 6.3.2 Deere & Company

- 6.3.3 American Honda Motor Co. Inc.

- 6.3.4 Husqvarna Group

- 6.3.5 Kubota Corporation

- 6.3.6 Makita Corporation

- 6.3.7 Stanley Black & Decker

- 6.3.8 Yamabiko Corporation

- 6.3.9 The Toro Company

- 6.3.10 Stihl Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS