Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683925

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683925

GCC Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 327 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

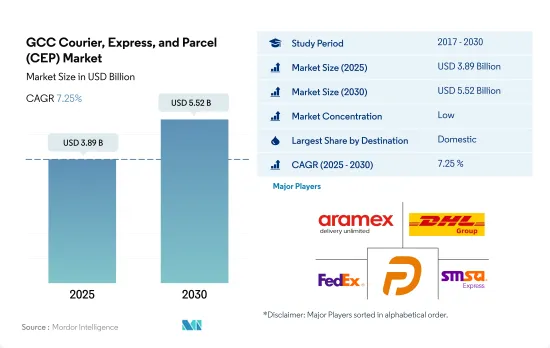

The GCC Courier, Express, and Parcel (CEP) Market size is estimated at 3.89 billion USD in 2025, and is expected to reach 5.52 billion USD by 2030, growing at a CAGR of 7.25% during the forecast period (2025-2030).

B2B segment dominating the parcel market with nearly 70% revenue share along with rising industry launches

- As of 2022, the CEP market was dominated by B2B deliveries with more than 70% share. In May 2023, J&T Express KSA introduced its Domestic Express Service in Saudi Arabia. Residents in Riyadh can utilize the J&T Express APP to place orders, and the courier will collect their parcels within 24 hours. This service extends to existing options like door-to-door, package collection, and return services. Riyadh is the 1st market to benefit from this service in the country.

- E-commerce has been a major driver for CEP growth in Saudi Arabia. The biggest player in the e-commerce market is extra.com, recording a revenue of USD 278.3 million in 2022. It was followed by amazon.sa and nahdionline.com, with revenues of USD 242 million and USD 211.6 million, respectively. Collectively, the top 3 stores accounted for 31.8% of the top 100 online stores' revenue in Saudi Arabia in 2022. With e-commerce user penetration projected to touch 73% by 2027, the Saudi Arabian CEP market is expected to grow significantly.

Regional market is driven by the adoption of drone deliveries, digital automated warehouses and distribution centres

- The parcel volume in the region has witnessed growth driven mainly by a surge in e-commerce-led parcel shipments. Regional e-commerce has grown at a CAGR of 25% during 2017-2021. Saudi Arabia, the United Arab Emirates, Qatar, Oman, Bahrain, and Kuwait comprise the CEP market in the GCC region. Major courier players in the region comprise DHL, FedEx, Oman Post, Bahrain Post, Muscat Post, Saudi Post, Qatar Post, and Emirates Post.

- The region faces certain challenges in meeting the warehousing and fulfillment needs of the CEP market, such as a lack of modern warehousing infrastructure, especially in the smaller towns and villages, to cope with a surge in the demand generated by the market. The inefficient last-mile delivery and cash-driven economy are other challenges affecting the market's growth. However, several players have been establishing fulfillment centers in the region. For instance, in 2022, the Saudi Authority for Industrial Cities and Technology Zones signed an agreement to establish 14 digital automated warehouses. In 2023, Amazon launched its new FC, increasing its total storage capacity in the United Arab Emirates by 70%. In 2022, e-commerce retailer Noon announced its aim of launching a 252,000 sq. meter fulfillment center facility.

GCC Courier, Express, and Parcel (CEP) Market Trends

GCC's booming logistics sector, with investments worth billions in infrastructure, fuels economic growth and development

- As of February 2024, the Makkah region in Saudi Arabia has initiated 20 road projects valued at USD 373 million to enhance connectivity and travel within the area. These projects cover 385km of roadways and include a 24km direct route linking Jeddah to Makkah and the doubling of the 90km Allaith-Makkah Road. Expansion of the Bisha-Raniyah-Al-Khurma Road is also planned. The road projects signify a substantial infrastructure investment focused on boosting connectivity and enriching transportation for both residents and visitors.

- The UAE's Dubai Autonomous Transportation Strategy aims to generate an annual revenue of USD 5.99 billion by 2030 through various means such as reducing transportation costs, carbon emissions, and accidents. This includes reclaiming lost commuting hours and boosting individual productivity. The strategy targets a 44% reduction in transportation expenses, equating to savings of USD 245.01 million annually, and a 12% decrease in environmental pollutants, leading to savings of USD 0.40 billion. Led by Dubai's RTA, the Shindagha Corridor project aims to optimize transportation efficiency and generate an annual economic uplift of USD 4.90 billion by 2030.

Approximately 30% of the Middle East's natural gas reserves are held by Qatar

- Saudi Aramco has announced that starting from January 1, 2024, the retail price of diesel will surge by 53% to USD 0.3067 per liter. This marks the third increase since 2016. Also, prices for natural gas and other fuels will also see an uptick in 2024. These price hikes are part of KSA's government-led reforms aimed at restructuring domestic fuel prices. Launched in 2016 amidst a period of low oil prices, these reforms entail gradual adjustments to gasoline, diesel, and electricity prices as the country moves towards phasing out energy subsidies.

- The weighted average cost of gas production across the GCC is expected to increase by one-third to two-thirds between 2015 and 2030, from USD 1.50 to USD 4.50 per thousand cubic feet in 2015 to USD 2.00-USD 7.00 per thousand cubic feet in 2030. Qatar holds 11% of the world's proven natural gas reserves and almost 30% of the Middle East's reserves. With reserves of crude oil estimated at 25.2 billion barrels in January 2023, Qatar held the 6th largest reserves in the Middle East and the 14th largest in the world.

GCC Courier, Express, and Parcel (CEP) Industry Overview

The GCC Courier, Express, and Parcel (CEP) Market is fragmented, with the major five players in this market being Aramex, DHL Group, FedEx, Postaplus and SMSA Express Transportation Company Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001615

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Qatar

- 4.12.2 Saudi Arabia

- 4.12.3 UAE

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

- 5.7 Country

- 5.7.1 Qatar

- 5.7.2 Saudi Arabia

- 5.7.3 UAE

- 5.7.4 Rest of GCC

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aramex

- 6.4.2 DHL Group

- 6.4.3 Emirates Post

- 6.4.4 FedEx

- 6.4.5 Postaplus

- 6.4.6 Qatar Post

- 6.4.7 Saudi Post- SPL (including Naqel Express)

- 6.4.8 SMSA Express Transportation Company Ltd.

- 6.4.9 Uber Technologies Inc.

- 6.4.10 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.