Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683924

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683924

GCC International Express Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 254 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

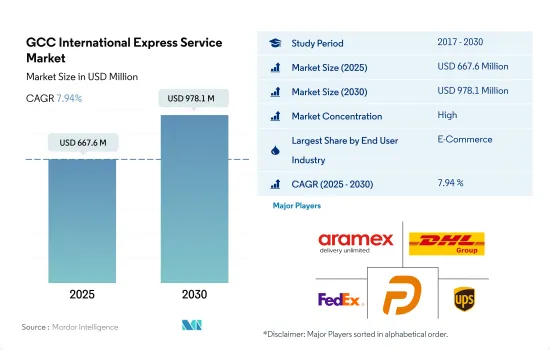

The GCC International Express Service Market size is estimated at 667.6 million USD in 2025, and is expected to reach 978.1 million USD by 2030, growing at a CAGR of 7.94% during the forecast period (2025-2030).

The launch of several initiatives to promote cross-border trade has created a favorable environment for international express services

- The governments of the GCC countries have launched several initiatives to promote cross-border trade, including simplifying customs procedures and reducing trade barriers. This has created a more favorable environment for international express services to operate in the region. For instance, the UAE and India entered into a Comprehensive Economic Partnership Agreement (CEPA). Also, international express delivery services have become more affordable due to increased competition and advancements in logistics technology.

- Like many other regions worldwide, the GCC countries have witnessed a rise in chronic diseases, such as diabetes, cardiovascular diseases, and respiratory conditions. Moreover, International express delivery services for healthcare products are expected to grow in the coming years in the region due to several factors, including increasing demand for medical supplies, rising healthcare spending, and the need for faster and more efficient delivery services. In addition, the medical devices market is expected to register a CAGR of 4.80% during 2023-2027 and reach USD 11.46 billion by 2027.

Saudi Arabia's international shopping surge planned to drive 65.5% growth in express services by the end of 2023

- In Saudi Arabia, cross-border e-commerce has played a crucial role in driving the demand for international courier, express, and parcel (CEP) services. For example, as of 2022, 60% of consumers engaged in cross-border online shopping, purchasing products from international businesses and retailers. Apparel, health, and beauty products emerged as popular goods among Saudi Arabian customers in cross-border transactions. China emerged as the top cross-border e-commerce partner for Saudi Arabia in 2020, accounting for 46% of the market share, followed by the United States and the United Arab Emirates, with shares of 20% and 10%, respectively. With an anticipated e-commerce user penetration rate of 65.5% by 2023, a significant portion of purchases is expected to be held by cross-border transactions, leading to substantial growth in the international express service market.

- FedEx Express UAE specializes in providing international express deliveries to more than 220 countries and territories worldwide. The company caters to goods within the weight range of 10 kg to 25 kg. FedEx utilizes its FedEx International Priority service to ensure speedy deliveries, which guarantees shipments to arrive within 2-3 days.

GCC International Express Service Market Trends

GCC's booming logistics sector, with investments worth billions in infrastructure, fuels economic growth and development

- As of February 2024, the Makkah region in Saudi Arabia has initiated 20 road projects valued at USD 373 million to enhance connectivity and travel within the area. These projects cover 385km of roadways and include a 24km direct route linking Jeddah to Makkah and the doubling of the 90km Allaith-Makkah Road. Expansion of the Bisha-Raniyah-Al-Khurma Road is also planned. The road projects signify a substantial infrastructure investment focused on boosting connectivity and enriching transportation for both residents and visitors.

- The UAE's Dubai Autonomous Transportation Strategy aims to generate an annual revenue of USD 5.99 billion by 2030 through various means such as reducing transportation costs, carbon emissions, and accidents. This includes reclaiming lost commuting hours and boosting individual productivity. The strategy targets a 44% reduction in transportation expenses, equating to savings of USD 245.01 million annually, and a 12% decrease in environmental pollutants, leading to savings of USD 0.40 billion. Led by Dubai's RTA, the Shindagha Corridor project aims to optimize transportation efficiency and generate an annual economic uplift of USD 4.90 billion by 2030.

Approximately 30% of the Middle East's natural gas reserves are held by Qatar

- Saudi Aramco has announced that starting from January 1, 2024, the retail price of diesel will surge by 53% to USD 0.3067 per liter. This marks the third increase since 2016. Also, prices for natural gas and other fuels will also see an uptick in 2024. These price hikes are part of KSA's government-led reforms aimed at restructuring domestic fuel prices. Launched in 2016 amidst a period of low oil prices, these reforms entail gradual adjustments to gasoline, diesel, and electricity prices as the country moves towards phasing out energy subsidies.

- The weighted average cost of gas production across the GCC is expected to increase by one-third to two-thirds between 2015 and 2030, from USD 1.50 to USD 4.50 per thousand cubic feet in 2015 to USD 2.00-USD 7.00 per thousand cubic feet in 2030. Qatar holds 11% of the world's proven natural gas reserves and almost 30% of the Middle East's reserves. With reserves of crude oil estimated at 25.2 billion barrels in January 2023, Qatar held the 6th largest reserves in the Middle East and the 14th largest in the world.

GCC International Express Service Industry Overview

The GCC International Express Service Market is fairly consolidated, with the major five players in this market being Aramex, DHL Group, FedEx, Postaplus and United Parcel Service of America, Inc. (UPS) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001614

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Qatar

- 4.12.2 Saudi Arabia

- 4.12.3 UAE

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Shipment Weight

- 5.1.1 Heavy Weight Shipments

- 5.1.2 Light Weight Shipments

- 5.1.3 Medium Weight Shipments

- 5.2 Route

- 5.2.1 Inter-Region

- 5.2.2 Intra-Region

- 5.3 End User Industry

- 5.3.1 E-Commerce

- 5.3.2 Financial Services (BFSI)

- 5.3.3 Healthcare

- 5.3.4 Manufacturing

- 5.3.5 Primary Industry

- 5.3.6 Wholesale and Retail Trade (Offline)

- 5.3.7 Others

- 5.4 Country

- 5.4.1 Qatar

- 5.4.2 Saudi Arabia

- 5.4.3 UAE

- 5.4.4 Rest of GCC

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aramex

- 6.4.2 DHL Group

- 6.4.3 Emirates Post

- 6.4.4 FedEx

- 6.4.5 Postaplus

- 6.4.6 Qatar Post

- 6.4.7 Saudi Post- SPL (including Naqel Express)

- 6.4.8 SMSA Express Transportation Company Ltd.

- 6.4.9 Uber Technologies Inc.

- 6.4.10 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.