PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1651059

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1651059

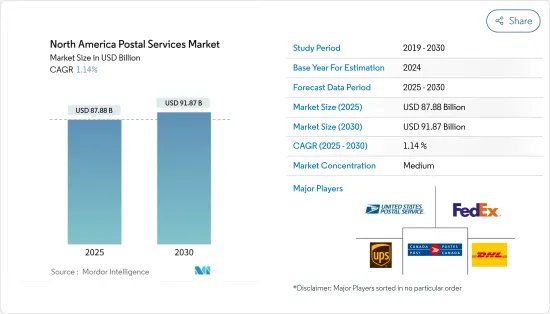

North America Postal Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America Postal Services Market size is estimated at USD 87.88 billion in 2025, and is expected to reach USD 91.87 billion by 2030, at a CAGR of 1.14% during the forecast period (2025-2030).

Key Highlights

- In North America, the rise of digital communication has diminished the volume of traditional mail. At the same time, the flourishing e-commerce sector has spurred greater demand for parcel delivery and last-mile logistics. These interconnected trends are transforming the industry, prompting postal operators to expand their services and modernize their operations. The United States Postal Service (USPS) is the official postal entity in the USA. FedEx and UPS, in direct competition with USPS's Express Mail, provide nationwide delivery services for urgent letters and packages.

- Leveraging its monopoly, USPS restricts other U.S. couriers from delivering non-urgent letters and prohibits them from shipping to U.S. mailboxes at residential and business locations. With few exceptions, USPS maintains a legal monopoly on letter delivery, backed by the Private Express Statutes, which impose fines and potential imprisonment on private letter carriers. In Canada, Canada Post is the dominant player, overseeing the majority of both package and traditional mail shipments. This government-run service enjoys the trust of many Canadians, managing the shipment of two out of every three parcels.

- In 2023, US parcel revenue saw its first dip in seven years, falling from USD198.4bn in 2022 to USD197.9bn. This decline came despite a modest 0.5% uptick in total parcel volume, which rose from 21.5 billion in 2022 to 21.7 billion in 2023. The annual US Parcel Shipping Index reveals that among the four primary carriers (USPS, Amazon Logistics, UPS, and FedEx), only Amazon Logistics registered a significant year-over-year (YoY) volume surge of 15.7%. Moreover, Amazon Logistics has surpassed both FedEx and UPS in parcel volumes and is rapidly approaching the market leader, USPS. Sources indicate that the 'others' category, which includes smaller carriers, saw a substantial uptick in both revenue and volume, enhancing their market share by 28.5% in 2023, bringing it to nearly 3%, or about 0.6 billion parcels. According to the sources, in 2023, USPS led in parcel volume with 6.6 billion parcels (a nearly 1% YoY decline), followed by Amazon Logistics at 5.9 billion parcels (a 15.7% increase), UPS with 4.6 billion parcels (a 10.3% decrease), and FedEx at 3.9 billion parcels (down 6.1%).

- In recent years, North America's postal service industry has faced disruptions from the digital landscape. As communication increasingly migrates online, the traditional mail delivery business is witnessing a decline. Concurrently, the industry is grappling with fierce competition in the expanding e-commerce parcel market. As a result, postal and mailing entities are evolving from state-owned monopolies to commercial firms with diversified portfolios.

North America Postal Services Market Trends

United States exhibits a clear dominance in the market

In the wake of the pandemic, e-commerce in the United States has experienced unprecedented growth, mirroring trends seen in many other countries. With a population of 332 million, the U.S. ranks as the world's third most populous nation, trailing only India and China. Notably, nearly 80% of American internet users engage in online shopping. This surge in e-commerce presents a significant opportunity for postal services. As consumers increasingly turn to both emerging e-commerce platforms and traditional brick-and-mortar stores transitioning online, the demand for efficient delivery and collection channels has intensified. Leveraging their established national networks and expertise in last-mile delivery, postal services are positioning themselves as valuable partners in this evolving landscape. By Q2 2024, e-commerce sales in the U.S. reached USD 291.64 billion, constituting 15.9% of the nation's total retail sales. In the first half of the year, U.S. e-commerce sales soared to USD 579.45 billion, with projections suggesting a climb to USD 1.22 trillion by year's end. The continued growth of e-commerce underscores the critical role of postal services in supporting the digital economy.

Letter Volume is on Decline

The U.S. Postal Service (USPS) stands as the official postal authority in the United States. After peaking at approximately 213 billion units in 2006, USPS has witnessed a consistent annual decline in mail volume. By 2023, deliveries had plummeted to a mere 116.15 billion units. This decline is primarily due to reduced volumes in traditional mail, marketing materials, and periodicals. In contrast, revenue from package shipping has surged. Technology is the primary catalyst for this transformation. An increasing number of Americans are turning to email, leading to a reduced appetite for traditional mail. Additionally, U.S. online retail sales have doubled in the last decade, heightening the demand for package deliveries. Canada Post, Canada's official postal service, mirrors this trend.

North America Postal Services Industry Overview

The industry is currently fragmented. Large companies have advantages in widespread infrastructure and diversity of services. Small companies compete by specializing. Government-owned postal agencies typically have a monopoly on mail delivery but face heavy competition from private package delivery companies. The competing entities form partnerships to capitalize on each other's strengths. For instance, major express delivery companies Federal Express (FedEx) and United Parcel Service (UPS) contract certain residential deliveries to the US Postal Service (USPS), while the USPS contracts air transportation out to FedEx and UPS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Drivers

- 4.2.1 Rise In Ecommerce

- 4.2.2 Expansion of Same Day and Next- Day Delivery

- 4.3 Market Restraints

- 4.3.1 Rising Labor Costs

- 4.3.2 Cybersecurity and Mail Security

- 4.4 Market Opportunities

- 4.4.1 Increased Automation and Technology

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Express Postal Services

- 5.1.2 Standard Postal Services

- 5.2 By Item

- 5.2.1 Letter

- 5.2.2 Parcel

- 5.3 By Destination

- 5.3.1 Domestic

- 5.3.2 International

- 5.4 By Geography

- 5.4.1 US

- 5.4.2 Canada

- 5.4.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 USPS

- 6.2.2 Canada Post Corporation

- 6.2.3 UPS

- 6.2.4 DHL

- 6.2.5 FedEX

- 6.2.6 Purolator

- 6.2.7 Correos de Mexico

- 6.2.8 Estafeta

- 6.2.9 GLS

- 6.2.10 APC Postal Logistics

- 6.2.11 Santa Lucia Post

- 6.2.12 Grenada Postal Corporation

- 6.2.13 Paquetexpress*

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators

- 8.2 Contribution of Transportation and Storage to GDP