PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911753

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911753

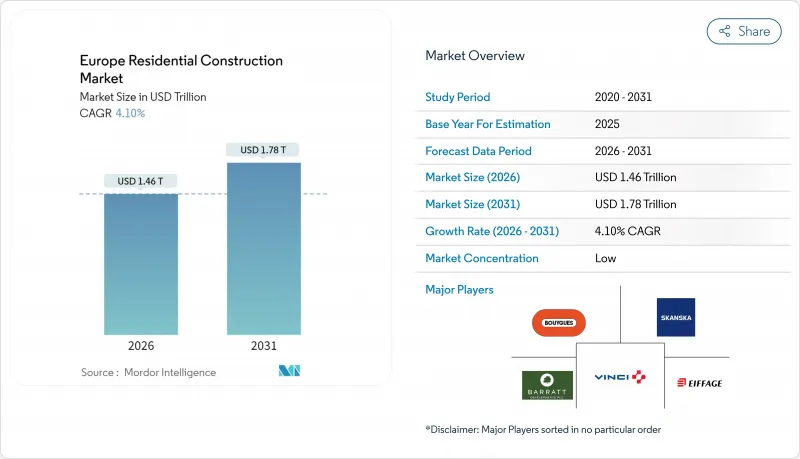

Europe Residential Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe Residential Construction Market market size in 2026 is estimated at USD 1,457.4 billion, growing from 2025 value of USD 1,400 billion with 2031 projections showing USD 1,781.9 billion, growing at 4.1% CAGR over 2026-2031.Renewed policy momentum, led by the EU Renovation Wave, is anchoring the sector's expansion while cushioning macroeconomic shocks.

Affordable-housing targets, institutional build-to-rent strategies, and rising demand for climate-resilient homes are driving fresh capital inflows and altering design standards. The rebound is also fuelled by modular technologies that mitigate labour shortages and shorten project cycles. Public-sector involvement is deepening as governments deploy subsidy programmes to counteract elevated borrowing costs. That mix of policy support, private innovation, and demographic tailwinds positions the Europe residential construction market for sustained growth despite interest-rate headwinds.

Europe Residential Construction Market Trends and Insights

EU Renovation-Wave Subsidies for Energy-Efficient Retrofits

The EU Renovation Wave aims to renovate 35 million dwellings by 2030, backed by EUR 560 billion in Recovery and Resilience Facility allocations. Germany restarted its KfW climate-friendly loan line in 2024, earmarking EUR 762 million to boost green residential builds. Minimum energy-performance requirements that mandate at least an E-rating by 2030 make deep-retrofit works unavoidable, effectively converting an optional activity into a compliance necessity. France's MaPrimeRenov scheme funds up to EUR 20,000 per household and targets 500,000 annual retrofits, embedding subsidy support into long-run housing policy. Complementing grant instruments, the EIB has partnered with Deutsche Bank to channel more than EUR 600 million of discounted mortgages into green housing upgrades, underscoring the crowd-in effect of blended finance.

Housing-Supply Gap in Major Cities Accelerating Multi-Family Builds

Urban undersupply is forcing a construction pivot toward higher-density formats. Housing prices in the Netherlands jumped 11% year-over-year in 2024 amid scarce listings, even as mortgage rates rose. Poland delivered nearly 200,000 units in 2024, ranking among Europe's top four builders and signalling Eastern Europe's capacity to scale output quickly. The UK's "Get Britain Building Again" programme sets a 370,000 annual target, signalling central-government willingness to direct supply after decades of laissez-faire policy. Germany's build-to-rent push is opening new channels for institutional capital as fund managers pivot from retail to housing stock. Additional EU cohesion funds, doubled to EUR 15 billion through 2027, confirm Brussels views the housing gap as an economic-competitiveness threat.

Construction-Material Cost Inflation & Supply-Chain Volatility

OSB prices surged 15-20% in 2024 as energy-intensive manufacturing met volatile commodity inputs. Timber, cement, and steel inflation is squeezing contractor margins, with firms like Eiffage citing cost spikes that outpaced revenue gains in Q3 2024. Dutch builders faced project cancellations when material allocations fell short, underscoring the fragility of just-in-time supply models. The EU's Carbon Border Adjustment Mechanism adds a carbon price on imported cement and steel, baking future cost escalators into project budgets. Developers are responding by value-engineering designs, but substitution options remain limited for structural products, keeping cost pressure within the Europe residential construction market.

Other drivers and restraints analyzed in the detailed report include:

- Affordable-Housing & First-Time-Buyer Incentives

- Institutional Build-to-Rent Capital Inflow

- ECB Rate-Hike Driven Financing Squeeze

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Apartments and condominiums captured 54.62% of the Europe residential construction market share in 2025, mirroring entrenched urbanisation patterns. Institutional portfolios favour multi-family blocks for their predictable yields and lower per-unit maintenance costs. In Germany, Vonovia SE continues to aggregate apartment stock, leveraging energy-upgrade subsidies for asset repositioning. Villas and landed houses record the quickest 4.31% CAGR through 2031, benefiting from remote-work adoption and a pandemic-influenced preference for larger dwellings. Dutch suburban price appreciation outpaced city-centre gains by 2024, indicating spatial demand rebalancing.

Demand for detached homes is also rising in Poland where greenfield subdivisions on city peripheries address young-family requirements. Nevertheless, apartment retrofits outnumber single-family renovations, because multi-unit blocks offer economies of scale when installing facade insulation or heat-pump clusters. France's "1 Euro house" scheme underscores the governance challenge of upgrading scattered villa stock without over-capitalising low-value assets. Consequently, developers juggle two diverging design briefs: dense, transit-oriented multi-family stock for core cities and larger lot-size homes in exurbs, a duality shaping the Europe residential construction market's next cycle.

New-build activity retained 73.45% of the Europe residential construction market size in 2025, anchored by structural undersupply in several capitals. Yet renovation is advancing at a 4.27% CAGR, propelled by mandatory energy-performance upgrades. Germany's KfW scheme channels low-interest loans up to EUR 150,000 per apartment, boosting deep-retrofit economics.

The Renovation Wave sets interim milestones that bind national plans, prompting builders to diversify from greenfield projects to refurbishment expertise. France's MaPrimeRenov funnels EUR 2 billion yearly into home upgrades, effectively underwriting contractor order books. Supply-chain synergies emerge when firms repurpose labour from cyclical private developments toward counter-cyclical retrofit contracts, smoothing revenue volatility. Renovation also unlocks carbon credits under EU taxonomy rules, providing new monetisation levers. That convergence explains why renovation weightings will progressively redefine the Europe residential construction market mix.

Europe Residential Construction Market Report is Segmented by Type (Apartment & Condominiums, Villas and Landed Houses), Construction Type (New Construction, Renovation), Construction Method (Conventional On-Site, Modern Methods of Construction), Investment Source (Public, Private), and Geography (Germany, United Kingdom, France, Italy, Spain, Netherlands, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Bouygues SA

- Vinci SA

- STRABAG SE

- Eiffage SA

- Skanska AB

- Barratt Developments plc

- Persimmon plc

- Taylor Wimpey plc

- Berkeley Group Holdings plc

- Redrow plc

- Crest Nicholson Holdings plc

- Miller Homes Group

- Vistry Group plc

- Bellway plc

- YIT Corporation

- Vonovia SE

- Hexaom Group

- Charles Church Developments Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Renovation-Wave subsidies for energy-efficient retrofits

- 4.2.2 Housing-supply gap in major cities accelerating multi-family builds

- 4.2.3 Affordable-housing & first-time-buyer incentives

- 4.2.4 Institutional build-to-rent capital inflow

- 4.2.5 Modular/off-site construction adoption amid labour shortages

- 4.2.6 Demand for climate-resilient low-carbon homes

- 4.3 Market Restraints

- 4.3.1 Construction-material cost inflation & supply-chain volatility

- 4.3.2 ECB rate-hike driven financing squeeze

- 4.3.3 Embodied-carbon caps slowing approvals

- 4.3.4 Skilled-trade labour deficit

- 4.4 Government Initiatives & Vision

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing (Construction Materials) and Construction Cost (Materials, Labour, Equipment) Analysis

- 4.9 Key Upcoming/Ongoing Projects (with a focus on Mega Residential Projects)

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Apartment & Condominiums

- 5.1.2 Villas and Landed Houses

- 5.2 By Construction Type

- 5.2.1 New Construction

- 5.2.2 Renovation

- 5.3 By Construction Method

- 5.3.1 Conventional On-Site

- 5.3.2 Modern Methods of Construction (Prefabricated, Modular, etc)

- 5.4 By Investment Source

- 5.4.1 Public

- 5.4.2 Private

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Poland

- 5.5.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Bouygues SA

- 6.4.2 Vinci SA

- 6.4.3 STRABAG SE

- 6.4.4 Eiffage SA

- 6.4.5 Skanska AB

- 6.4.6 Barratt Developments plc

- 6.4.7 Persimmon plc

- 6.4.8 Taylor Wimpey plc

- 6.4.9 Berkeley Group Holdings plc

- 6.4.10 Redrow plc

- 6.4.11 Crest Nicholson Holdings plc

- 6.4.12 Miller Homes Group

- 6.4.13 Vistry Group plc

- 6.4.14 Bellway plc

- 6.4.15 YIT Corporation

- 6.4.16 Vonovia SE

- 6.4.17 Hexaom Group

- 6.4.18 Charles Church Developments Ltd

7 Market Opportunities & Future Outlook