PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644948

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644948

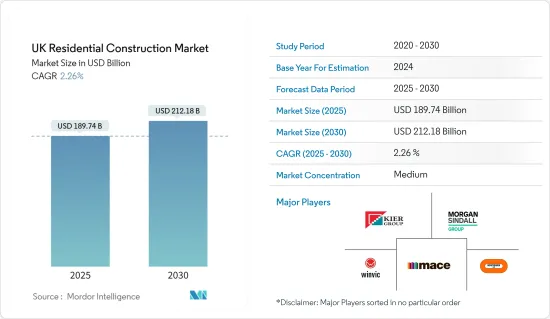

UK Residential Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The UK Residential Construction Market size is estimated at USD 189.74 billion in 2025, and is expected to reach USD 212.18 billion by 2030, at a CAGR of 2.26% during the forecast period (2025-2030).

A significant driver of this market expansion is the government's ambitious target of constructing 300,000 new homes annually. While this goal is undeniably bold, it's essential for addressing the persistent housing challenges in the UK. To achieve these ambitious targets, construction firms must rapidly scale operations. This necessitates the adoption of contemporary construction techniques, such as off-site prefabrication, and harnessing cutting-edge technologies to expedite processes, curtail expenses, and boost productivity.

However, the journey isn't without hurdles. The UK government has rolled out several new building regulations and standards, introducing additional complexities to projects. For instance, the Building Safety Act and the Future Homes Standard aim to enhance home safety and energy efficiency, but they also complicate and prolong construction endeavors. Builders must adeptly navigate these regulatory shifts to sidestep potential delays.

Furthermore, surging property prices present a dual-edged challenge. While homeowners benefit from refinancing opportunities, these elevated property values translate to escalating construction costs. Coupled with persistent inflation and supply chain disruptions affecting material prices, the financial burden of home construction is rising. Yet, despite these escalating costs, housing demand remains robust, particularly in urban centers and regions witnessing population growth.

The pandemic significantly reshaped the sector, hastening the adoption of digital tools and adaptable work methodologies. While numerous construction firms grappled with lockdown-induced challenges, those that swiftly integrated technologies-ranging from digital project management and Building Information Modeling (BIM) to automation-managed to maintain momentum.

Looking forward, the industry's digital evolution is poised to continue, with the integration of AI, drones, robotics, and other advanced technologies promising enhanced efficiency, minimized waste, and the ability to cater to surging demand.

In summary, despite facing a myriad of challenges, the UK residential construction market is on track for robust growth in the coming years. The industry's push towards sustainable and energy-efficient homes promises to spur innovation. Yet, with tightening regulations, escalating costs, and a workforce grappling with skill shortages, construction firms must remain agile, inventive, and prepared for the road ahead.

UK Residential Construction Market Trends

Government mandates pertaining to Energy Efficiency

The UK residential construction industry is being significantly shaped by the government's commitment to achieving Net Zero greenhouse gas emissions by 2050. This ambitious goal is not only driving the formulation of new regulations but also promoting the adoption of sustainable materials in construction. To bolster this green transition, the government has set aside approximately GBP 30 billion (USD 36.4 billion) for its green industrial revolution. Furthermore, the government aims to amplify investments in sustainable building practices and eco-friendly technologies. Projections indicate that by 2030, these initiatives could draw in private investments of up to GBP 90 billion (USD 109 billion) and generate 440,000 jobs in green industries. This heightened emphasis on sustainability is poised to unlock fresh opportunities in the residential construction market, especially in the realms of low-carbon materials and energy-efficient building techniques.

Continuing its trend, the government has allocated GBP 11.5 billion (~USD 14 billion) for housing projects in the 2022-2023 period. A substantial chunk of this investment targets the affordability crisis, with a keen focus on bustling cities like London, Manchester, and Birmingham. Out of the total budget, around GBP 8.4 billion (~USD 10 billion) is channeled to bolster local authority housing. Beyond funding new constructions, the government is also channeling resources into retrofitting existing homes, ensuring they align with stringent energy efficiency standards. Such steadfast investments in affordable and energy-efficient housing are set to be pivotal in propelling the growth of the UK's residential construction market.

Rising Focus on Apartment Construction in the UK Residential Construction Market

The UK residential construction market is increasingly prioritizing apartment developments to address the growing demand for affordable housing in urban areas. Cities such as Manchester, London, and Birmingham are facing space constraints and rising populations. As a result, high-density housing solutions, including build-to-rent (BTR) projects, are becoming critical. For example, in February 2024, Legal & General announced plans to develop 500 BTR apartments in Manchester, showcasing the sector's growth potential. However, rising costs for raw materials and energy have added complexity to these projects. Developers like Legal & General are addressing these challenges by adopting modular construction techniques, which enhance efficiency and reduce costs.

Government funding initiatives are also driving the shift toward apartment construction. In April 2024, the UK government allocated EUR 1.8 billion (USD 1.94 billion) to its Affordable Housing Programme, emphasizing the role of apartment complexes in mitigating urban housing shortages. These projects focus on maximizing land use efficiency in densely populated cities like London and Birmingham, delivering essential housing solutions while addressing land scarcity. Such measures are vital for sustaining construction momentum amid financial pressures and rising project costs, ensuring affordable housing remains accessible to underserved populations.

Despite these advancements, rising construction costs continue to pose challenges. According to industry reports, material prices for apartment projects increased by 8% year-on-year in March 2024. Developers, including Barratt Developments, are revising project budgets and timelines to manage these rising costs. Additionally, the need for alternative materials and improved supply chain strategies has become more pressing, as developers aim to balance affordability with quality. This dual focus on demand-driven apartment construction and cost management highlights the complexities shaping the UK residential construction market in 2024.

UK Residential Construction Industry Overview

The UK residential construction market is witnessing heightened competition, spearheaded by industry giants such as Barratt Developments, Taylor Wimpey, and Persimmon Homes. These leading firms are not only striving to meet government housing targets but are also tackling the affordable housing crisis and delivering high-quality, energy-efficient homes. As they broaden their portfolios, they prioritize sustainability and green building practices, ensuring alignment with Net Zero objectives.

Beyond these major players, firms like Berkeley Group and Kier Group are carving out niches in premium residential and urban regeneration projects, placing a pronounced focus on sustainable development. At the same time, up-and-coming entities like Winvic Group are making strides with cutting-edge construction techniques, including modular building and off-site manufacturing, which promise quicker and more economical project completions. This collective pivot towards innovation and sustainability is elevating standards across the board in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Urbanization and Demand for Affordable Housing

- 4.2.1.2 Adoption of Modular and Sustainable Construction Techniques

- 4.2.2 Market Restraints

- 4.2.2.1 Rising Construction Costs

- 4.2.2.2 Labor Shortages in the Construction Sector

- 4.2.3 Market Opportunities

- 4.2.3.1 Investment in Energy-Efficient and Sustainable Apartments

- 4.2.1 Market Drivers

- 4.3 Insights into Technological Innovation in the Residential Real Estate Sector

- 4.4 Government Regulations and Initiatives

- 4.5 Supply Chain/Value Chain Analysis

- 4.6 Industry Attractiveness - Porters' Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Geopolitics and Pandemics on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Condominiums and Apartments

- 5.1.2 Villas and Landed Houses

- 5.2 By Key Cities

- 5.2.1 London

- 5.2.2 Birmingham

- 5.2.3 Glasgow

- 5.2.4 Liverpool

- 5.2.5 Rest of the UK

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Kier Group

- 6.2.2 Morgan Sindall Group

- 6.2.3 Mace

- 6.2.4 Winvic Group

- 6.2.5 Bouygues UK

- 6.2.6 Lendlease

- 6.2.7 Balfour Beatty

- 6.2.8 Willmott Dixon Holdings

- 6.2.9 Skanska UK

- 6.2.10 Laing O'Rourke

- 6.2.11 Galliford Try*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX