PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644579

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644579

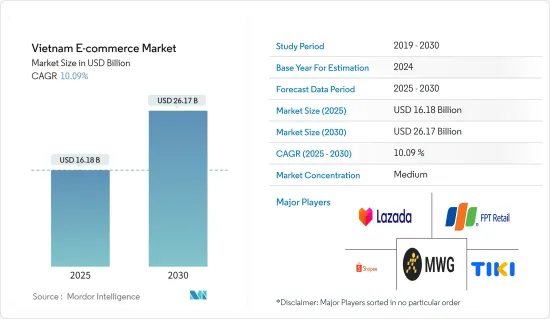

Vietnam E-commerce - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Vietnam E-commerce Market size is estimated at USD 16.18 billion in 2025, and is expected to reach USD 26.17 billion by 2030, at a CAGR of 10.09% during the forecast period (2025-2030).

In Vietnam, E-Commerce revenue continues to surge with the formation of new markets and the opportunities for growth for established markets. With their growing middle classes and lagging offline shopping infrastructure, East and Southeast Asia are expected to drive this trend.

Key Highlights

- The Vietnamese government actively promotes a cashless society to lower cash transactions to less than 10% of total payments and reach 70% of the banking population. Recently the Vietnamese government approved a national e-Commerce growth master plan. This master plan perfectly aligns with current Vietnamese Fourth Industrial Revolution strategies and policies, with the overarching goal of establishing a digital economy and fostering national digital transformation.

- Moreover, the plan intends to encourage enterprises and consumers to use e-commerce, close the gap between major cities and localities, create a sustainable virtual market, and increase cross-border online trading. The Vietnamese government, in particular, is actively promoting a cashless society, intending to reach a cashless payment rate of over 50% by 2025.

- Vietnam has one of the most favorable legal environments in the ASEAN region. Five of the six pieces of legislation intended to regulate e-commerce activity have been passed in the country. The e-commerce sector has dominated the recent development of the country's transportation, distribution, and fulfillment services ecosystem.

Vietnam Ecommerce Market Trends

Rise of Digital Payments Across the Vietnam

- The growth of Vietnam's digital payments sector is fueled by the expansion of e-commerce as an alternative to traditional brick-and-mortar sales. Increased desire for contact-free and cashless transactions has been facilitated by improved acceptance of digital financial technology (fintech) and the COVID-19 pandemic. Cash payments account for a significant share of all e-commerce transactions in Vietnam. Still, this figure is anticipated to decline by 2025 with increasing interest in digital payment modes.

- Moreover, the increasing use of digital payment mechanisms in Vietnam is fueled by the country's burgeoning e-commerce economy and positive regulatory reforms. E-wallets have the most significant growth estimates of all payment modes over the forecasted period compared to other digital payment methods.

- The rapid expansion of Vietnam's 4G infrastructure has reduced mobile internet costs. The country's mobile phone base has grown to over 100 million registered subscriptions because of affordable mobile internet access. One of the pillars for the quick adoption of e-commerce and digital payments in Vietnam has been many internet users and cheap internet connections.

- According to a survey on online shopping behavior done by Rakuten in June 2022, 71% of respondents in Vietnam said they had paid for their online purchases with cash on delivery in the previous three months. As reported by 54% of the respondents, mobile wallets were the second most popular payment option for online shopping.

Rise in Regional E-commerce Platforms

- Vietnam's ability to foster e-commerce is demonstrated by the success of various Vietnamese-origin e-commerce platforms, such as Tiki, Sendo, and Thegioididong. These platforms have grown into big e-commerce powerhouses due to investments from Japan, Germany, the United States, South Korea, China, and Singapore.

- Post is a crucial piece of infrastructure that is strongly related to e-commerce. Postal services for e-commerce are gradually replacing traditional delivery services due to the phenomenal growth of e-commerce. Foreign e-commerce platforms frequently favor international postal and delivery companies. Foreign exchanges dominate the industry, placing significant risks and challenges on domestic postal and delivery enterprises. Foreign e-commerce exchanges also expand and enhance their postal businesses. For instance, JD.com invested VND 1,000,000 Million(40.57) in Tiki.

- Furthermore, merchants should prioritize mobile commerce to beat the domestic competition: only 19% of local merchants' websites are mobile-friendly. According to JP Morgan, apps are preferred over browsers for online purchases in Vietnam, accounting for 62% of all transactions.

- The volume of visitors demonstrates the dominance of foreign e-commerce platforms in the market. According to February 2022, the Ministry of Information and Communication data shows 78.5 million users on Shopee, 14.8 million on Lazada, 14.1 million on Tiki, and 12.7 users on Good Market (Vietnam).

Vietnam Ecommerce Industry Overview

The gioididong.com is one of the key players in the Vietnamese e-commerce market. Other major players include fptshop.com.vn and shopee. vn. These three major players dominate the studied market. These are popular sites to decide which would best fit users' items regarding visitor volume, competition, and the types of e-commerce consumers they attract.

- January 2024 - Vietnam is recognized as one of the top 10 countries in the world with the highest e-commerce growth rates, leading Southeast Asia. Vietnam's largest e-commerce platforms are expected to continue their strong growth in 2024, with revenue and sales volume exceeding VND310 trillion (USD12.5 billion), a 35% increase from 2023.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Key market trends and share of E-Commerce of Total Retail sector

- 4.4 Impact of COVID-19 on the E-Commerce sales

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Formal E-Commerce Platforms Grow alongside Social Commerce

- 5.1.2 Consumers are Driven to Online Platforms for Grocery needs by Wider Assortment and Fast Delivery

- 5.2 Market Challenges

- 5.2.1 Low Non-cash Payment Usage

- 5.2.2 Security Risks and Concerns over Electronic Payment

- 5.3 Analysis of key demographic trends and patterns related to the E-Commerce industry in Vietnam (Coverage to include Population, Internet Penetration, E-Commerce Penetration, Age & Income etc.)

- 5.4 Analysis of the key modes of transaction in the E-Commerce industry in Vietnam (coverage to include prevalent modes of payment such as cash, card, bank transfer, wallets, etc.)

- 5.5 Analysis of cross-border E-Commerce industry in Vietnam (Current market value of cross-border & key trends)

- 5.6 Current positioning of Vietnam in the E-Commerce Industry in Asia-Pacific

6 MARKET SEGMENTATION

- 6.1 By B2C E-Commerce

- 6.1.1 Market size (GMV) for the period of 2017-2027

- 6.1.2 Market Segmentation - By Application

- 6.1.2.1 Beauty & Personal Care

- 6.1.2.2 Consumer Electronics

- 6.1.2.3 Fashion & Apparel

- 6.1.2.4 Food & Beverage

- 6.1.2.5 Furniture & Home

- 6.1.2.6 Others (Toys, DIY, Media, etc.)

- 6.2 By B2B E-Commerce

- 6.2.1 Market size for the period of 2017-2027

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Shopee Pte. Ltd.

- 7.1.2 Lazada Vietnam

- 7.1.3 TiKi Corporation

- 7.1.4 Cho Tot

- 7.1.5 Sendo Vietnam

- 7.1.6 The Gioi Di Dong

- 7.1.7 Dien May Xanh

- 7.1.8 FPT Shop

- 7.1.9 Cellphone S

- 7.1.10 Bach Hoa Xanh

- 7.1.11 Dien May Cho Lon

- 7.1.12 Hoang Ha Mobile

- 7.1.13 Meta

- 7.1.14 Nguyen Kim

- 7.1.15 Mediamart

- 7.1.16 Viettel Store

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET