PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850962

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850962

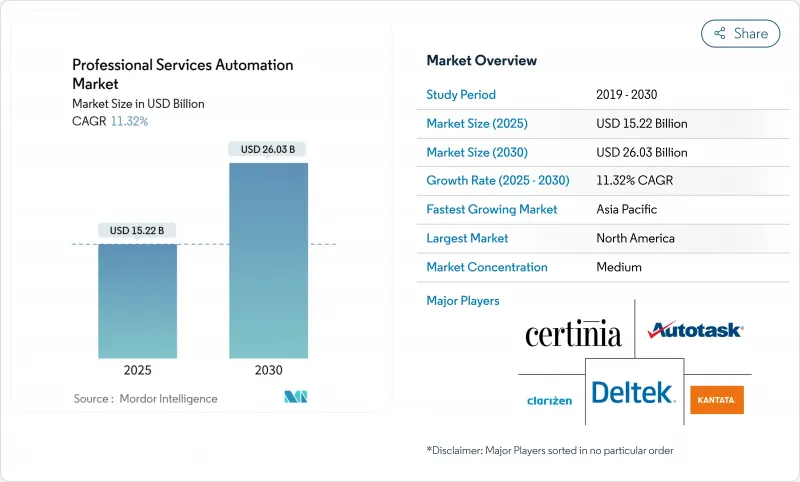

Professional Services Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Professional Services Automation Market size is estimated at USD 15.22 billion in 2025, and is expected to reach USD 26.03 billion by 2030, at a CAGR of 11.32% during the forecast period (2025-2030).

Cloud-first transformation, AI-driven workflow orchestration, and the need for unified project-to-cash visibility anchor this expansion. Firms race to embed predictive analytics that guide staffing, margin management, and client outcomes, while outcome-based billing models spur richer performance measurement capabilities. A 69.3% cloud deployment footprint in 2024 proves that scalable, subscription-based delivery now underpins most new implementations, and AI modules that surface utilization risks before month-end close accelerate decision cycles. As talent shortages persist, vendors differentiate through low-code configuration, embedded best-practice templates, and tight ERP/CRM connectors that de-risk complex rollouts. Competitive advantage hinges on platform breadth: suites that combine project management, resourcing, billing, and analytics in one workspace capture larger seat counts and drive expansion revenue.

Global Professional Services Automation Market Trends and Insights

Cloud PSA Adoption Among SMEs

Small and medium enterprises propel the most dynamic growth in the professional services automation market as public-sector digitization grants and easy SaaS onboarding dismantle historical infrastructure hurdles. Singapore's Productivity Solutions Grant reimburses up to 50% of subscription fees, letting micro-firms access capabilities once reserved for global consultancies. A referral flywheel forms as early wins showcase productivity boosts, and subscription pricing converts upfront CAPEX into manageable OPEX, giving vendors recurring cash flows that fund feature velocity. Jana Small Finance Bank cut turnaround time by 65-70% after deploying UiPath's automation suite. Such results validate the thesis that even a 10-seat firm can wield enterprise-grade orchestration, reshaping competitive parity across professional services segments.

Drive for Real-Time Resource and Margin Visibility

Macroeconomic volatility forces firms to expose utilization gaps and margin leaks in real time rather than at quarterly review. BeyondTrust lifted resource utilization 20% after adopting Certinia PSA, pairing granular skills matrices with live feedback loops. Dashboards that surface over-allocated engineers or under-funded milestones curb cost overruns before they erode profitability. As more project teams work across time zones, instantaneous variance alerts allow managers to re-sequence tasks without breaching delivery windows. Embedded AI simulators pressure-test resourcing scenarios, ensuring that rate-card discounts or scope changes do not dilute forecasted gross margin.

Data-Privacy Concerns in Multi-Tenant Clouds

GDPR imposes strict residency and consent rules that intensify scrutiny of shared-tenant architectures handling client records, project notes, and employee timesheets. Regulated advisory practices now negotiate data-processing addendums that stipulate encryption keys, regional failover, and audit-ready logging. While hyperscale clouds boast SOC 2 and ISO-27001 attestations, some clients still prefer single-tenant or EU sovereign zones, delaying pure-cloud migrations and marginally dampening professional services automation market adoption in the short term.

Other drivers and restraints analyzed in the detailed report include:

- ERP/CRM Integration Momentum

- AI-Driven Predictive Staffing Analytics

- Integration Complexity with Legacy Stacks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployments represented 69.3% of the professional services automation market size in 2024 and are slated to grow at 13.2% CAGR to 2030, reflecting a decisive pivot from on-premise custom builds. Automatic patching, elastic compute, and subscription pricing align with distributed workforce realities and CFO mandates to shift CAPEX to OPEX. On-premise PSA persists in highly regulated niches that mandate behind-firewall data residency, but even there, hybrid adjacency-analytics or mobile time capture in the cloud-gains traction. Platform vendors deepen alliances with AWS and Microsoft to tap global availability zones and shared AI accelerators. These moves compress implementation cycles from quarters to weeks, broadening the total addressable professional services automation market.

Traditional vendors that once relied on perpetual licenses now craft phased migration toolkits, offering data migration utilities and dual-running options that limit downtime. Emerging entrants born in the cloud exploit this inertia by promising zero-footprint deployment, consumption-based billing, and in-product walk-throughs suited to teams without dedicated IT support. As a result, cloud PSA adoption not only displaces legacy tools but can also catalyze first-time PSA buyers in emerging economies, extending the professional services automation market footprint.

While Solutions retained 61.6% revenue in 2024, the Services segment is expanding at 13.7% CAGR, mirroring the rise in enterprise-wide rollouts that demand process re-engineering, data cleanup, and user enablement. Every new AI module or ERP connector creates a downstream need for configuration, integration, and governance frameworks, and customers often lack the bandwidth to manage this layer themselves. Systems integrators, therefore, carve premium consulting revenue, shaping roadmaps, configuring role-based dashboards, and staging phased cut-overs.

Because successful adoption hinges on behavior change, change-management specialists orchestrate communications, role-play sessions, and KPI dashboards that sustain momentum post go-live. Vendors such as Thirdera became early movers, delivering Workflow Data Fabric accelerators for ServiceNow customers. The services upturn bolsters average contract value and underpins recurring expansion bookings, solidifying long-term vendor-client relationships within the professional services automation market.

Professional Services Automation Market is Segmented by Deployment Type (Cloud and On-Premise), Component (Solutions and Services), Enterprise Size (Large Enterprises and Small and Medium Enterprises), End-User Industry (IT and Telecom, BFSI, and More), Functionality Module (Project and Resource Management, Billing and Invoicing, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 38.06% of the professional services automation market size in 2024, anchored by mature IT consulting ecosystems, Sarbanes-Oxley controls, and early AI pilot budgets. Headquarters proximity grants many vendors live feedback loops and design-partner engagements that accelerate feature rollouts. Early adopters now progress from departmental pilots to enterprise-wide consolidations, focusing on utilization optimization, advanced profitability modeling, and AI-assisted proposal generation. Although saturation tempers volume growth, cross-selling into analytics, mobile expense, and talent marketplaces sustains revenue lift.

Asia-Pacific is on track for the fastest 14.5% CAGR, backed by government grants, rising wage pressure, and a vibrant SaaS developer base. Japan saw a 157% spike in electronic contract inquiries in 2024, signaling widespread digitization momentum. India's SaaS firms target an 8% global share by 2028, translating into dual-role participation as both buyers and builders of PSA capabilities. Singapore's Productivity Solutions Grant and Australia's focus on AI productivity further energize the regional pipeline. Vendors localize tax, compliance, and language packs to capture these diverse micro-markets.

Europe offers steady uptake tempered by GDPR anxieties. Many advisory practices pursue private-cloud or EU-sovereign deployments, elongating sales but enlarging deal size once procurement hurdles clear. Workday's GBP 550 million UK investment includes local AWS regions and apprenticeship programs, easing data-residency fears and talent shortages. ESG reporting mandates also catalyze PSA enhancements that capture carbon impact and diversity metrics, positioning the professional services automation market as an enabler of regulatory compliance. Meanwhile, the Middle East and Africa begin to deploy PSA for megaproject oversight-think smart-city builds and infrastructure rollouts-though connectivity gaps and scarce admin talent slow mass adoption.

- Autotask Corporation (Datto)

- Kantata (Mavenlink + Kimble Apps)

- Clarizen Inc.

- Deltek Inc.

- Certinia (FinancialForce.com, Inc.)

- Infor Inc.

- Oracle NetSuite OpenAir

- Upland Software (Tenrox)

- Projector PSA Inc.

- Replicon Inc.

- Unanet Technologies

- Adobe Workfront

- ConnectWise PSA

- BigTime Software

- Planview (Changepoint)

- Avaza Ltd.

- Accelo Ltd.

- Wrike (Citrix)

- Hub Planner

- BQE Software (BQE CORE)

- Smartsheet (Resource Mgt)

- ServiceNow PSA

- Unit4 PSA

- Kimble (legacy)

- Workday PSA

- SAP Professional Services Cloud

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud PSA adoption among SMEs

- 4.2.2 Drive for real-time resource and margin visibility

- 4.2.3 ERP/CRM integration momentum

- 4.2.4 Shift to outcome-based service models

- 4.2.5 AI-driven predictive staffing analytics

- 4.3 Market Restraints

- 4.3.1 Data-privacy concerns in multi-tenant clouds

- 4.3.2 Integration complexity with legacy stacks

- 4.3.3 Scarcity of PSA-skilled implementation talent

- 4.3.4 Vendor consolidation and lock-in risk

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Deployment Type

- 5.1.1 Cloud

- 5.1.2 On-Premise

- 5.2 By Component

- 5.2.1 Solutions

- 5.2.2 Services

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-user Industry

- 5.4.1 IT and Telecom

- 5.4.2 BFSI

- 5.4.3 Architecture, Engineering, and Construction

- 5.4.4 Healthcare

- 5.4.5 Legal Services

- 5.4.6 Consulting and Advisory

- 5.4.7 Other End-user Industries

- 5.5 By Functionality Module

- 5.5.1 Project and Resource Management

- 5.5.2 Billing and Invoicing

- 5.5.3 Time and Expense Tracking

- 5.5.4 Business Analytics and Reporting

- 5.5.5 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Malaysia

- 5.6.4.6 Singapore

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Autotask Corporation (Datto)

- 6.4.2 Kantata (Mavenlink + Kimble Apps)

- 6.4.3 Clarizen Inc.

- 6.4.4 Deltek Inc.

- 6.4.5 Certinia (FinancialForce.com, Inc.)

- 6.4.6 Infor Inc.

- 6.4.7 Oracle NetSuite OpenAir

- 6.4.8 Upland Software (Tenrox)

- 6.4.9 Projector PSA Inc.

- 6.4.10 Replicon Inc.

- 6.4.11 Unanet Technologies

- 6.4.12 Adobe Workfront

- 6.4.13 ConnectWise PSA

- 6.4.14 BigTime Software

- 6.4.15 Planview (Changepoint)

- 6.4.16 Avaza Ltd.

- 6.4.17 Accelo Ltd.

- 6.4.18 Wrike (Citrix)

- 6.4.19 Hub Planner

- 6.4.20 BQE Software (BQE CORE)

- 6.4.21 Smartsheet (Resource Mgt)

- 6.4.22 ServiceNow PSA

- 6.4.23 Unit4 PSA

- 6.4.24 Kimble (legacy)

- 6.4.25 Workday PSA

- 6.4.26 SAP Professional Services Cloud

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment