PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640668

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640668

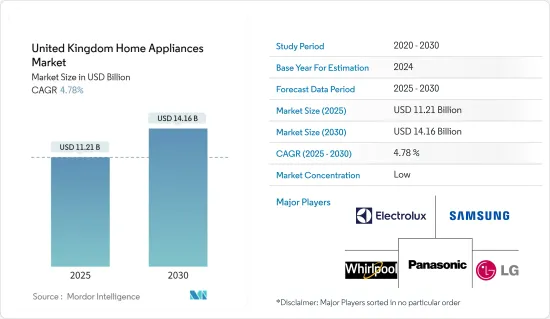

United Kingdom Home Appliances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United Kingdom Home Appliances Market size is estimated at USD 11.21 billion in 2025, and is expected to reach USD 14.16 billion by 2030, at a CAGR of 4.78% during the forecast period (2025-2030).

The United Kingdom is a significant market for household appliances owing to increasing consumption expenditure on such products. Factors such as technological advancements, rapid urbanization, growth in the housing sector, rising income per capita, improving living standards, and a shift in consumer lifestyles are driving the household appliances market in the United Kingdom.

Additionally, the market is expanding with the introduction of smart home appliances, which offer increased convenience and efficiency. The growing ownership of smart home devices among consumers is contributing to the rise in smart kitchen appliances. Moreover, the market is expanding due to consumer preferences for eco-friendly and energy-efficient appliances.

United Kingdom Home Appliances Market Trends

The Growth in the Working Population Drives Demand for Household Products in the United Kingdom

The United Kingdom's growing working population is a crucial driver behind the increasing demand for household products. As more individuals enter the workforce, their disposable incomes rise, leading to greater purchasing power and an increased focus on improving home environments. This trend is particularly evident among younger professionals and dual-income households, who prioritize convenience, functionality, and aesthetics in their home purchases. The need to create comfortable, efficient living spaces that accommodate busy lifestyles boosts the demand for various household products, including appliances, furniture, and home decor.

The shift toward remote and hybrid working models has heightened the importance of well-equipped home offices and multifunctional living spaces, further fueling demand. Consumers are investing in products that enhance productivity and comfort, such as ergonomic furniture, advanced kitchen appliances, and smart home devices. The rise in the working population also correlates with a trend toward urbanization, where compact living spaces require innovative and space-saving household solutions. Retailers and manufacturers are responding to this demand by offering a diverse array of products tailored to the needs of modern, working consumers, making household products a thriving market in the United Kingdom.

Consumer Preferences Are Driving the Growth of the Small Appliance Segment

Consumers are increasingly seeking trending designs and high-quality standards in addition to appliance core functionality. The segment for small home appliances is witnessing substantial growth due to their efficiency, ease of cleaning, and time-saving features. Smart connectivity features further enhance the appeal of these products.

The rising sales of coffee machines, electric kettles, and toasters highlight the importance consumers place on these features. To appeal to millennial consumers and their evolving aesthetic tastes, manufacturers are incorporating trendy finishes and pastel hues like teal, aqua, ivory, and lavender into small kitchen appliances, including coffee makers and blenders. This focus on quality and design is helping drive sales in the segment, as consumers look for products that not only perform well but also enhance the overall look and feel of their living spaces.

United Kingdom Home Appliances Industry Overview

The UK household appliances market is fragmented, with the presence of many players. With technological advancements and product innovations, mid-sized to smaller companies are increasing their market presence by securing new contracts and tapping into new markets. Additionally, the companies are highlighting durable, high-quality products to foster consumer trust and loyalty and prioritizing attractive designs to satisfy preferences for modern, stylish appliances that enhance home decor. The key players in the market include Samsung, Electrolux Group, LG Group, Panasonic Corporation, and Whirlpool Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Enhanced Quality and Trending Designs Driving the Market Demand

- 4.2.2 Rise in Working Population led to Demand of the Household Product

- 4.3 Market Restraints

- 4.3.1 Rise in Reports of Household Appliance Hazards or Accidents

- 4.4 Market Oppportunities

- 4.4.1 Growing Smart Home Integration

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights of Technological Innovations in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Major Appliances

- 5.1.1 Refrigerators

- 5.1.2 Freezers

- 5.1.3 Dishwashing Machines

- 5.1.4 Washing Machines

- 5.1.5 Cookers and Ovens

- 5.1.6 Other Major Appliances

- 5.2 By Small Appliances

- 5.2.1 Vacuum Cleaners

- 5.2.2 Small Kitchen Appliances

- 5.2.3 Hair Clippers

- 5.2.4 Irons

- 5.2.5 Toasters

- 5.2.6 Grills and Roasters

- 5.2.7 Hair Dryers

- 5.2.8 Other Small Appliances

- 5.3 By Distribution Channel

- 5.3.1 Multi-Branded Stores

- 5.3.2 Speciality Stores

- 5.3.3 E-commerce

- 5.3.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.2 Electrolux AB

- 6.2.3 LG Electronics

- 6.2.4 Samsung Electronics

- 6.2.5 Panasonic Corporation

- 6.2.6 Haier Electronics Group Co. Ltd

- 6.2.7 BSH Hausgerate GmbH

- 6.2.8 Arcelik AS

- 6.2.9 Gorenje Group

- 6.2.10 Mitsubishi Electric Corporation*

7 MARKET FUTURE TRENDS

8 APPENDIX AND ABOUT US