PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630391

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630391

United Kingdom Small Home Appliances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

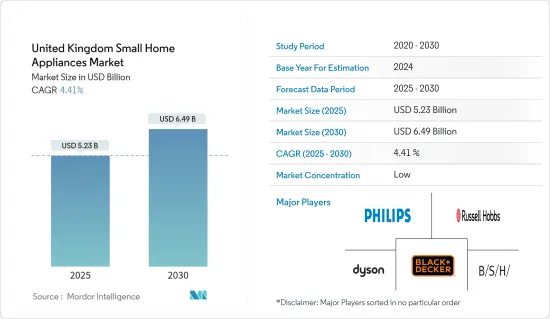

The United Kingdom Small Home Appliances Market size is estimated at USD 5.23 billion in 2025, and is expected to reach USD 6.49 billion by 2030, at a CAGR of 4.41% during the forecast period (2025-2030).

The UK small home appliances market is surging, driven by population growth and urbanization. Manufacturers are responding by producing smart kitchen devices, prioritizing consumer comfort and convenience. As household incomes rise and living standards improve, consumers evolve their lifestyles. Technological advancements have enabled sensors and communication capabilities, allowing seamless connections between kitchen appliances and devices like tablets and smartphones.

Also, with increased disposable incomes, consumers are investing significantly in advanced kitchen gadgets. Items such as rice cookers, coffee makers, food processors, blenders, and juicers are not just conveniences but also contribute to the growth of the small appliance industry. Given these dynamics, the small appliance industry stands on the brink of substantial growth opportunities.

The home appliance trend, particularly for smaller devices, underscores the importance of energy efficiency and IoT connectivity. Many modern appliances now offer remote control capabilities or have sensors for automatic management. This momentum toward smart appliances and the broader concept of smart homes is poised to drive the market toward steeper growth trajectories.

United Kingdom Small Home Appliances Market Trends

Rise of Smart Appliances and AI Integration

Technological advancements and innovations are poised to enhance product performance and expand applications across diverse industries. Key developments in smart and energy-efficient technologies are driving market growth. The Kitchen OS, a cutting-edge smart kitchen technology, effortlessly connects various kitchen gadgets and keeps pace with the latest small appliances.

Beyond enabling communication between smart refrigerators, ovens, and even smartphones, the integrated Kitchen OS leverages artificial intelligence to automate meal planning and cooking, customizing it to individual dietary needs and preferences. Similarly, the infusion of AI into floor care has transformed the small household appliance industry.

Take Roborock, a leader in robotic cleaning, launched the Roborock S6 Max, a top-tier vacuum equipped with an AI-driven stereo camera and sophisticated obstacle avoidance capabilities. In conclusion, these technological advancements offer promising growth opportunities for the small appliances industry.

E-commerce Dominates Distribution Channels for Home Appliances

With the rise of internet retailing and a connected lifestyle, e-commerce has solidified its position as a leading distribution channel. Notably, electronics and appliance specialist retailers dominate in terms of volume. The distribution landscape is increasingly favoring channels that offer significant discounts. This includes outlets for private label goods, mega markets leveraging tax rebates, manufacturer partnerships for discounts, and e-commerce platforms. The latter has emerged as a formidable competitor, consistently providing competitive discounts and enticing offers.

E-commerce portals empower consumers to select advanced products at budget-friendly prices. In the realm of small home appliances, vacuum cleaners, microwave ovens, and coffee machines stand out as primary revenue drivers. Given this momentum, the e-commerce industry's growth is poised to unveil promising opportunities in the coming years.

United Kingdom Small Home Appliances Industry Overview

The UK small home appliances market is highly competitive and globalized, with competition intensifying from retail players. Companies maintain their global competitiveness in the market through research and innovation. Some of the major players in the market for small home appliances include BSH Home Appliances Ltd, Philips, Russell Hobbs, Dyson, and Black & Decker.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Consumer Spending and Disposable Income Driving the Market

- 4.2.2 Rapid Urbanization and Compact Living Spaces

- 4.3 Market Restraints

- 4.3.1 Semi-Conductor Chip Shortage is Challenging the Market Growth

- 4.4 Market Opportunities

- 4.4.1 Investments in R&D for Green Technology Adoption

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porters' Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technology and Innovation in Operation in Small Home Appliances Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Vacuum Cleaners

- 5.1.2 Coffee Machines

- 5.1.3 Food processor

- 5.1.4 Irons

- 5.1.5 Toasters

- 5.1.6 Grills and Roasters

- 5.1.7 Hair Dryers

- 5.1.8 Other Products

- 5.2 By Distribution Channels

- 5.2.1 Supermarkets and Hypermarkets

- 5.2.2 Specialty Stores

- 5.2.3 E-commerce

- 5.2.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 BSH Home Appliances Ltd

- 6.2.2 Philips

- 6.2.3 Russell Hobbs

- 6.2.4 Dyson

- 6.2.5 Black & Decker

- 6.2.6 AB Electrolux

- 6.2.7 Kenwood

- 6.2.8 Hoover

- 6.2.9 Hotpoint

- 6.2.10 Murphy Richards*

7 FUTURE MARKET TRENDS

8 DISCLAIMER AND ABOUT US