Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640336

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640336

West Africa Oil and Gas Upstream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

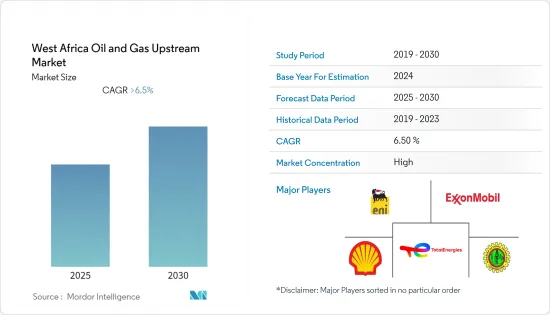

The West Africa Oil and Gas Upstream Market is expected to register a CAGR of greater than 6.5% during the forecast period.

The outbreak of COVID-19 negatively impacted the market. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as the region's increasing oil and gas production and the strengthening of crude oil prices due to various geopolitical reasons are likely to drive the market during the forecast period.

- However, political instability, coupled with vandalism of oil and gas infrastructure and theft of petroleum products, results in business losses for stakeholders, reducing the confidence to invest in oil and gas projects, which is anticipated to restrain the West African oil and gas upstream market during the forecast period.

- Several offshore discoveries have been done in the region in recent years, which is expected to create a lucrative opportunity for oil and gas upstream companies to invest in this region.

- Nigeria dominated the market due to a large number of upstream projects coming up in the country due to operators gaining confidence and increased production, with a rise in crude oil prices after a slump. Therefore, Nigeria is expected to dominate the market during the forecast period.

West Africa Oil & Gas Upstream Market Trends

The Offshore Segment is Expected to be the Fastest-growing Segment

- In contrast to the offshore sector, the onshore sector in West Africa is vulnerable to terrorist operations. As a result, investors are more focused on the offshore market, leading to a proliferation of offshore projects and discoveries while the onshore sector remains unexplored.

- The offshore oil and gas sector in West Africa is still growing, albeit slowly, which is creating new market potential. Oil explorers and producers have continued to extend their operations in West Africa's offshore deep and ultra-deep space, particularly in Southern and Western Africa, where substantial projects have either started or have been announced, awaiting resource appraisal and development.

- The growth of West Africa's offshore exploration and production activities has been mainly driven by the efforts of governments in their region to provide key incentives and supporting policies to unlock the investment opportunity, as well as the growing number of international oil and gas companies interested in exploring alternative fields to replace the maturing offshore producing sites in countries such as Nigeria and Ghana.

- In August 2022, Nigeria's state-owned oil company, Nigerian National Petroleum Company (NNPC) Limited, renewed its oil production sharing contracts for five deep-water blocks with multinational oil companies Shell, Equinox, Chevron, ExxonMobil, Sinopec, and Nigerian company South Atlantic Petroleum. Over the following 20 years, the business plans to generate up to 10 billion barrels of oil. The OML 128, 130, 132, 133, and 138 blocks are jointly and individually owned by NNPC.

- Furthermore, in Angola, Ghana, and Nigeria, several long-term tenders for the development of reserves have been issued. The West African offshore region has also recently witnessed successful discoveries, such as Eni's recent finding in offshore Cote d'Ivoire and Ghana. Such discoveries will require an additional appraisal, and development activities in the region are likely to attract investors, thereby driving the market demand during the forecast period.

- Thus, based on the above-mentioned factors, the offshore segment is expected to dominate the West African oil and gas upstream market during the forecast period.

Nigeria is Expected to Dominate the Market

- In terms of proven oil and gas reserves, Nigeria is one of Africa's largest nations. Nigeria had reserves of 5.53 trillion cubic meters of natural gas and 36.9 million barrels of crude oil as of 2021, respectively. While the nation's proven gas reserves have increased by almost 10% during the same time, proved oil reserves have remained largely stable since 2006.

- Nigeria is having trouble managing its cash flow, low revenue, and convertibility problems. The nation is actively taking action to combat the economic downturn. It is investigating a number of alternative revenue streams, particularly through the commercialization of gas and the expansion of its infrastructure.

- Furthermore, the country plans to become an export hub in Africa by exporting not only to regional countries but also to other Asian countries like India and China, where the gas demand is anticipated to increase in the coming years, resulting in increased upstream activities in the region.

- In January 2022, Nigerian National Petroleum Company Ltd secured a USD 5 billion corporate finance commitment from the African Export-Import Bank to fund major investments in the Nigerian upstream sector. This is likely to aid the market's growth during the forecast period.

- Therefore, based on the above-mentioned factors, Nigeria is expected to dominate the West African oil and gas upstream market during the forecast period.

West Africa Oil & Gas Upstream Industry Overview

The West African oil and gas upstream market is consolidated. Some of the key players in the market (in no particular order) include Shell PLC, TotalEnergies SE, Eni SpA, Exxon Mobil Corporation, and Nigerian National Petroleum Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 51604

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Macro-economic Condition in the Oil and Gas Industry

- 4.3 Crude Oil Production and Forecast in thousand barrels per day, till 2028

- 4.4 Natural Gas Production and Forecast in million-ton oil equivalent, till 2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitute Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography

- 5.2.1 Nigeria

- 5.2.2 Ghana

- 5.2.3 Ivory Coast

- 5.2.4 Senegal

- 5.2.5 Rest of West Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Shell PLC

- 6.3.2 TotalEnergies SE

- 6.3.3 Eni SpA

- 6.3.4 Exxon Mobil Corporation

- 6.3.5 Nigerian National Petroleum Corporation

- 6.3.6 Ghana National Petroleum Corporation (GNPC)

- 6.3.7 BP PLC

- 6.3.8 Cairn Energy PLC

- 6.3.9 Chevron Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.