PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636211

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636211

Asia Pacific Engineering, Procurement, And Construction Management (EPCM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

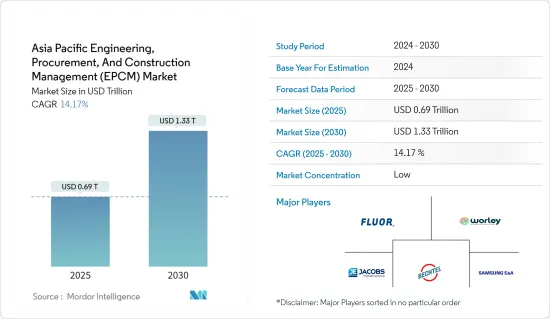

The Asia Pacific Engineering, Procurement, And Construction Management Market size is estimated at USD 0.69 trillion in 2025, and is expected to reach USD 1.33 trillion by 2030, at a CAGR of 14.17% during the forecast period (2025-2030).

The Asia-Pacific engineering, procurement, and construction management (EPCM) market has grown substantially, propelled by rapid industrialization, urbanization, and infrastructure expansion. Key industries fueling this growth include energy, mining, oil and gas, and construction.

Across APAC, governments are channeling significant investments into a broad spectrum of infrastructure endeavors. These span transportation (comprising roads, railways, and airports), urban development, and the promotion of smart cities. The escalating energy needs are steering investments toward power generation, with a notable emphasis on renewables like solar and wind farms. Notably, the swift industrial expansion, particularly in nations such as China and India, bolsters the demand for EPCM services in manufacturing and industrial setups. Given APAC's abundant mineral resources, the region is witnessing a surge in mining projects, all necessitating comprehensive EPCM services.

China stands out in the regional market, spearheading substantial investments across the infrastructure, energy, and industrial domains. Its ambitious Belt and Road Initiative (BRI) further cements its position in the EPCM market. Meanwhile, India is making significant strides with pronounced investments in urban development, renewable energy, and industrial ventures. Key government programs like Make in India and the Smart Cities Mission are pivotal in driving this growth. Australia, known for its robust mining industry, is increasingly turning to advanced EPCM solutions to meet the demands of its numerous projects. Furthermore, the country's focus on renewable energy and infrastructure is further fueling market expansion. Japan and South Korea, on the other hand, are directing their attention toward integrating cutting-edge technologies into their infrastructure projects, with a keen eye on smart cities and sustainable energy solutions.

Asia Pacific EPCM Marke Trends

Government Initiatives Bolstering the APAC EPC Market

Governments in Asia-Pacific (APAC) countries are rolling out various initiatives to bolster growth in the engineering, procurement, and construction (EPC) market. These initiatives predominantly target infrastructure, energy, and industrial expansions.

China's Belt and Road Initiative (BRI) is a cornerstone of its strategy, aiming to enhance connectivity and collaboration across Asia, Europe, and Africa. This initiative translates into significant transportation, energy, and trade route investments.

China has earmarked a hefty USD 30 billion for infrastructure projects in Tibet from 2021 to 2025. By 2025, Tibet is set to boast over 1,300 km of expressways and a staggering 120,000 km of highways. Notable projects in Tibet's 14th Five-Year Plan encompass the Ya'an to Nyingchi leg of the Sichuan Tibet Railway, initial groundwork on the Hotan-Shigatse and Gyirong-Shigatse railway lines, and the expansive Chengdu-Wuhan-Shanghai high-speed railway network.

In India, the Smart Cities Mission is a pivotal endeavor, aiming to transform 100 cities into smart urban centers. These cities are envisioned with upgraded urban infrastructure, sustainable resources, and a strong integration of smart technologies. The National Infrastructure Pipeline (NIP) is a comprehensive blueprint outlining investments nearing USD 1.5 trillion by 2025, spanning transportation, energy, water, and sanitation.

Additionally, 'Make in India' is a flagship government initiative, beckoning both domestic and international firms to set up manufacturing bases in the country. The initiative is laser-focused on bolstering industrial infrastructure and attracting investments, particularly in industries like electronics, automotive, and pharmaceuticals.

Conclusively, governments across Asia-Pacific countries are actively bolstering the engineering, procurement, and construction (EPC) market through strategic measures. China's Belt and Road Initiative (BRI) stands out as a prime example, showcasing its dedication to enhancing global connectivity and cooperation. Notably, China is channeling significant investments into transportation, energy, and trade routes, with a particular focus on infrastructure projects in Tibet, underscoring its regional development commitment. Simultaneously, India is reshaping its urban fabric through initiatives like the Smart Cities Mission and the expansive National Infrastructure Pipeline (NIP).

India Leads Among APAC Countries as one of the Fastest-growing EPCM Markets

India leads Asia-Pacific as one of the fastest-growing markets for engineering, procurement, and construction management (EPCM) services. The Indian government's ambitious infrastructure programs, such as the Smart Cities Mission, Bharatmala Pariyojana for highways, and the Sagarmala Project for ports, are pivotal. These initiatives underscore the nation's commitment to infrastructure, which is opening up substantial avenues for EPCM services. With urbanization on the rise, there is a pressing need for enhanced urban infrastructure, from metro rail systems to airports and smart city endeavors. Complementing this, the "Make in India" initiative, designed to bolster the manufacturing industry, is fueling the construction of new plants and industrial facilities, escalating the demand for EPCM services.

India's welcoming stance on foreign direct investment (FDI) lures global players, further amplifying the call for infrastructure development and EPCM expertise. Additionally, India's aggressive renewable energy targets, especially solar, wind, and hydroelectric power, create fertile ground for EPCM firms.

As India expands and modernizes its power generation and distribution networks to meet escalating energy needs, the EPCM market receives an added impetus. Housing initiatives like the Pradhan Mantri Awas Yojana (PMAY) are also propelling the demand for residential construction and its associated infrastructure. Furthermore, substantial investments in rural infrastructure, spanning from roads to electrification projects, are further broadening the scope of EPCM services.

India's infrastructure industry is poised for strong growth, with planned investments amounting to USD 1.4 trillion by 2025. The government's ambitious National Infrastructure Pipeline (NIP) program outlines the injection of massive capital into various industries, including energy, roads, railways, and urban development. This unprecedented push is expected to spawn associated industries, create jobs, and stimulate the economy. Specific focus areas are expanding public digital infrastructure, clean and renewable energy projects, and establishing resilient urban infrastructure. This ambitious undertaking seeks to enhance India's global competitiveness and improve the quality of life across its vast populace.

The Indian EPCM market is witnessing substantial growth, propelled by the nation's proactive infrastructure projects, ambitious renewable energy goals, and favorable foreign direct investment policies.

Asia Pacific EPCM Industry Overview

The Asia-Pacific engineering, procurement, and construction management (EPCM) market features a fragmented landscape, hosting numerous players. Prominent entities in this market include Fluor Corporation, Worley, Jacobs Engineering Group, Bechtel Corporation, and Samsung Engineering.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of Renewable Energy Sources and Sustainable Infrastructure Projects

- 4.2.2 Rapid Industrialization and Urbanization

- 4.3 Market Restraints

- 4.3.1 Rising Costs Associated with Construction Material

- 4.3.2 Supply Chain Disruptions

- 4.4 Market Opportunities

- 4.4.1 Adoption of Smart Infrastructure Technologies

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 PESTLE Analysis

- 4.8 Insights into Technology Innovation in the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Engineering

- 5.1.2 Procurement

- 5.1.3 Construction

- 5.1.4 Other Services

- 5.2 By Sectors

- 5.2.1 Residential, Industrial, Infrastructure (Transportation), and Energy and Utilities

- 5.2.2 Industrial

- 5.2.3 Infrastructure (Transportation)

- 5.2.4 Energy and Utilities

- 5.3 By Country

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 Australia

- 5.3.5 South Korea

- 5.3.6 Rest of APAC

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Fluor Corporation

- 6.2.2 Worley

- 6.2.3 Jacobs Engineering Group

- 6.2.4 Bechtel Corporation

- 6.2.5 Samsung Engineering

- 6.2.6 Hyundai Engineering & Construction

- 6.2.7 Chiyoda Corporation

- 6.2.8 JGC Corporation

- 6.2.9 China State Construction Engineering Corporation

- 6.2.10 Larsen & Toubro (L&T)

- 6.2.11 Kent

- 6.2.12 Nuberg EPC

7 FUTURE TRENDS