Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637828

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637828

Unified Communication-as-a-Service (UCaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

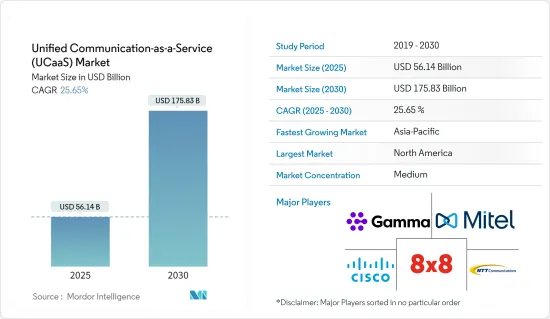

The Unified Communication-as-a-Service Market size is estimated at USD 56.14 billion in 2025, and is expected to reach USD 175.83 billion by 2030, at a CAGR of 25.65% during the forecast period (2025-2030).

The increasing trend of work from home (WFH) model is compelling employers to use UCaaS solutions as it's beneficial for companies to reevaluate their operational costs and save their marginal revenue from declining.

Key Highlights

- Unified Communications as a Service is the cloud service that brings together different communication and collaboration applications in one central platform. UCaaS allows businesses to optimise their communication channels, reduce costs and improve efficiency.

- UCaaS provides a wide range of communication tools, including voice and video conferencing, communications, email or collaborate software. The platform provides users with access to these tools through an Internet connection wherever they are, on any device. It's an appealing option for businesses of all sizes, eliminating the need to incur expensive hardware, software and maintenance costs. For instance, in May 2023, the Indian government granted Zoom Video Communications, a web conferencing company, a Unified License with access covering all of India, National Long Distance (NLD), and International Long Distance (ILD). This will allow it to offer Zoom Phone, a cloud-based private branch exchange (PBX) service, to enterprises in the country.

- In addition, the introduction of 5G technology and high-speed internet is anticipated to boost the market in the forecasted period, Because the 5G network is easy to use for video and Audio Conferencing, which requires high speed and minimal latency. According to 5G Americas, there are expected to be 1.9 billion fifth generation subscribers in the world by 2023. By 2024 and by 2027, this number is projected to be 2.8 billion and 5.9 billion respectively.

- The rising implementation of smart mobile gadgets and association tool improvements empower remote work and dispersed workforce tactics. Similarly, establishments employ a 'bring your device' (BYOD) rule across their business facilities. This approach will likely help organizations upsurge efficiency, refine internal interaction, and eradicate different prices. This is anticipated to eventually bolster the unified communication as a service market growth during the forecast period.

- Considering the growing preference for digitization, customer service is expected to emerge as a major challenge as customers continue to use various modes of communication.

- Moreover, the demand for Unified Communications has grown over the last decade. It witnessed an exceptional rise after the pandemic outbreak. With the emergence of COVID-19, digital transformation became an urgent requirement for businesses to ensure their survival, growth, and market leadership. The need for unified, frictionless, and secure access to data and applications anytime, anywhere exponentially increased.

Unified Communication as a Service (UCaaS) Market Trends

Migration from Legacy Systems to Cloud-Based Communication Services to Witness the Growth

North America Expected to Hold a Significant Market Share

Unified Communication as a Service (UCaaS) Industry Overview

Additional Benefits:

Product Code: 47539

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

5 MARKET DYNAMICS

6 TECHNOLOGY OVERVIEW

7 MARKET SEGMENTATION

8 COMPETITIVE LANDSCAPE

9 KEY RECOMMENDATIONS

10 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.