Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636619

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636619

Europe IP Telephony And Unified Communications As-a-service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

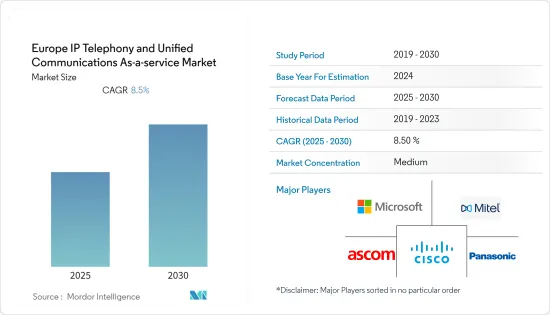

The Europe IP Telephony And Unified Communications As-a-service Market is expected to register a CAGR of 8.5% during the forecast period.

Key Highlights

- The European market for IP telephony and unified communications as a service (UCaaS) is growing rapidly, generating value for enterprises and opportunities for service providers. Decommissioning of the Integrated Services Digital Network (ISDN) is creating chances for enterprises to migrate to Internet Protocol (IP)-based communications solutions, such as line-side voice over IP (VoIP), SIP trunking, cloud private branch exchange (PBX), and UCaaS.

- VoIP has been increasing for the past two decades, and with technology advancements, industry support, and widespread use, it does not appear that this market will slow down anytime soon. As more people and organizations use and rely on VoIP, it's important to research and monitor market trends to ensure that you and your company are getting the most out of it.

- Communication channels have been steadily consolidated into a single service during the last few years. Unified Communications as a Service was born due to this technique (UCaaS). Although VoIP is the underlying technology, these services provide much more than just phone calls. Web and video conferencing, faxing, instant messaging, and team collaboration features are some of the other services that can be integrated into a single service platform.

- One of the most significant benefits of utilizing UCaaS is that it may save organizations time and money when setting up their communications networks because they won't have to buy and install separate video and audio equipment, instant messaging software, or phone solutions.

- Another key benefit of UCaaS is that it is cloud-based, which is why organizations should keep an eye on it. This means that customers can access it or log in from wherever as long as they have access to the Internet, which is where 5G comes in. Because UCaaS is cloud-based, linking it with other marketing tools is simple.

- VoIP was the tool that businesses quickly adapted to meet their needs in these uncertain times when a large portion of the working world was sent to work from home to help stem the rising tide of COVID infections. Employees needed technology to keep them connected to and collaborate with their coworkers. Employees might work from home and use their domestic Internet connections to call coworkers, participate in video conferences, and stay reachable because VoIP calling happens over the Internet. The demand for cloud-based UCC solutions is increasing due to many IT and telecom industries moving their company activities online to continue operations during the COVID-19-imposed lockdown. UCC solutions, comprising UCC, enterprise telephony, and telepresence, are being offered by the majority of telecom providers, including Google, Microsoft, and Zoom, to enable cost-effective communication platforms, lowering business costs, and boost productivity.

Europe IP Telephony and UCaaS Market Trends

Adoption of 5G will drive the Market

- The fifth-generation wireless network technology, 5G, is expected to revolutionize internet connectivity. Its primary benefits include higher internet speeds, shorter reaction times, and eliminating packet loss and jitter during data transmission. VoIP users will benefit from improved call quality, faster connectivity while making and receiving calls, and higher capacity.

- The European Commission recognized 5G prospects early on, forming a public-private partnership on 5G (5G-PPP) in 2013 to speed up 5G research and development. The European Commission has allocated more than EUR 700 million in public funds to support this work under the Horizon 2020 program.

- Telefonica Germany, which goes by the brand name O2, intends to deploy the base stations to boost capacity for huge events. Each mobile device has an antenna that may be extended up to 30 meters. O2 customers can get 4G and 5G coverage from the base stations, which will use a range of spectrum bands, including the 3.6 GHz band.

- With a 20-fold increase in speed over 4G in a 5G setting, Artificial intelligence technologies will be able to process large amounts of data in near real-time as speed and data processing capabilities increase. Using more powerful online collaboration tools with lower latency and faster connectivity will be possible. 5G wireless will catapult internet service to new heights, offering faster speeds in the office, at home, and on the go and supporting a new generation of remote collaboration tools.

- As 5G evolves, UCaaS will facilitate the consolidation and delivery of even more robust communications and collaboration solutions.

Artificial Intelligence Integration will drive the Market

- AI has made enormous strides in many areas, and the VoIP industry is no exception. Service delivery will improve at call centers that rely on humans to make and pick calls, for example. This can be accomplished by giving consumers AI-assisted self-help solutions and options, leaving human agents to handle only the most difficult issues.

- AI can also evaluate call center interactions between agents and customers to forecast customer behavior and the most frequently asked questions. Human agents can better serve clients by predicting what they need and resolving their issues in less time once this data has been distilled into an understandable manner.

- In February 2022 - G-Core Labs, a European cloud and EDGE provider, introduced a new public AI cloud service in Europe, which the company claims to use Graphcore Intelligence Processing Units. The company stated that it chose IPU systems to fulfill the growing demand for cloud-based AI that is powerful, efficient, and safe. To fulfill the data sovereignty demands of European corporations, major labs, and research institutions, G-Core Labs' first IPU service will be constructed on an initial IPU cluster in Luxembourg, with further development anticipated in Central Europe.

- STARLIGHT, a European Union-backed innovation project aimed at increasing the EU's strategic autonomy in the field of artificial intelligence (AI) for law enforcement agencies (LEAs), began on October 1, 2021. STARLIGHT is a four-year collaborative innovation project led by CEA (the French Alternative Energies and Atomic Energy Commission) to improve law enforcement agencies' understanding of AI's legal and ethical use, bolstering their investigative and cybersecurity operations and assisting them in combating the misuse of AI-supported crime and terrorism.

- Compared to today's benefits achieved only through VoIP technology, artificial intelligence and VoIP have significantly impacted technology, specifically in the telecommunications world where artificial intelligence is used for shipping VoIP delivering more benefits and increased efficiency for small businesses to large.

Europe IP Telephony and UCaaS Industry Overview

The Europe IP Telephony and Unified Communications as- a- service market is fragmented due to the presence of various regional players. In addition, key companies are involved in multiple strategies such as mergers & acquisitions and product innovation, among others, to gain a competitive edge over others.

- In September 2021 - RingCentral received a Unified License, allowing it to offer its Unified Communications as a Service (UCaaS) and Contact Center as a Service (CCaaS) solutions in India. This makes RingCentral the first global cloud provider to offer fully compliant voice and other unified cloud communications in India. RingCentral will give global enterprises of all sizes access to RingCentral's Message Video Phone (MVP) solutions globally, including in India, to help them speed their journey to the cloud.

- In November 2021 - RingCentral, Inc. announced a strategic agreement with Mitel, a global pioneer in business communications, to provide Mitel's global client base with a seamless migration route to RingCentral's Message Video Phone (MVP) cloud communications platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 91209

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the payments market in the country

5 Key Market Segments

- 5.1 By Solution

- 5.1.1 Hardware

- 5.1.2 Software

- 5.2 By Type

- 5.2.1 Integrated Access/Session Initiation Protocol (SIP) Trunking

- 5.2.2 Managed IP PBX

- 5.2.3 Hosted IP PBX

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises

- 5.4 By End User

- 5.4.1 BFSI

- 5.4.2 Healthcare

- 5.4.3 Retail

- 5.4.4 IT & Telecom

- 5.4.5 Government

- 5.4.6 Manufacturing

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Freshworks Inc

- 6.1.2 Intermedia.net, Inc

- 6.1.3 Microsoft

- 6.1.4 Mitel Networks Corp.

- 6.1.5 Ooma, Inc

- 6.1.6 RingCentral MVP

- 6.1.7 Vonage

- 6.1.8 Ziff Davis, Inc.

- 6.1.9 8x8, Inc.

- 6.1.10 Ascom Holding AG

- 6.1.11 Cisco Systems, Inc.

- 6.1.12 Panasonic Corporation

- 6.1.13 NEC Corporation

- 6.1.14 Grandstream Networks, Inc.

- 6.1.15 DIALPAD, INC.

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.