PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636579

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636579

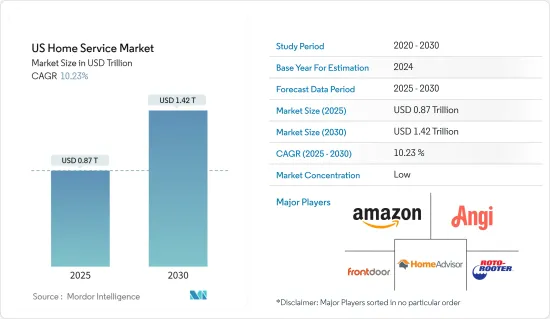

US Home Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US Home Service Market size is estimated at USD 0.87 trillion in 2025, and is expected to reach USD 1.42 trillion by 2030, at a CAGR of 10.23% during the forecast period (2025-2030).

The demand for home services is closely linked to rising homeownership rates, with homeowners often seeking maintenance, repairs, and upgrades. The aging housing stock amplifies this demand; older homes typically require more upkeep, including roofing, plumbing, and electrical work. Moreover, technological advancements significantly influence the home services market. Innovations such as energy-efficient solutions, smart home automation, and integrated home systems are becoming increasingly popular. As consumers adopt these technologies to boost their homes' convenience, efficiency, and sustainability, the growth of the home services sector accelerates.

Consumers in the US home service market increasingly prioritize efficiency, convenience, and aesthetics. This market, characterized by a mix of established giants and specialized players, continually evolves, driven by innovation and a focus on customization. Urbanization and population growth are driving the rising demand for home services. Economic downturns and high unemployment rates can reduce consumer spending on home services. Homeowners often prioritize essential expenses over non-critical services during such times.

US Home Service Market Trends

The Home Improvement Segment is a Crucial Driver of US Home Service Market Growth

The home improvement and DIY segment is a significant growth driver in the U.S. home service market, fueled by changing consumer preferences and economic factors. Homeowners increasingly seek to personalize their living spaces, enhance functionality, and boost property value, leading to a surge in demand for renovations and upgrades. Popular projects include kitchen and bathroom remodeling, painting, and flooring upgrades, reflecting a desire for modern aesthetics and energy-efficient solutions.

The rise of the DIY culture is another key contributor, with consumers inspired by online tutorials, social media trends, and cost-saving motivations. Retailers and platforms offering DIY tools, materials, and step-by-step guides have made it easier for individuals to undertake home improvement projects independently. The pandemic further amplified this trend as more people spent time at home and prioritized creating comfortable, multi-functional spaces.

Moreover, the aging housing stock in the U.S. necessitates repairs and upgrades, while increased homeownership rates, especially among millennials, drive spending on professional services and DIY initiatives. As consumers continue to invest in their homes for personal enjoyment and resale value, the home improvement and DIY segment is poised to remain a robust growth driver within the broader U.S. home service market.

Rising Homeownership Rates Influences the Home Service Market

In the United States, rising homeownership rates significantly influence the home service market, boosting demand across various sectors. As individuals and families increasingly secure homeownership, they turn to a variety of services to maintain, enhance, and personalize their homes. This trend is especially pronounced in the surging demand for maintenance and repair services. Homeowners are prioritizing regular upkeep investments, including plumbing, electrical work, and HVAC maintenance, to keep their homes in prime condition. Additionally, with the U.S. housing stock aging, there's a heightened demand for repairs and renovations, ensuring a consistent workload for service providers.

Homeowners, taking pride in their properties, are increasingly motivated to make renovations that boost both functionality and aesthetics. This trend fuels demand for contractors, interior designers, and specialized service providers, catering to needs ranging from kitchen remodels to bathroom upgrades. Rising homeownership is driving a trend towards outdoor living spaces. With more individuals owning homes, there's heightened interest in landscaping and outdoor services. Homeowners are keen on boosting their curb appeal and crafting welcoming outdoor settings.

With the rise in homeownership, there's a parallel surge in interest in smart devices and home automation systems. Homeowners seek services that install and maintain these technologies, aiming to boost convenience, security, and energy efficiency in their residences. This escalating demand for smart home services opens up fresh avenues for service providers, especially those targeting tech-savvy homeowners, thereby propelling growth in the home service market.

US Home Service Industry Overview

The US Home Service Market is fragmented. This prevalence can be attributed to the multitude of small, independent businesses and local service providers spanning sectors such as plumbing, HVAC, cleaning, and landscaping. The report covers the major players operating in the United States Home Services. Some of the top market participants in the United States are Amazon.com Inc., Angi Inc., Frontdoor Inc., HomeAdvisor, and Roto-Rooter.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Homeownership Rates

- 4.2.2 Aging Housing Stock

- 4.3 Market Restraints

- 4.3.1 Significant Shortage of Skilled Labour

- 4.3.2 Consumer Trust and Safety Concerns

- 4.4 Market Opportunities

- 4.4.1 Rising Demand for Smart Home Services

- 4.4.2 Collaborations with Home Improvement Retailers

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porters 5 Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technological Innovations in the Market

- 4.8 Impact of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Maintenance & Repairs

- 5.1.1 Plumbing Services

- 5.1.2 Electrical Repairs

- 5.1.3 Appliance Repairs

- 5.1.4 Other Home Services

- 5.2 Home Improvement

- 5.2.1 Renovations & Remodeling

- 5.2.2 Carpentry & Woodworking

- 5.2.3 Painting & Wall Treatments

- 5.2.4 Other Home Improvement

- 5.3 Distribution Channel

- 5.3.1 Traditional Service Providers

- 5.3.2 Online Platforms

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Company Profiles

- 6.2.1 Amazon.com Inc.

- 6.2.2 Angi Inc.

- 6.2.3 Frontdoor Inc.

- 6.2.4 HomeAdvisor

- 6.2.5 Roto-Rooter

- 6.2.6 Thumbtack

- 6.2.7 Porch

- 6.2.8 TaskRabbit

- 6.2.9 Handy

- 6.2.10 Gapoon Online Consumer Services Pvt. Ltd.*

7 MARKET FUTURE TRENDS

8 DISCLAIMER AND ABOUT US